Table of Contents

Introduction

Trading in the foreign exchange (forex) market can be exciting. While it can offer excellent rewards, it is not uncommon for people to incur substantial losses. Indeed, if one does not adhere to the best practices and makes mistakes that are avoidable, there’s a high chance that they will lose money. For instance, if one does not choose a reliable broker like any of the ones that partner with fxcash.net, they may incur high transaction costs. These costs, in turn, lead to reduced gains or even losses. If you are wondering what other noteworthy mistakes are, you have come to the right place.

In this article, we will be diving deep into various beginner forex trader errors and what measures one can take to avoid them. We will be exploring poor risk management, trading without factoring in the latest market, and other reasons that may lead to losses in the market. By the end of this article, you will have a clear idea of how to steer clear of common forex trading mistakes. By becoming aware of these mistakes, you will have a better chance of succeeding in the market.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

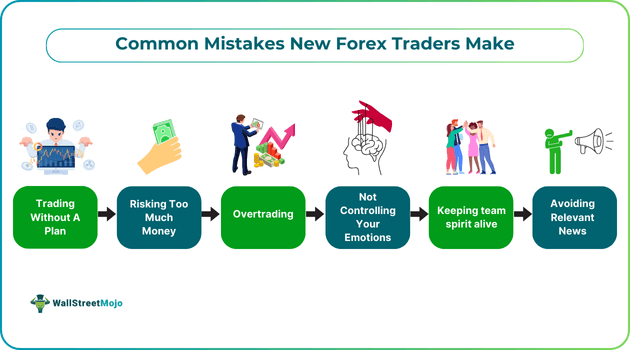

Common Mistakes In Forex Trading

Let us look at some common forex trading mistakes in detail.

#1 - Trading Without a Plan

When trading in the forex market or any other financial market, having a clear plan is imperative. This plan comprises key elements, like the trading strategy, the capital for trading, time commitments, etc. Without it, reaching your predetermined trading goal is highly unlikely. On a bad day, after a few trades go wrong, individuals may want to scrap their plan. Note that acting on that thought is a common forex trading mistake one must avoid.

Just because a few trades go wrong, it does not mean that the trader’s plan is ineffective. The losses only indicate that the markets did not move per the trader’s expectations.

In this case, a useful forex trading tip is to maintain a trading diary to record what did not work and what worked, and the reason for the same. It can help in improving decision-making for the future, especially when paired with tools like a Forex VPS that ensure trades are executed without lag or disruption.

#2 - Risking Too Much Money

Another one of the common forex trader errors is taking too much risk. This may happen when one does not know their own risk appetite and does not have an understanding of leverage. Indeed, fully understanding the key concepts of leverage and margin is key to avoiding forex losses. If you do not know what these terms mean in trading, you might accidentally put more funds at risk than you actually planned. While trading with leverage might seem attractive, executing trades with limited knowledge may result in substantial losses. You might even lose your trading account’s entire value.

#3 - Overtrading

This is a common forex trading mistake made by individuals. It involves placing buy or sell orders impulsively. Typically, people make trading decisions, in this case, on the basis of their emotions instead of a clear strategy. It may seem that more frequent trading can increase the chances of generating profits. That said, in reality, overtrading usually results in unnecessary losses.

Besides decision-making, two factors that lead to losses are the reduced focus and the increased transaction costs and the reduced focus. The focus gets reduced because traders execute orders without proper analysis of the market conditions. One may compare different brokers and select a reliable one that charges lower fees to avoid paying high transaction costs. A reputed broker with the right technology can also ensure an optimal trading experience.

#4 - Not Controlling Your Emotions

With exchange rates fluctuating constantly, keeping emotions like greed, fear, and stress in check can be challenging. That said, if one fails to control their emotions, avoiding forex losses becomes impossible. One needs to have a proper plan in place to refrain from making impulsive decisions in the market. Because of this, highly experienced traders say that trading is repetitive; they adhere to the rules set by them to make financial gains.

So, an important forex trading tip is to consider losing and winning sessions the same while fully focusing on long-term goals. One must place buy and sell orders within their capacity to build trust in their system and themselves prior to raising the stakes.

#5 - Avoiding the News

Among beginner forex trader errors, a common one is that individuals fail to keep themselves up-to-date with the latest news related to the foreign exchange market. Such news may be about geopolitical developments, economic events, central bank decisions, economic data releases, etc., that may have a significant impact on the market. Fortunately, some of the events have a fixed schedule. That said, predicting how the market participants will react to the events or decisions is not a straightforward task.

Without having knowledge of the latest updates affecting the forex market, one is less likely to make trading decisions that result in financial gains.

Become A Professional Trader

Once individuals are aware of the common forex trading mistakes, they can learn about the process of becoming a professional trader. Note that the process requires one to follow these steps:

- Learn Continuously: One must have the dedication to keep learning something relevant continuously. Acquiring knowledge is key to elevating the skills needed to succeed.

- Create A Trading Plan: This plan will be a roadmap for success in the trading world. It will have the trader’s goals, entry strategies, money management rules, risk appetite, and exit strategies.

- Trading With A Demo Account: Doing so allows one to practice trading utilizing different strategies and build confidence without worrying about losing money.

- Manage Emotions: As noted above, keeping emotions in check is vital to refrain from making emotion-driven decisions that lead to losses.

- Have A Trading Journal: Keeping a trading diary allows one to monitor strategies, trades, and emotions. This gives a chance to analyze failures and successes and spot patterns to improve future performance.

- Implement Risk Management Strategies: These strategies involve setting take-profit and stop-loss levels to safeguard capital.

- Stay Updated: One needs to have the latest information that may impact forex markets to ensure effective decision-making.

- Join Trading Communities: One must join different online forums, groups, and events across different platforms. It will allow them to connect with different forex traders worldwide and gain access to vital insights.

Besides following the above steps, one must remain patient as well as persistent. Moreover, they need to be open to accumulating as much knowledge as possible. With the right mindset, awareness, and knowledge, one can avoid common forex trading mistakes and improve the chances of becoming a successful trader.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.