Table of Contents

Introduction

Bitcoins have one of the most volatile trading histories among all asset classes. Its first significant price increase occurred in July 2010 when it jumped from $0.008 to $0.08 within just 5 days. Bitcoin, the world’s first cryptocurrency, is stored and exchanged securely through a public ledger called blockchain on the internet.

Over the years, the BTC to USD price fluctuations have been volatile. There have been several majors price surges and sharp drops since it first became available. This article provides valuable insights into the USD vs. BTC volatile fluctuations and why it behaves the way it does.

Overview of Current Bitcoin Market Trends

Bitcoin is in a rising trend, and investors are willing to pay higher prices to buy Bitcoin. These rising trends indicate that the currency has a positive effect on the buying interest of investors.

The exchange rate of Bitcoin is increasing, according to data. The current value of 1 BTC as of August 2025 is $114,567.06 USD. In the last seven days, it has been observed that the BTC to USD exchange rate has fallen by 3.26%.

Compared to July 2025, when 1 BTC was worth $109,057.23 USD, it's up by 5.05% in August 2025. Though bitcoin is not issued by a bank or a government, factors such as supply, media, and news influences, regulatory changes, and competition from other cryptocurrencies cause BTC to USD price fluctuations.

However, factors such as inflation rates, which typically influence the value of a currency, cannot be applied when it comes to cryptocurrencies like Bitcoin.

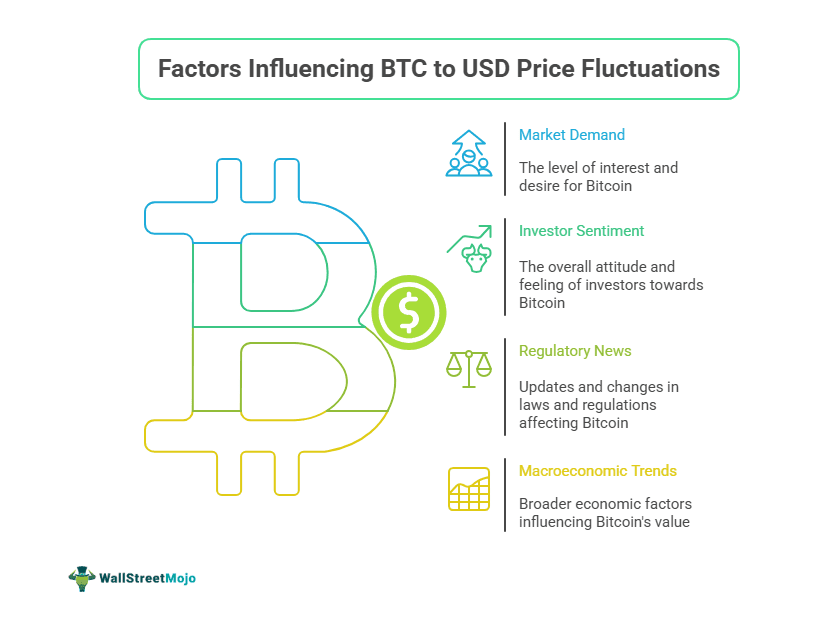

Key Factors Influencing BTC to USD Exchange Rates

Let us look at a myriad of factors that influence USD vs. BTC, which represents the value of Bitcoin in relation to the US dollar. Some key elements include:

1. Macroeconomic Undercurrents

There is a constantly evolving relationship between macroeconomic events and Bitcoin's market dynamics. Elements like inflation, interest rate changes, and geopolitical tensions have a direct impact on Bitcoin price trends.

When there is a rise in inflation, investors often rely on Bitcoin as a hedge, driving up its demand and price. Conversely, when banks raise interest rates, investors tend to gravitate towards traditional assets, moving away from crypto. In contrast, lower interest rates tend to increase capital flow into cryptocurrencies.

During a recession, investors may liquidate investments like Bitcoins that are considered riskier, leading to BTC to USD price fluctuations. During periods of economic expansion, there is an increased investment in assets like Bitcoin due to consumer confidence.

Other factors, such as geopolitical tensions, boost the prospects of Bitcoin as a safe-haven asset.

2. Supply Compression

An asset's supply is a key feature in determining its price. The supply of Bitcoin is well-publicized since it was first introduced. It has a maximum supply of only 21 million coins. Hence, only a limited number will be created each year. This makes it a scarce digital asset. Its protocol was designed such that only new bitcoins are rewarded at a fixed rate.

The reward halves every 4 years by halving, thereby slowing the rate at which new bitcoins are created.

Thus, Bitcoin’s future supply is reducing, thereby increasing its demand. To date, 19 million bitcoins have already been mined, with less than 2 million remaining to be created. This supply compression with rising demand leads to an increase in its price.

3. Maturing Market Behavior

Studies related to BTC volatility, in response to halving events that took place every four years from 2012 to 2024, show that the impact of halving on Bitcoin's pricing has significantly reduced over time. This shows the emergence of a maturing market that has been largely driven by increased anticipation of supply shocks and clear regulatory frameworks.

From 2012, when the returns were the highest given the early market’s growth, the trend has a downward slide; returns are much lower, showing that the market is maturing, resulting in less volatility.

As the market matures, Bitcoin trading is increasingly influenced by institutional behavior and broader financial trends.

Technical Analysis of Recent Price Movements

Given below is a BTC USD forecast, showcasing recent price movements. The six-month Bitcoin price chart looks like a redemption arc — with an initial decline, then a recovery, and an upward trend. The crypto market analysis in March 2025 saw BTC to USD price fluctuations with a fall from near $115,000 to around $82,550. It then climbed steadily in April, reaching $94,200. May marked a recovery above $100,000.

From March’s low to August’s high of $113,754.00, Bitcoin surged approximately 40–41%. The climb has been measured and is not explosive. Bitcoin’s 30-day volatility stands at around 2.72%; it means the daily price fluctuations have been relatively modest in recent weeks.

The current Relative Strength Index (RSI) shows a balanced price trend, staying in the neutral 30–70 range. The volatility remains, but is more contained as the price action is steady, not erratic. The overall growth trend indicates that the coin can become a solid asset now if it continues to grow.

Expert Predictions for Bitcoin's Future Performance

Financial experts and crypto analysts are positive on the long-standing potential of Bitcoins. Industry experts are forecasting $1.02 million by the end of 2035. They also predict that by the end of 2025, Bitcoin (BTC) is expected to hit $145,167, driven by limited supply and growing acceptance of Bitcoin ETFs.

On the other hand, some experts caution that there could be a downward pressure on prices depending on market momentum and interest rates. However, all of them agree that Bitcoin is a high-risk, high-reward asset.

Strategies for Investors in a Volatile Crypto Market

Some important strategies that crypto investors can follow are as follows:

- Diversifying The Portfolio - Spread your investments across multiple cryptocurrencies and other assets to reduce risk.

- Dollar-Cost Averaging -Use Dollar-Cost Averaging (DCA) and invest fixed amounts regularly instead of a large sum at a potentially unfavorable time.

- Set Stop-Loss Orders - Use stop-loss and take-profit orders to manage your trades with discipline.

- Stay Informed About Market Trends - Stay updated on any regulatory changes or any macroeconomic events that can shift the market quickly.

- Long-Term Perspective - Crypto markets can swing wildly in the short term; investors should look at long-term results to see better returns.

The Verdict

Bitcoin's recent price fluctuations reflect various macroeconomic pressures, market sentiments, and regulatory developments. While BTC volatility appears to be a norm in the short term, long-term indicators suggest an optimistic outlook. Thus, Bitcoins are both a high-risk and high-reward asset in today’s financial landscape.