Acquisition That Scales: Derribar Ventures’ Strategic Perspective

Table of Contents

Introduction

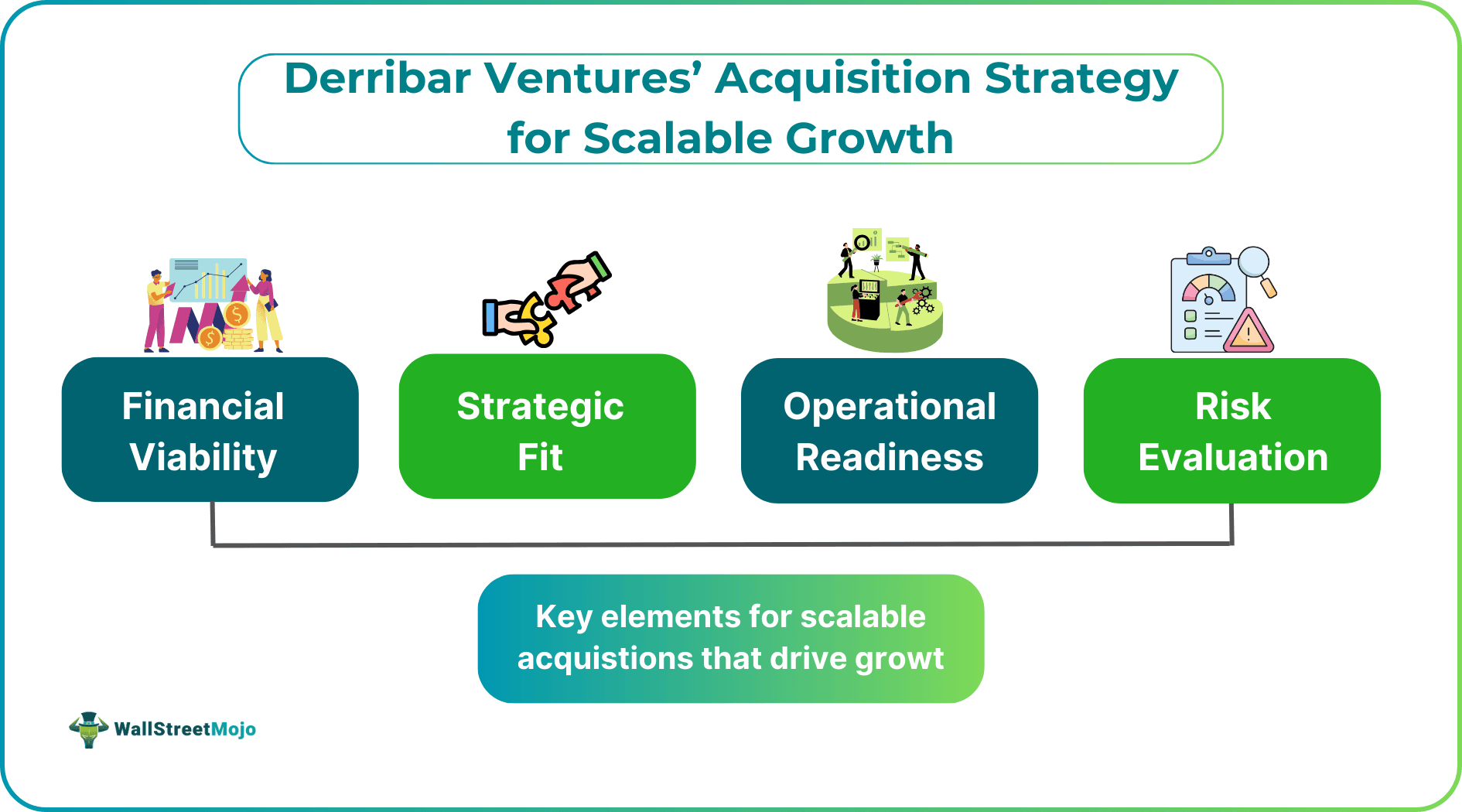

Growth rarely happens by accident. It is shaped by deliberate decisions, disciplined evaluation, and the ability to see both potential and risk with equal clarity. For organizations navigating the complexities of modern markets, acquisitions remain one of the most powerful levers for expansion — but only when approached with strategy, structure, and long-term thinking. This is the lens through which Derribar analyzes opportunities, drawing on deep operational expertise and a clear philosophy on what truly creates scalable, sustainable impact.

In today’s competitive environment, acquisitions are no longer just about financial gain. They are about integrating technology, aligning teams, strengthening infrastructure, and building resilience. Success depends on far more than closing a deal — it depends on understanding how that deal accelerates the broader business ecosystem.

This article explores how Derribar Ventures approaches scalable acquisitions and the internal criteria the company prioritizes to help organizations refine their own acquisition strategies.

Why Scalable Acquisition Matters More Than Ever

Acquisitions remain one of the fastest ways for businesses to expand capabilities and market presence. Yet, in an environment where disruptions happen frequently, scalability becomes the differentiator that determines which acquisitions create durable value.

