How to Calculate Interest Payable on a Gold Loan?

Table of Contents

Introduction

Gold Loans have become one of the most accessible and popular forms of short-term credit in India. Whether for weddings, education, business expansion, or emergency medical expenses, borrowers often turn to their gold jewellery and ornaments to unlock liquidity. Yet, while the borrowing process is simple, it’s crucial to understand the interest component. Knowing how to calculate Gold Loan interest payable ensures you stay in control of your finances and avoid unexpected burdens.

Why Interest Calculation Matters?

Simply put, interest is the price you pay for borrowing credit. Unlike other loans that require extensive paperwork and lengthy approval processes, a Gold Loan offers quick disbursement. Still, it carries financial obligations that you must be prepared for. Being aware of your interest obligations is essential for making a Gold Loan a truly beneficial financial decision. By learning how to calculate Gold Loan interest, you will be able to do the following:

- Compare loan offers from different lenders effectively

- Plan monthly payments with accuracy

- Select the most suitable Gold Loan repayment option

- Avoid hidden surprises when the repayment date arrives

The Basic Formula to Calculate Gold Loan Interest

The simplest way to calculate Gold Loan interest is through using the following formula:

Interest Payable = (Principal × Rate of Interest × Tenure) / 100

Here,

- Principal: The amount you borrow against your pledged gold

- Rate of Interest: The annual interest rate charged by the lender

- Tenure: The Gold Loan repayment period

For example, if you borrow Rs 2 Lakh at 10% interest for 12 months, the calculation will be as follows:

(2,00,000 × 10 × 1) / 100 = Rs 20,000

So, your total interest payable over one year is Rs 20,000.

Types of Interest Calculation in Gold Loans

Although the above formula is the simplest interest calculation method, lenders may apply different interest structures that can change your Gold Loan repayment schedule. These are the common types of interest calculation in Gold Loans:

- Simple Interest: Some lenders charge simple interest, meaning you only pay interest on the principal amount. Using the earlier example, you will owe exactly Rs 20,000 in interest after one year. This method is transparent and easy to calculate.

- Reducing Balance Interest: Many lenders apply interest on the outstanding balance after each repayment. For instance, if you make partial payments towards the principal during the loan tenure, your interest gradually decreases. You can significantly benefit from this structure if you plan to repay in instalments.

- Monthly Compounded Interest: In this method, the lender calculates the interest on the principal plus the accumulated interest every month. That means your payable amount can grow faster if you delay Gold Loan repayment. Although this is a complex method, you can easily manage it by making timely instalment payments.

Factors Influencing Interest Payable

While calculating the Gold Loan interest, the following factors may affect the final figure:

- Loan Amount: Higher amounts attract a larger interest outgo

- Rate of Interest: Different lenders charge varying rates based on their policies, RBI guidelines, and competitive offers.

- Tenure: Longer repayment terms mean more interest accumulation, even at lower rates

- Repayment Method: Whether you choose equated monthly instalments (EMIs) or bullet repayment, it impacts your overall interest cost.

- Market Gold Price: As gold prices rise, your eligibility increases, which can influence your interest outgo. The bigger the loan, the higher the interest cost.

Methods of Gold Loan Repayment and Their Impact

Choosing the right repayment option can dramatically impact your interest outgo. When it comes to Gold Loan repayment, reputable lenders usually provide the following options:

#1 - Equated Monthly Instalments (EMIs)

Here, you pay both principal and interest in fixed monthly instalments. This structure makes financial planning easier and reduces the burden at the term end.

#2 - Bullet Repayment

In this method, you pay the entire principal and interest in a lump sum at the end of the tenure. While convenient for those expecting future income, it often results in higher overall interest outgo.

#3 - Interest-Only Payments

Some lenders allow borrowers to pay only the interest in instalments and the principal at the end. This keeps monthly obligations light, but requires a substantial outlay in the end.

