How to Build Inclusive Training for Finance Teams

Table of Contents

Introduction

Inclusive training works best when analysts and bankers can focus on mastering skills instead of navigating rigid learning formats. Finance education is often dense, timed, and inflexible, which quietly disadvantages neurodivergent learners and contributes to burnout across teams. This article outlines a practical, performance focused approach to building inclusive training for finance teams without lowering expectations.

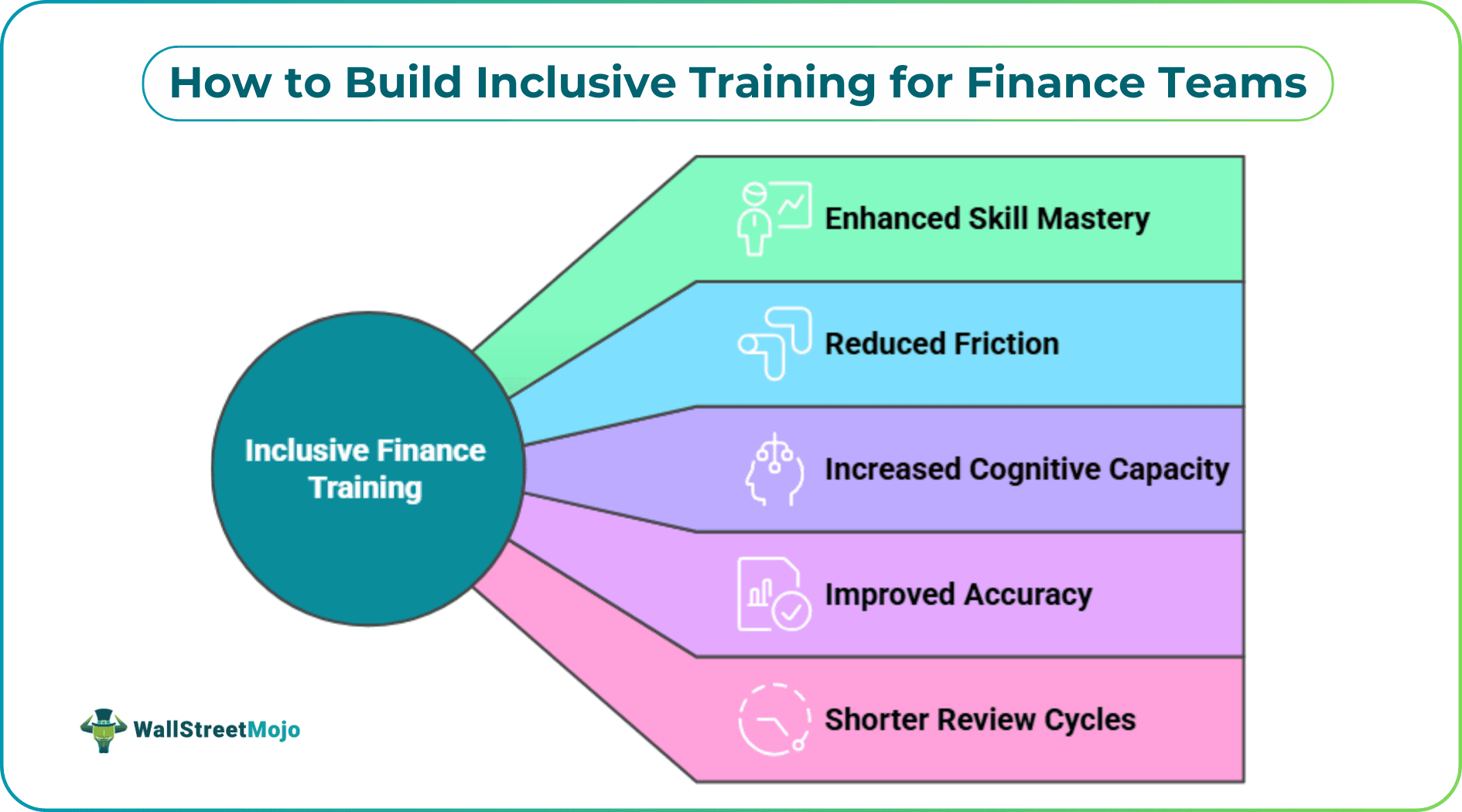

Inclusive design improves finance training accuracy by reducing friction rather than lowering standards. When learners spend less effort navigating formats, they devote more cognitive capacity to judgment, modeling, and decision making. This shift increases consistency in outputs and shortens review cycles, which matters in high stakes finance environments.

