How Does the Cash Conversion Cycle Differ Across Digital Platform Businesses?

Table of Contents

Introduction

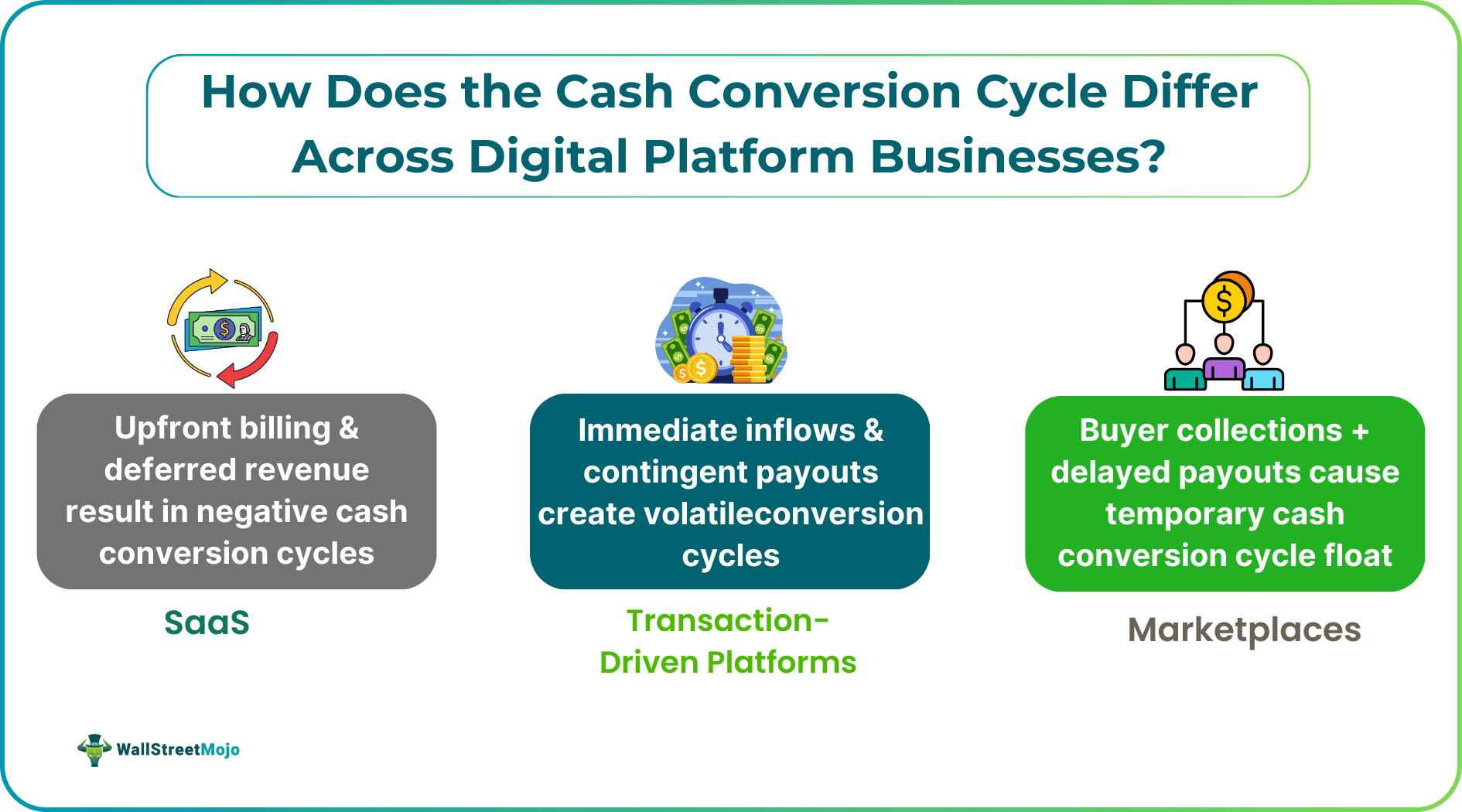

The cash conversion cycle (CCC) remains one of the clearest ways to understand how efficiently a business turns operations into liquidity. For digital platform companies, however, the metric behaves very differently than it does for manufacturers or retailers. The reason lies in how these platforms collect cash, recognise revenue, and settle obligations.

Transaction-led platforms make this dynamic especially clear. User activity generates immediate cash inflows, while withdrawals, rewards, or partner settlements are processed later. Online casinos, particularly AU players favourite sites, are a strong example of this efficiency. Real-time deposits and instant gameplay monetisation allow operators to maintain high liquidity, reinvest quickly in user experience, and reduce dependence on external financing.

This model supports scalability and financial resilience when paired with robust compliance and payout management systems. Similar cash-flow advantages can be seen in subscription-based software platforms that collect fees upfront before delivering services, or digital marketplaces that receive customer payments immediately while settling with service providers on a scheduled basis. In each case, a structurally short cash conversion cycle reflects operational strength rather than accounting distortion.

Cash Conversion Cycle Explained

At its core, the cash conversion cycle measures how long cash is tied up in operations before returning to the business. It combines Days Sales Outstanding, Days Inventory Outstanding, and Days Payable Outstanding into a single operating metric. For digital platforms with little or no inventory, CCC becomes almost entirely a function of billing and settlement timing.

This matters because CCC increasingly influences valuation models. Investors assessing platform scalability want to know whether growth consumes cash or releases it. A shrinking or negative CCC can signal that expansion is funding itself rather than relying on external capital.

Revenue Models And Timing Effects

Subscription-based platforms tend to show the most striking CCC profiles. Cash is frequently collected upfront, while revenue is recognised gradually over the contract period. That creates deferred revenue, which effectively acts as interest-free financing.

Benchmarks highlight this advantage clearly. Data from subscription model benchmarks shows SaaS companies typically target Days Sales Outstanding of 15–30 days and Days Payable Outstanding of 30–60 days, making negative CCCs achievable when collections outpace expenses. The accounting treatment, not just operational speed, drives the outcome.

Marketplace platforms sit somewhere in the middle. They collect funds from buyers but remit payments to sellers after a delay, creating a temporary float. While this can lengthen CCC on paper, optimised settlement systems can reduce friction without sacrificing liquidity control.

Working Capital Accounting Nuances

Transaction-driven platforms, including gaming or payment-based services, face more volatile CCC dynamics. Cash inflows are immediate, but contingent outflows such as bonuses or rebates introduce uncertainty. The timing of these obligations can cause CCC to swing sharply from period to period.

For comparison, traditional online retail offers a useful baseline. Typical cash conversion cycles fall in the 60–90 day range, with one illustrated calculation near 66.5 days. Digital platforms that outperform this are often benefiting from structural timing advantages rather than superior margins alone.

Interpreting Platform Cash Efficiency

For analysts and finance professionals, CCC should be read alongside revenue recognition policies and payout mechanics. A negative cycle is not automatically superior if it relies on deferred obligations that scale unpredictably. Context matters.

Understanding how platform models reshape working capital helps separate sustainable efficiency from accounting optics. In digital finance, cash timing is a strategy, not just arithmetic.