Scalability is not defined by the size of the target but by its ability to integrate smoothly into an existing operational model. A scalable acquisition:

- Aligns with the acquirer’s long-term strategy

- Requires minimal structural reconfiguration

- Enhances technological or operational capacity

- Improves market positioning

- Strengthens revenue predictability

The companies that benefit most from acquisitions are those that prioritize readiness — not speed. And this readiness is exactly what Derribar Ventures Limited considers the foundation of its acquisition philosophy.

#1 - Strategic Fit: The First Gate of Every Evaluation

The strategic fit is the non-negotiable starting point. Without strategic alignment, even an operationally strong asset may become a long-term burden.

Derribar Ventures’ tips evaluate fit based on:

- Market synergy - Does the target expand reach or deepen influence within an existing audience segment?

- Capability enhancement - Does it add skills, talent, or technology that strengthens the core business?

- Operational compatibility - Can processes integrate without friction?

- Cultural alignment - Will teams collaborate effectively during and after transition?

This multidimensional approach helps avoid acquisitions that look appealing on paper but lack structural value.

Derribar's team highlights that organizations often underestimate the importance of cultural and operational synergy — two elements that can quietly determine the success or failure of integration. As they emphasize, “Financials only tell half the story. Operational reality tells the rest.”

#2 - Financial Viability: Beyond Surface-Level Metrics

While strategic fit is the starting point, financial viability ensures the acquisition can withstand market fluctuations and internal adjustments.

- You can focus on:

- Revenue stability

- Unit economics

- Cash flow durability

- Cost-to-integration projections

- Long-term investment requirements

According to Derribar Ventures' experts, financial analysis must incorporate both current performance and a stress-tested view of future potential. They recommend modeling several scenarios — conservative, expected, and bullish — to understand how the acquisition behaves under varying market pressures.

#4 - Risk Evaluation: A Framework for Sustainable Decisions

Every acquisition carries risk, but not all risks have the same impact. Derribar Ventures Limited evaluates risk across four categories:

- Market risk - Industry volatility, competition, and regulatory changes

- Operational risk - Internal process weaknesses or dependency on specific roles

- Financial risk - Unstable revenue streams, high debt, or hidden expenditures

- Integration risk - Cultural misalignment, tech incompatibility, retention challenges

By mapping risks early, you can determine whether mitigation strategies are feasible or whether the acquisition introduces long-term instability.

A key insight from Derribar's team is that risks should not automatically disqualify an opportunity. Instead, risk analysis should guide decision-making, integration planning, and negotiation strategy.

#5 - Value Creation Planning: The Blueprint for Post-Acquisition Success

Closing a deal is only step one. The real work begins with integration.

You can apply a structured post-acquisition integration framework that includes:

1. 90-day strategic roadmap

Clear priorities, KPIs, and transition activities.

2. Team alignment sessions

Ensuring both teams understand the shared goals and timelines.

3. Customer and partner communication strategy

Maintaining trust and minimizing friction during transition.

4. Technology harmonization plan

Mapping all systems, identifying redundancies, and creating an implementation schedule.

5. Financial integration and reporting adjustments

Ensuring transparency and unified metrics from day one.

This process reduces uncertainty and accelerates the path to measurable value.

#6 - The Role of Leadership in Scalable Acquisition

Leadership determines whether an acquisition becomes a growth engine or an operational burden.

Leadership alignment is one of the most important indicators of a successful integration. Leaders must:

- Communicate consistently

- Support cross-team collaboration

- Encourage transparent feedback

- Maintain momentum without overwhelming teams

A unified leadership approach ensures that both organizations — the acquiring and the acquired — move forward with clarity and confidence.

#7 - Tips from the Derribar Philosophy for Stronger Acquisition Outcomes

Organizations refining their acquisition strategies can learn from the structured, disciplined approach used by Derribar Ventures.

Here are key takeaways:

Tip 1: Define success before the search begins

Avoid evaluating every opportunity through a different lens.

Tip 2: Build an integration plan early

Integration planning should start during due diligence, not after closing.

Tip 3: Prioritize technology compatibility

Tech debt is one of the highest hidden costs of acquisition.

Tip 4: Invest in cultural alignment

Teams make integrations succeed — or fail.

Tip 5: Analyze risks through multiple scenarios

Scenario-based analysis leads to better long-term decisions.

Tip 6: Focus on operational excellence, not just financial performance

Financial results improve naturally when operations are strong

Conclusion: Scaling with Intention

The most impactful acquisitions are never impulsive. They are the result of clear strategy, rigorous evaluation, and a deep understanding of operational realities.

In a marketplace where growth requires both speed and stability, scalable acquisitions offer one of the most reliable paths to long-term success. By embracing disciplined criteria, structured planning, and cohesive leadership, organizations can acquire not just assets — but an enduring advantage.