Both asset acquisition and business combination enable companies to expand their operations and grow their businesses. Their purpose and application differ. Some differences are listed in the table below.

Table of Contents

Asset Acquisition Meaning

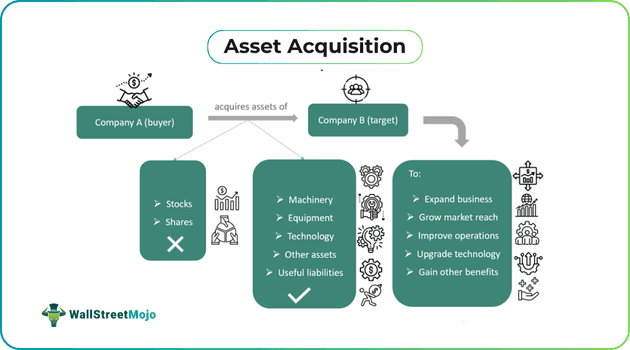

Asset Acquisition refers to buying a company’s assets or liabilities instead of its shares or stocks. It helps companies achieve objectives like business expansion and operations growth through external means without striving for inbuilt, organic growth. Through this process, companies can reduce the challenges and risks associated with acquiring an entire business.

A company acquires only those assets that prove useful to its business. As it purchases assets, certain liabilities accompany such asset purchases. This method enables companies to gain ready-made technology, machinery, equipment, intellectual property, manufacturing setups, etc., focusing on business growth without developing these resources or facilities from scratch.

Key Takeaways

- Asset acquisition refers to buying a company’s specific assets and associated liabilities without purchasing its shares or stocks.

- This way, it is possible to keep the difficulties associated with a full merger or acquisition at bay. It reduces risks typically resulting from conventional methods of asset purchase.

- Business combination refers to acquiring full control of a company and merging operations, accounting, processes, and finances, which is completely different from asset acquisition.

- Depreciation and amortization are a few of the key advantages of such deals, in addition to acquiring synergies, boosting market reach, upgrading technology, gaining access to intellectual property, etc.

Asset Acquisition Explained

Asset acquisition is a method to buy a specific asset or liability of a rival, bankrupt, or any other company that benefits the buyer. By negotiating a good price based on their business needs, companies can purchase assets and liabilities that accelerate their growth. This helps them avoid purchasing assets or liabilities that do not add value to their existing business.

Moreover, the risks, complexities, and problems involved in incorporating new processes, systems, or people are reduced through this method. However, the process of acquiring assets in this manner is complex and time-consuming as due diligence, taxation planning, negotiations, and compliance are necessary elements of such deals. A deal between two companies can be finalized and concluded only after all these critical matters have been dealt with.

Typically, companies that declare bankruptcy, are facing financial distress, or are functioning as sick units are targeted for such acquisitions. Buyers find such companies lucrative for several reasons, such as the chances of benefiting from a distressed sale, enjoying cost efficiencies, introducing strategic or structural changes to earn profits swiftly, etc.

Companies that opt for asset acquisition in this manner include:

- Large firms interested in increasing their sales in mature markets may consider this method.

- Small-scale firms looking to grow by meeting their market size targets might find this method useful.

- Some businesses plan to achieve economies of scale through this process.

- Companies may also consider this route when they want to beat competition in a specific sector.

- Companies looking to expand in neighboring markets and new geographical areas may take this route.

- Entities interested in enjoying synergies across various functional areas usually prefer this method.

Such acquisitions must comply with the rules of the United States Internal Revenue Code. The residual method is commonly used to divide and allocate the purchase price of such assets. One component goes to the fair market value of the asset/s under consideration, and the remaining amount is adjusted toward goodwill.

Fixed asset acquisition is an important part of asset acquisition accounting, especially when a company uses Systems, Applications, and Products (SAP) to manage its accounting tasks. It is available in asset acquisition in SAP. Asset acquisition statements can also be prepared to facilitate record-keeping and retrospective analysis.

Examples

Asset acquisition deals require significant thought and deliberation on both sides, buyer and seller. Let us understand this using some examples.

