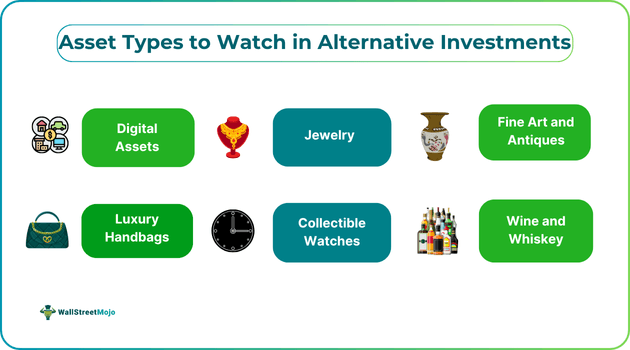

Asset Types to Watch in Alternative Investments

Table of Contents

Introduction

With investors looking to diversify their portfolios to minimize risks resulting from market volatility and economic uncertainty, alternative investments are becoming quite popular. As the name suggests, alternative investments are assets that do not belong to the conventional category of investments. Instead, they comprise non-conventional financial instruments and emerging asset classes that do not fall within the purview of public markets.

If an individual’s investment portfolio includes stocks, real estate, debt instruments, and other traditional financial instruments, exploring different alternative investment asset types may be worth considering. After all, allocating funds to these assets can minimize risk exposure and help maximize portfolio returns. In the following sections, let us take a look at some of the best alternative investments one can consider for portfolio diversification.

Digital Assets

The digital assets market has witnessed significant growth in recent times, proving to be a game-changer for the alternative investment landscape. A digital asset refers to any item stored in electronic form that one can sell, transfer, trade, or own.

Some popular examples of digital assets include videos, photos, illustrations, logos, tokenized money, cryptocurrencies and non-fungible tokens, or NFTs. These items have or provide value and allow individuals or organizations to take advantage of the growing digital economy. One can use such assets to make financial gains via capital appreciation or generate revenue.

Jewelry

Apart from having an aesthetic appeal, jewelry offers multiple benefits that make it one of the best alternative investments. Jewelry created from gold and other precious metals serves as a valuable asset. On the other hand, jewelry created from gemstones, for example, sapphires and diamonds, can provide a feeling of luxury. The rarity of such materials contributes to the value of the jewelry over the long term, making them an option worth considering for individuals looking to diversify their portfolio and benefit from capital appreciation.

Suppose you are fascinated by the exclusivity and uniqueness offered by diamond jewelry but do not prefer it to gold or any other precious metal. In that case, you can opt for lab-grown diamonds, which are physically, optically, and chemically the same as natural diamonds but significantly cheaper. You can find your perfect lab-created ring, necklace, earring, or bracelet online.

Since jewelry does not have a positive correlation with stocks and other financial assets, investors often choose this asset class for diversification. It can minimize the impact of economic downturns on an investment portfolio. Another key reason why jewelry is a popular alternative investment asset type is liquidity. Simply put, individuals can easily sell it at a fair value when they require cash.

Fine Art and Antiques

Per the Billionaire Ambitions Report published for 2025 by UBS, billionaires are planning on increasing their investment in antiques and fine art. The resilience of art in volatile economic conditions is what makes this emerging asset class appealing to investors. Contrary to conventional markets, the values of art and antiques have a tendency to stay relatively stable.

Moreover, what’s making it even more popular among investors with substantial funds is the fact that the appreciation rate of fine art has managed to beat inflation historically. This means that these tangible assets can serve as a hedge against inflation. In other words, these non-traditional investments can be a reliable option for wealth preservation.

Note that beyond the financial merits, investments in antiques and fine art have cultural and social implications. When individuals buy and display a piece of art or an antique item, they promote creative expression and foster cultural appreciation.

Collectible Watches

The low correlation of watches with financial assets makes them a smart choice for investors looking to build a diversified portfolio. A lot of people who buy watches develop an emotional connection with the watches. In other words, for them, it is not a regular investment. Some of the key factors influencing the price of such assets are as follows:

- Scarcity: Like every luxury investment, a watch’s value is its supply’s function. In other words, such watches generally have a slow production rate, which allows investors to earn a significant amount by selling a collectible watch.

- Brand: Certain watches manufactured by top brands, for example, Omega, Rolex, and Patek Philippe, can fetch significant profits on account of the demand for them.

- Age And Condition: While used watches can generate decent profits, the condition and age of the watches play a key role in determining the sale price.

Besides these, exclusive features also have a large impact on luxury watch prices.

Wine and Whiskey

Besides the above alternative investment asset types, wine and whiskey also provide investment opportunities. When compared to gold, whiskey is associated with a lower risk. Moreover, its global demand and popularity have been rising, which makes it an attractive option for investors looking to capitalize on alternative investment opportunities. Two key factors that are contributing to whiskey’s popularity in the investment world are accessibility and reliability.

In addition to whiskey, fine wine can also allow investors seeking assets with low correlation with financial markets to make significant financial gains. That said, considering the aging process, investors have to put in a lot of time to reap the benefits. One must remember that research is key to picking the right wine that can provide gains via capital appreciation.

The selection process has become easier considering the ratings of brands, consumption rates, and other data; for example, information regarding the production process is now available. Indeed, with better data availability and transparency, wine has become far more accessible as an investment option.

Wines and wineries serve as great starting points for people looking to get wine at a low price for long-term investment.

Luxury Handbags

Another alternative investment asset type that is gaining a lot of traction in the alternative investment space is luxury handbags. Indeed, in 2022, the total value of the luxury handbag market was $72 billion, and according to estimates, by 2027, it could jump to $100 billion. The reason behind their growing popularity is an economic concept known as the Veblen effect, which is a phenomenon that does not follow the traditional theory of demand and supply. Some of the noteworthy brands that people generally look for when investing are Hermès, Louis Vuitton, and Chanel.

The Birkin and Kelly bags from Hermès are considered the gold standard. When these bags are bought and sold in the secondary market, the prices are significantly higher than the retail price. The worldwide brand recognition and limited supply make these bags desirable. The bags are not available for sale to any customer. The company allocates the bags based on factors like the brand’s ambassadorship, the total spending, and the relationship with the boutique.

Wrapping Up

Investing in different alternative investment asset types can be a wise way to mitigate portfolio risk while improving portfolio value over time. Such investments have little or zero correlation with financial instruments, which helps protect investors from any economic downturn.

That said, one must remember that while alternative asset opportunities can seem lucrative, there are certain cons associated with these investments. For example, they might be subject to strict regulations, or some governments might levy a significant tax rate on the gains earned from some of them. Hence, it is important to weigh the pros and cons and make informed decisions to reach the set financial goals without any hassle.