How Blockchain And Digital Assets are Reshaping Finance

Table of Contents

Introduction

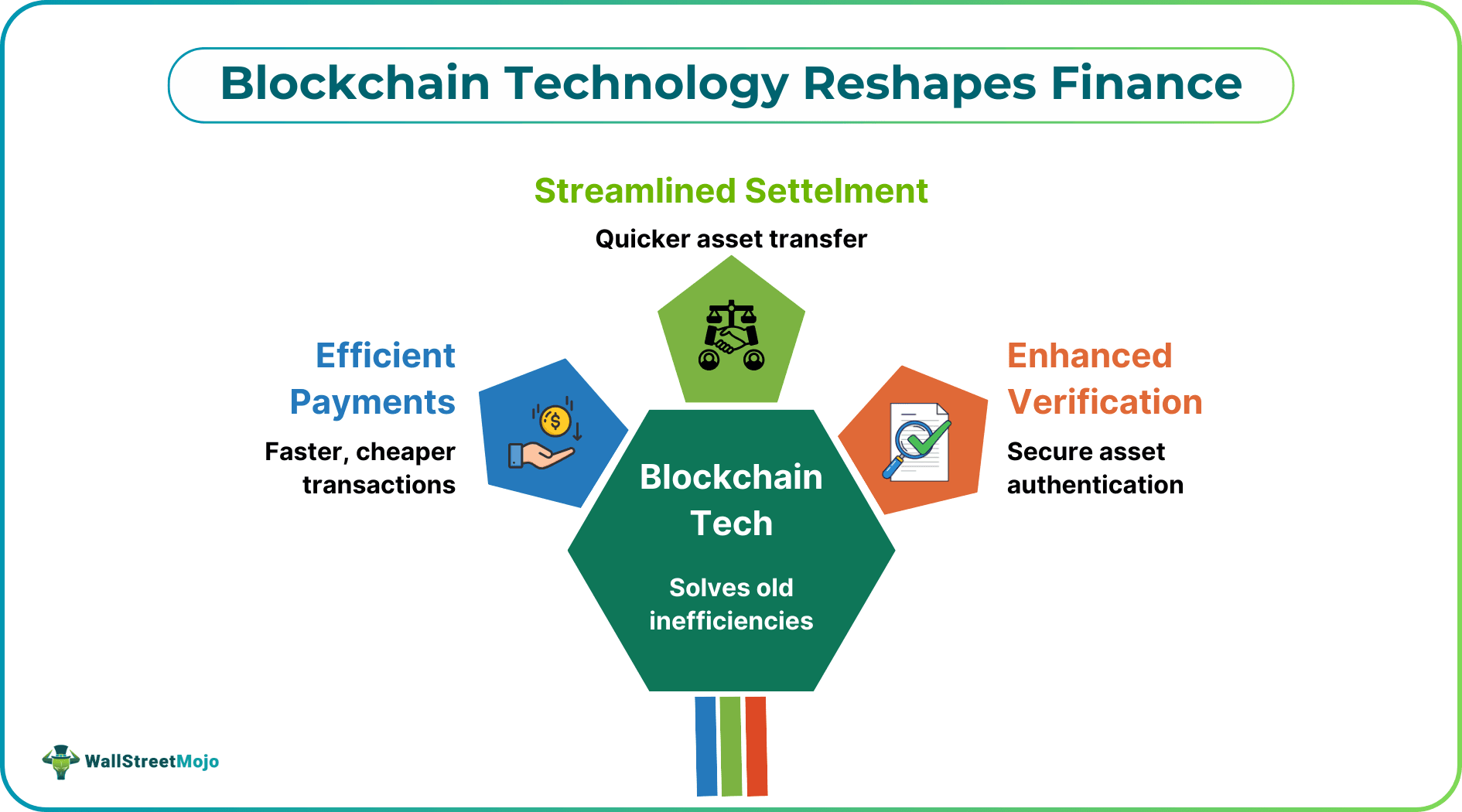

The idea of digital assets is not just a news item or a price fluctuation to the average finance worker and analyst. It represents a bigger change in the financial infrastructure, driven by blockchain technology. More and more, we’re seeing this technology solving old inefficiencies in payments, settlement, and asset verification.

The Practical Value of Blockchain in Finance

A blockchain is essentially a decentralized, immutable registry. In the case of the financial sector, it helps in the transfer of peer-to-peer values without the use of traditional intermediaries such as the normal banks. The advantages are:

- Faster settlement times: Transactions are done within minutes or seconds, 24/7, as compared to traditional systems, where they are done in batches and may require days, particularly for cross-border transactions.

