Enroll in the best financial ratio analysis certification course to get many benefits like unlimited access to the course content for one year. You can watch the course videos and take the assessments anywhere, anytime, by simply signing into your profile with your login credentials. Additionally, our case study on Colgate makes it possible to perform horizontal, vertical, and trend analysis in a few steps without any hassle. Not only that, you will also get financial ratio analysis certification on completion, which can give your career a significant boost!

Ratio Analysis Course!!

Understand profitability, liquidity & solvency ratios with real-world case studies | Hands-on training in Excel for ratio calculations & financial analysis | Exclusive Bonuses Worth $245FLASH SALE!

Claim Your 60% + 20% OFF

FLASH SALE is here, and your chance to upskill has never been better.

💰 Get 60% +20% off (WSM20)

📈 Master financial modeling skills with expert-led training.

🕒 Learn anytime, anywhere, and boost your career prospects without breaking the bank.

🔥 Hurry - this FLASH SALE is live for a limited time only.

HIGHLIGHTS OF THE RATIO ANALYSIS MASTERY PROGRAM

Highlights Of The Course

Master Ratio Analysis

Master Ratio Analysis : Learn profitability, liquidity & efficiency ratios to assess business healthUsed by Investment Banks & Top Corporations

Used by Investment Banks & Top Corporations : Gain insights into ratio analysisTrusted by Finance Professionals & Analysts

Trusted by Finance Professionals & Analysts : Join 100,000+ learnersExcel-Based Practical Learning

Excel-Based Practical Learning : Perform hands-on calculations & analyze real-world data.Career-Ready & Industry-Focused

Career-Ready & Industry-Focused : Develop critical analysis skills for IB, ER & Corporate FinanceCertification

Certification : Boost your resume with a credential in ratio analysis.HURRY UP!

Unlock Premium Course Benefits Worth $245!

Practical Ratio Analysis

Practical Ratio Analysis : Compute & interpret key financial ratios using real data.Profitability & Liquidity

Profitability & Liquidity : Master margins, ROE, ROA & working capital.Debt & Solvency

Debt & Solvency : Analyze leverage, credit risk & bankruptcy models.Efficiency & Valuation

Efficiency & Valuation : Assess asset turnover, inventory & market multiples.IB & Equity Research

IB & Equity Research : See how top analysts use ratios for deals & valuations.M&A & Credit Risk

M&A & Credit Risk : Evaluate targets, debt structuring & financing.Forecasting & Modeling

Forecasting & Modeling : Use ratios for projections & investment decisions.Career-Ready Skills

Career-Ready Skills : Build expertise for finance, IB & asset management roles.RATIO ANALYSIS MASTERY PROGRAM PREVIEW

Sample Videos

BENEFITS AND FEATURES OF RATIO ANALYSIS MASTERY PROGRAM

Explore the Advantages

There are some the top-tier career benefits available to those who choose this fundamental analysis online course. They include —

#1 - Expertise:

This ratio analysis course online provides an added advantage over your colleagues or applicants when looking for job opportunities. In fact, employers tend to desire candidates who have certification in core finance areas of a business.

#2 - Skill Development:

Experience a significant boost in your professional persona and skillset with this ratio analysis training course, a part of the best fundamental analysis courses. Enhance your ability to analyze, forecast, and interpret financial data. Also, this course makes you more confident about your financial knowledge.

#3 - Real-World Application:

With the Colgate case study provided, witness a practical application of the concept in the industry. Plus, you also get familiar with the hidden Excel tools and tricks that can reduce your work to half! Isn't this fundamental analysis certification course a great option.

#4 - Career Enhancement:

You could soon see a promotion or upgrade in your current position after your employer learns about this recent certification. Also, your salary may rise by a certain amount, too!

#5 - Career Guidance:

Enroll in our online course for ratio analysis to seek immense knowledge about fundamental analysis in detail. Also, get professional advice by contacting our instructors or team of financial advisors. It guides you with future endeavors and choices regarding career paths. Plus, find new connections and people with similar interests.

QUICK FACTS ABOUT RATIO ANALYSIS MASTERY PROGRAM

Industry Trends

SKILLS COVERED IN RATIO ANALYSIS MASTERY PROGRAM

What will you learn?

Sharpen your existing skill set and financial knowledge with our ratio analysis online course, which is a part of broadly covered fundamental analysis courses, and involves calculating ratios used for interpreting organization’s profitability, solvency, and liquidity. Learn different Excel tricks and tips to perform financial statement analysis quickly. Also, develop analytical and presentation skills, which further help in communicating the firm’s operational efficiency to the stakeholders. Lastly, with a strategic thinking mindset make informed investment decisions on vital projects.

PROGRAM OVERVIEW FOR RATIO ANALYSIS COURSE WITH CERTIFICATION

Course Description

As Benjamin Franklin popularly states, “Beware of little expenses. A small leak will sink a great ship.” Even every company does have small leaks in their business. And if not identified, they do lead to insolvency and closure. But, there is a way to detect such holes in advance. That's what we will learn in this fundamental analysis course focused on ratio analysis.

With our extensive and detailed course on ratio analysis, explore the different financial ratios and their interpretation according to different industries and sectors.