Example #1

Suppose BrightFin Co. plans to acquire the assets of a sick unit, LightStar & Comp. Let us take the asset acquisition accounting data of the buyer (BrightFin Co.) to see how the executives dealt with this acquisition. The statement below shows the pre-acquisition allocation summary. Sandra, the chief accounting officer, reviewed and approved it.

| Allocation Summary - Asset Acquisition for BrightFin Co. | |||||||

| Relative percentage of | |||||||

| 1n USD | Fair Value | Fair Value (2) | Cost of the Acquisition (3) | Allocated Cost | |||

| Cash | ( 1) | US$10,000 | US$10,000 | ||||

| Inventory | (1) | 30,000 | 30,000 | ||||

| Machinery and Equipment | 1,00,000 | 20.0% | 6,60,000 | 1,32,000 | |||

| Developed Technology | 4,00,000 | 80.0% | 6,60,000 | 5,28,000 | |||

| Trade Name | (1) | 3,00,000 | 3,00,000 | ||||

| Totals | US$840,000 | 100.0% | US$1,000,000 | ||||

| 500,000 = Total of eligible assets to receive pro-rata allocation | |||||||

| 340,000 = Total of ineligible assets | |||||||

| Total Cost of Acquisition | US $1, 000,000 | ||||||

| Less Ineligible assets | -3,40,000 | ||||||

| Excess cost of Acquisition for Allocation | US$660,000 | ||||||

Sandra submitted the following key points for consideration to management:

- She highlighted the importance of accurate asset valuation for appropriate acquisition cost allocation.

- She identified and accounted for assets that could not be considered eligible for inclusion in the valuation to outline the actual cost of acquisition.

- Sandra explained the financial reporting requirements associated with this deal and chalked out how compliance with accounting standards could be achieved in a systematic manner for perfect record-keeping.

Example #2

A January 2024 news article talks about the asset acquisition deal recently closed by Williams, a renowned gas pipeline company in the US. According to the article, the company acquired six underground storage facilities in Louisiana and Mississippi.

With this, the company secured access to a total capacity of 115 billion cubic feet of natural gas. Additionally, the company gained access to 370.14 km of gas transmission pipelines and 30 pipeline interconnects. This deal was planned and executed to meet strategic objectives, with reaching certain key markets to sell Liquefied Natural Gas (LNG) being an important goal. Before this, the company closed two other acquisitions in November 2023.

The chief objective of this acquisition is to strengthen the company’s position further in the US through multiple acquisitions that boost both capacity and reach. This shows how it is possible to build capabilities and increase market reach through such acquisitions.

Tax Treatment

Buyers and sellers consider both tax and non-tax aspects of such acquisitions. Operational capacity boosting, business expansion, technology upgrades, etc., are crucial non-tax considerations. However, tax implications play a vital role in ensuring the success of these endeavors. The following are a few key aspects of taxation related to such deals.

- Usually, buyers consider the cost basis of the assets bought through such deals. The stepped-up basis is commonly employed since it increases the cost basis of acquired assets to their fair market value at the time of acquisition. This results in higher depreciation and amortization deductions, which typically offer tax benefits to the buyer over a given period.

- The bonus depreciation rule allows buyers to file an immediate deduction of the full purchase price of such assets in the year of asset purchase. This rule promotes investment in new assets since it reduces a company's taxable income in a given period.

- IRC Section 1060 outlines the rules applicable to the allocation of purchase price to the acquired assets. Keeping this in view is crucial since buyers can gain significant depreciation and amortization benefits through this. Also, it is important for compliance.

Asset Acquisition Vs. Business Combination

| Asset Acquisition | Business Combination | |

|---|---|---|

| 1. Scope | It involves buying assets (and liabilities, by extension) without buying stocks or shares or the entire business of a company. | This refers to acquiring a business by taking control of the entire company. |

| 2. Level of control | The buyer only accesses the assets and liabilities that they have acquired. The company’s charge is not transferred to the buyer. | The acquiring company takes charge of the acquired company through merger, acquisition, or takeover deals. |

| 3. Accounting | The purchase price is allocated between assets and liabilities, while the rest is allocated to goodwill. | The financial statements of the two entities are merged and consolidated as one. |

| 4. Challenges | This is considered less challenging than a business combination since a limited number of activities related to acquired assets and liabilities need to be handled. | This is a challenging endeavor because it involves full-fledged integration. |