Why Inclusive Training For Finance Teams Is A Performance Issue

Inclusive training for finance teams is not a wellness initiative. It directly affects model accuracy, review cycles, and how quickly new hires deliver reliable work. When learning materials overload working memory or reward speed over understanding, error rates rise and confidence falls.

Many financial training groups frequently observe this pattern during analyst onboarding. Candidates who pass hiring assessments often struggle in early training but perform well once learning barriers are removed. That gap points to a design issue rather than a talent issue. Inclusive training improves clarity, retention, and application under pressure.

Start With A Real Needs Assessment

Effective inclusive design starts with real job demands rather than assumed workflows. Map what analysts and bankers actually do each week across Excel modeling, valuation analysis, and risk reporting. Focus on task sequences instead of course outlines.

Interviews add essential context. Speak with recent hires, high performers, and managers to identify where learning breaks down. Patterns usually emerge quickly.

Common issues include dense slide decks, timed quizzes that reward speed over reasoning, and simulations that require constant mouse use. These barriers slow learning and hide real skill gaps. Documenting them early prevents expensive redesigns later.

Plan Training Around Awareness And Momentum

Timing influences adoption more than many teams expect. Launching inclusive training during periods of organizational awareness helps learners understand why changes are happening. Clear context reduces resistance and builds trust.

Many finance teams align pilots with internal learning initiatives or inclusion focused campaigns. Neurodiversity Celebration Week often provides a natural kickoff for inclusive training pilots and manager briefings. Framing the rollout this way positions training as a shared performance effort rather than an accommodation.

Design Multiple Formats From The Start

Inclusive design works best when options exist from day one. Every core concept should be available in more than one format so learners can choose how they engage.

Effective format options include:

- Short captioned videos that explain each concept clearly

- Written explanations with structured headings and hierarchy

- Step by step walkthroughs using realistic finance scenarios

Dyslexia friendly formatting is especially important in finance training. Clear spacing, readable fonts, and strong structure reduce cognitive load when reviewing formulas or assumptions. These choices benefit all learners.

Inclusive finance training boosts performance by reducing learning friction.

Use Microlearning Inside Your LMS

Microlearning fits naturally into finance workflows. Short modules focused on one concept are easier to revisit and apply under deadline pressure. A ten minute lesson on discounted cash flow assumptions is more usable than a long lecture.

Each microlearning unit should follow a consistent structure. Introduce the concept, demonstrate a worked example, and prompt a small application task. This approach works well for Excel modeling, valuation adjustments, and risk scenario setup.

Explain the format upfront so learners know what to expect. When training respects time and focus, engagement improves.

What Inclusive Finance Modules Should Always Include

Every inclusive finance module should meet a baseline quality standard before release. A consistent review checklist helps maintain alignment across courses.

Core elements to include are:

- Closed captions and transcripts that support different processing styles

- Dyslexia friendly text with clear spacing and layout consistency

- Full keyboard only navigation for lessons and assessments

These features remove friction and keep attention on learning outcomes.

Making Inclusive Training For Finance Teams Sustainable

Inclusive training for finance teams succeeds when it becomes an ongoing practice rather than a one time project. Regularly reviewing modules, updating formats, and gathering feedback from learners and managers keeps training aligned with real work. Over time, small improvements compound into better accuracy, stronger confidence, and faster contribution.

If your organization wants additional help designing inclusive, high performance finance training, WallStreetMojo offers assessment, pilot design, as well as implementation support. Contact the team to build training that reflects how finance professionals actually work.