- Reduced transaction costs: Blockchain removes a large number of intermediaries who are used in the process of checking and clearing payments. This will ensure that transfer of money is much cheaper, particularly in terms of cross-border transfer of money or b2b payments.

- Improved visibility and audit trails: A record of every transaction stored as an immutable and time-stamped record creates an easy audit trail to simplify reconciliation and compliance reporting.

There are niche online markets with a high number of very small transactions. An example is digital entertainment apps, such as casinos using crypto. Their adoption of blockchain is due to the fact that it is a superior payment system. Gamers are also able to withdraw and deposit money within seconds, which is much quicker than traditional banks.

Websites such as CCN indicate that this adoption belongs to a larger movement. Businesses are not turning to blockchain to be able to speculate but to pursue its actual, practical advantages, such as speed, easy accessibility, and utility.

How Stablecoins are Modernizing Treasury Management

Blockchain was not initially useful in corporate finance due to the volatility of assets such as Bitcoin. This has been altered by the invention of stablecoins (digital tokens tied to a stable asset such as the US dollar). Stablecoins are the biggest crypto-finance nexus, as seen by analysts.

#1 - How they operate

Businesses such as Circle, which issue the stablecoin USDC, operate by having a real-world reserve. Each USDC digital coin in the market belongs to them as cash and safe government bonds. This makes its value consistent and forms a stable blockchain-based programmable digital dollar.

#2 - Corporate Use Cases

- Cross-border payments and treasury management: Multinational companies are able to transfer funds between their national headquarters or remit money abroad to their company suppliers almost instantly and at very low charges. This frees up money and enhances cost-effectiveness.

- Real-time settlement: In trade finance, smart contracts are established to pay automatically. For instance, a transaction in stablecoins may be discharged as soon as digital shipping records are validated. This eliminates the chances of the non-payment of the other party.

Financial Analyst's Checklist for Blockchain Risk And Regulation

Despite the benefits related to the technology, a risk analysis should be conducted by a professional.

#1 - Asymmetry in regulations

Regulations are becoming decentralized. The analysts should be tracking developments such as the Markets in Crypto-Assets (MiCA) framework of the EU and the continued guidance of the SEC. Evaluate any firm in this field on its initiative compliance position and interaction with regulators.

#2 - Not your keys, Not your Coins

This is often used as a catchphrase that denotes a very important danger: when you do not have your own keys, you do not own your crypto. The collapse of firms such as FTX demonstrated the risks of entrusting your resources to unreliable third parties.

That is why it is important to employ certified and verified custodians who apply high-level security measures, such as cold storage, and are aware of the reserves that they possess.

#3 - Market and Liquidity Risk

Cryptocurrency markets may be volatile and inefficient. If a company has digital assets in its treasury, it must have a smart approach to this risk. Key questions to ask are:

- How much of our cash stock is digital? (It should likely be small.)

- Are we trading on professional trading desks and financial instruments (such as derivatives) to protect against movement in prices?

How Blockchain "Proof" Mechanisms Enable Trust in Finance

Payment is not the only thing that blockchain can do. It provides an innovative method of checking the information and proving ownership in a broad field.

#1 - Provably fair algorithms

Provably fair algorithms are useful in systems where trust is paramount; in digital systems, blockchain can be used to implement provably fair processes. Before a user engages a service provider, the provider can cryptographically commit to a seed of an outcome, and the user can then validate the integrity of the result. The model increases transparency and may save on audit costs.

#2 - Tokenization of Real-World Assets (RWA)

This is where a physical asset (e.g., real estate, art, commodities) or a financial instrument is represented as a digital token on a blockchain. This can not only fractionalize the ownership, but can also liquidate the traditionally illiquid assets, as well as it can also make it easier to transfer ownership.

Blockchain Insights for Finance

- Focusing on infrastructure, not speculation: Blockchain will live to be valuable to finance due to its payment and settlement infrastructure. Assess it like any other innovation within the financial technology sector, namely, efficiency, cost, and security.

- The critical bridge: The majority of companies get involved in the blockchain sphere with the help of trusted, regulated financial partners, such as stablecoin issuers and banks. These partners serve as a secure and familiar crossover to the new financial system from the traditional financial system.

- Risk is multidimensional: Go beyond market risk. In the process of evaluating projects or companies in this region, one can emphasize the regulatory, custody, and operational risk.

- Go beyond currency: Optimize on the capability of tokenization in the future and revolutionize capital markets and asset ownership, and create new capital products and services.