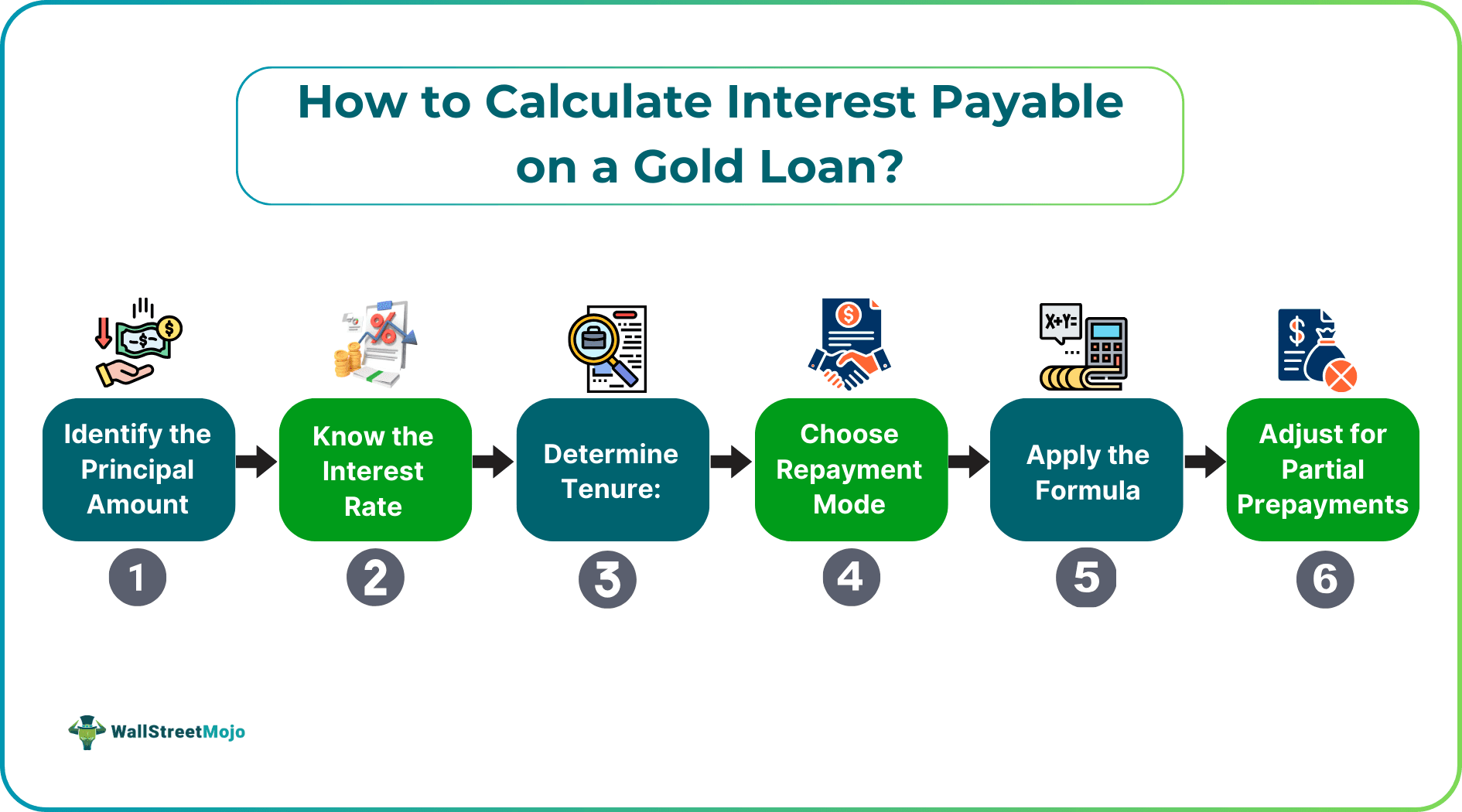

Stepwise Guide to Calculate Gold Loan Interest Payable

Here’s a simple stepwise process to calculate Gold Loan interest. Following these steps ensures that you know exactly how much you will owe:

- Identify the Principal Amount: Check the sanctioned loan amount.

- Know the Interest Rate: Confirm whether the lender is charging a simple, reducing balance, or compounded interest rate.

- Determine Tenure: Calculate the number of months or years required to repay the borrowed amount.

- Choose Repayment Mode: Decide between EMI, bullet, or an interest-only repayment plan.

- Apply the Formula: Use the appropriate formula based on the repayment structure.

- Adjust for Partial Prepayments: If you intend to make early payments, factor these into your calculation to reduce the outstanding balance.

Tips to Manage Interest Payable

Here are a few tips to calculate Gold Loan costs and ensure that your borrowing experience remains stress-free.

- Always compare different lenders before pledging your gold.

- Select a repayment mode that matches your cash flow.

- Make partial prepayments whenever possible to reduce your interest burden.

- Avoid unnecessary delays in instalment payments, especially under compounding loan structures.

- Use online tools like a Gold Loan EMI calculator to simplify your loan planning.

Conclusion Gold

Gold Loans are among the most reliable financial tools when used wisely. However, the real key lies in understanding interest obligations and structuring repayments strategically. Whether you choose EMIs, bullet payments, or overdraft facilities, learning how to compute interest payable will give you confidence in managing your finances.

By mastering the process of calculation and adopting a disciplined approach to Gold Loan repayment, you can enjoy the benefits of quick liquidity without facing undue financial pressure.