Table of contents

Coursera Financial Model Meaning

Coursera IPO has been a buzzword since the date this news became public. Online educational giant Coursera Inc. went public on March 31, 2021, on the New York Stock Exchange (NYSE) with its first IPO listing. The company promoted its initial public offerings at a price range of $30 to $33

Key Takeaways

- The Coursera financial model template refers to a number of pre-structured spreadsheets that make the process of building a financial model easier for individuals.

- Such a template includes various elements, for example, standard layouts, formulas, and formatting.

- Some key benefits of using such a template include reduced errors, standardization across departments within an organization, and quicker access to insights for faster decision-making.

- The Coursera IPO model includes the three main financial statements, which are the cash flow statement, the income statement, and the balance sheet.

Free Download – Coursera Financial Model

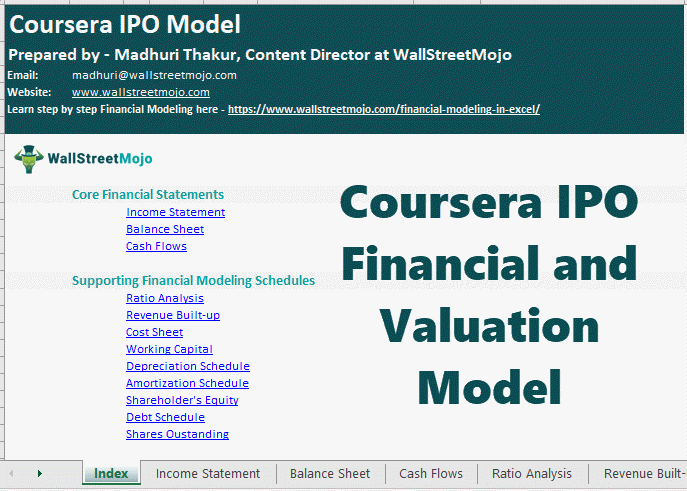

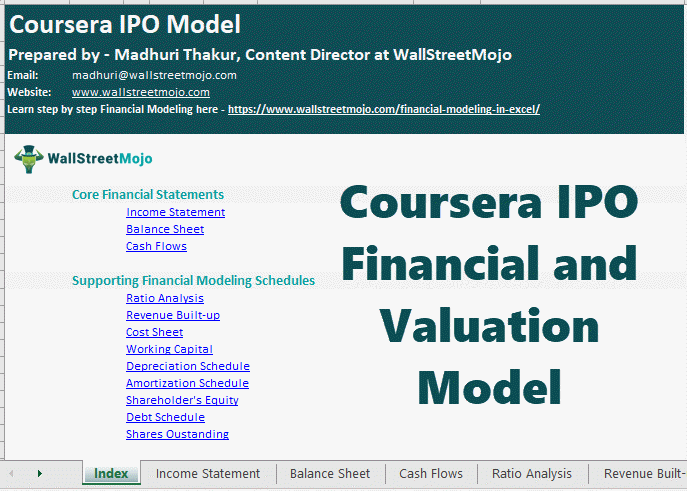

We prepared Coursera’s Financial and Valuation model to help you understand the nuts and bolts of the IPO valuation model and its dynamics.

What Is The Coursera Financial Model Template?

The Coursera financial modeling template comprises pre-structured spreadsheets that have been designed to help professionals and aspiring analysts build a financial model. These spreadsheets include formatting, standard layouts, and formulas to assist users in developing valuations, analyses, and estimates.

Using a financial modeling template can reduce the time taken to build a financial model. Moreover, it can minimize errors that often arise when carrying out the process manually.

How To Use The Coursera Financial Model Template?

- Download the template and review its structure to get a clear idea of its logic

- Accumulate and enter historical data in the correct cells and customize assumptions on the basis of the scenario.

- Make sure that the formulas used across all spreadsheets are linked accurately.

- Use the historical data to project future values and carry out the analysis of outputs like net income, cash flows, and earnings before interest, taxes, and depreciation or EBITDA.

If you are not sure how to use the Coursera financial modeling template correctly, taking the 2-Day Financial Modeling Bootcamp can be helpful. This instructor-led program shows how one can use such a template and build a financial model in Microsoft Excel without any hassle. The practical approach adopted by the trainer involves using real-world examples and case studies to help learners get a clear idea of the process.

Benefits of The Coursera Financial Model Template

Let us look at the benefits of using the Coursera financial model template.

- Considering this template includes formulas and pre-built structures, they can play a key role in helping users of such a template save time.

- A noteworthy benefit of this template is that you can gain access to it for free.

- This template includes proven formats, which significantly reduce the chances of errors that often arise when building a financial model manually from scratch without a tried and tested template.

- It allows for standardization across different departments and teams.

- The financial model template can provide insights quicker for decision-making.

- Our experts built this Course financial model template keeping the future in mind. This means after downloading the template, you can utilize it for many years without having to worry about it becoming outdated.

Note that this type of template is extremely helpful, especially for beginners, as it enables new users to learn the required formulas and develop a comprehensive idea of the structure of a financial model.

Coursera IPO Performance

With stunning trading performance, Coursera’s shares flared up by almost 36% (from Coursera’s IPO price) on the first trading day itself. The shares opened at $39, while the closing value was $45, giving Coursera the market cap of $5.9 billion. Soon after the IPO, Coursera started to trade on the stock exchange under the ticker symbol COUR.

Being a new entrant on the stock exchange, the performance of Coursera shares is not very clear to those who are keen to make most of this news. We’ve got you covered! This Coursera IPO Model provides you with a better insight into the company’s financials to help you as a learner or professional.

Coursera, the California-based EdTech company, offers Massive Open Online Courses (MOOCs). It is an e-learning platform that offers various professional certificates, guided projects, full-scale degrees, and free courses. For this purpose, it works in collaboration with 200 plus education providers and universities.

This full Coursera IPO model includes:

- Coursera’s complete income statement, balance sheet, and cash flow projections

- Revenue and Cost sheet, Working Capital, Depreciation, Amortization, Shareholder’s Equity and other essential schedules

- Discounted Cash Flow Analysis

- Relative Valuation

- You can edit the assumptions in this free excel financial model and tailor it to suit your analysis.

This free, downloadable Excel template equips you with all the sheets you’ll need to build an efficient model for any upcoming IPO.