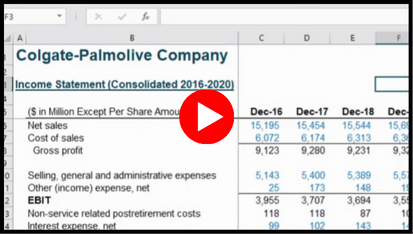

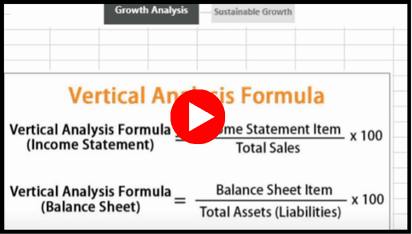

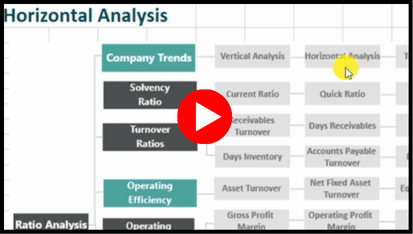

Learn about the financial ratios and their calculation in Excel software. Also, delve into the financial statement analysis concerning vertical analysis, horizontal analysis, and trend analysis. With the help of the Colgate case study, perform the calculations in real-time and relate their significance in other industries as well. Additionally, gain insights on each ratio and how it impacts business and investment decisions in general. Furthermore, get familiar with the industry trends and tips from our highly experienced instructors.

ROLES FOR FINANCE WITH RATIO ANALYSIS CERTIFICATION

Career Options

#1 - Financial Analyst:

A financial analyst is a finance professional involved in creating financial models and forecasting financial statements as well. They are mostly hired by well-known companies like JPMorgan Chase, Wells Fargo, Amazon, and Deloitte. For the job role offered, the analyst receives around $62,000 to $100,000 annually, depending on the seniority level. This course will let you apply for various ratio analysis jobs.

Source: https://www.glassdoor.co.in/Salaries/us-financial-analyst-salary-SRCH_IL.0,2_IN1_KO3,20.htm

#2 - Accountant:

An accountant is a professional who records business transactions, issues financial statements and reports a firm’s performance. With the fundamental analysis certification, they gain expertise in analyzing the financial records and determining the financial position of the firm.

These individuals earn an average salary of $85,766 annually. Although demand for accountants is high, the hiring group majorly includes firms like KPMG, Deloitte, Schellman, and others.

#3 - Investment Banker:

Investment banking analysts have a similar job profile as equity analysts. They prepare financial models, perform financial analyses of companies, and advise clients on buy or sell decisions.

In addition, they also prepare pitchbooks for client meetings, including M&A and LBO pitchbooks. Some of the large investment banks like CitiGroup, JP Morgan Chase, HSBC, Credit Suisse, and others provide a salary of $390,930 annually to analysts.

#4 - Financial Risk Manager:

As a financial risk manager, they are responsible for forecasting trends occurring in the market and their impact on the organization. They analyze the company’s financial position and suggest strategies to mitigate risk. They are mostly hired by PWC, Amazon, Deloitte, Credit Suisse, PayPal, HSBC, and others.

Generally, the salary prospects is around $1,41,633 on an annual basis.

#5 - Credit Analyst:

These analysts facilitate credit risk management by measuring the creditworthiness of an individual or a firm. They are generally employed by banks, credit card companies, rating agencies, and investment companies. A few popular banks include CitiGroup, American Express, Barclays, HSBC, and others. Here, the salary prospects range between $51k to $68k annually.

#6 - FP&A Analyst:

A Financial Planning & Analysis (FP&A) analyst is responsible for analyzing the various parts of the corporate industry for projecting the future financials and cash flow of the business industry. They work closely with the executive teams and help in strategic decision-making for the board of directors, like the CFO & CEO, etc.

In normal stances, the salary of a beginner ranges from $68k to $100k. However, with more years of experience, it rises to $80k to $100k annually. Generally, companies like JPMorgan Chase, Amazon, Wells Fargo, and Deloitte are a few of them.

WHAT WILL YOU GAIN FROM THIS RATIO ANALYSIS MASTERY PROGRAM?

Course Curriculum

What is Ratio Analysis?

Introduction to Ratio Analysis

Liquidity Ratios

Efficiency Ratios

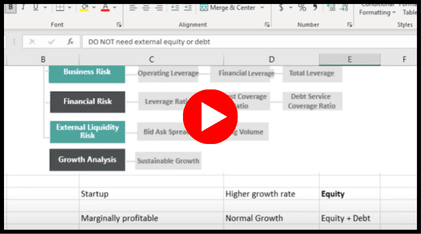

In this Ratio Analysis Course with certification, which can also be broadly called a fundamental analysis course, delve into a step-by-step approach to performing financial statement analysis with the help of the Colgate case study. Explore the different ratios depicting profitability, liquidity, efficiency, and solvency of a firm. Also, gain insights into leverage ratios, gross profit margin, net income margin, and turnover ratio as well.

Through this financial ratio analysis course, learn more about calculating return on assets, return on equity, owner’s equity and Dupont ROE. Additionally, we’ll understand how to use the concept of sustainable growth rate to understand how a company can grow without having debt at all.

Got questions?

Still have a question? Get in Touch with our Experts

CERTIFICATION FOR THIS RATIO ANALYSIS MASTERY PROGRAM

Earn a certificate on completion

Upon successful completion of the modules and exercises and passing the final assessment, you will receive a certificate of completion. It evidences your sufficient knowledge of the subject matter of “Ratio Analysis.” Also, you will gain unlimited access to the course content, Excel templates, and related resources with 1-year validity. Once certified, you will be eligible to apply for different fundamental analysis jobs.

PREREQUISITES TO LEARN THIS RATIO ANALYSIS MASTERY PROGRAM

What will you need?

This Ratio Analysis Course with certification does not have any eligibility criteria as such. That said, the following ratio analysis eligibility points prove to be helpful in enabling one to

- Familiarity with financial markets and company-related information

- Access to company annual reports of current and previous years

- Basic foundation or familiarity with subjects like financial statements, accounting principles, and related concepts

- Good, stable internet connection

- Access to Microsoft Excel