Digital Age Investing: The Perks and Perils of Online Trading

Table of Contents

Introduction

For most of us, traditional stock trading meant visits to a stockbroker and getting paperwork done. It was a hassle and kept us anxiously waiting to see how we fared. With the advent of online trading, thankfully, those days are long gone. Today, stock trading has grown by leaps and bounds due to the rise of online share trading. In this article, we help you, the potential online investor, understand this trend. We also discuss all the benefits and issues you would encounter with digital age investing.

Currently, all online trading platforms have democratized access to financial markets. They have helped replace traditional brokers with user-friendly interfaces through technology. They offer benefits like inexpensive trading and diverse investment options

Let us do a deep dive into the topic on the advantages and disadvantages of digital age investing. Whatever the location, access to a good online trading platform is essential for a good trading experience and the best returns. If you are from Europe, you can check out one of the best option trading platforms in Europe to get started.

The Advantages

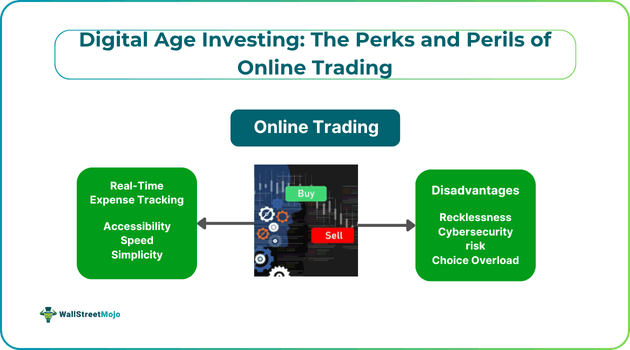

Digitalization in general has been beneficial to the world at large! Its no wonder that online trading in the digital age offers its host of benefits. Investors accessibility, convenience, and control, and trade execution with potentially lower costs make one less reliant on traditional brokers. Digital platforms provide extensive information and analytical tools helping investors make informed decisions in a swift way based on market fluctuations.

#1 - Accessibility

Online trading has been revolutionary in making financial markets more accessible than ever before. The digital nature provides far more reach in terms of global accessibility. Also, many online brokers have removed barriers like high minimum deposits, making it easier to setup an account for digital age investing.

Online trading eliminates the need to be physically present at a broker's office. Thus, people can trade at any time and there is no location-based barriers.

The online platforms also offer diverse investment options helping investors with different goals to build a portfolio that suits them.

#2 - Convenience

When one opts for online trading, the number one priority on most people’s list is convenience. Online trading offers the convenience of buying and panic selling securities whenever traders want. It can be done from any location in the world if one can access the internet. This implies that even when one is traveling, investors can respond promptly to stock market movements.

Speed

One of the online trading advantages is the speed it offers. In the past, placing a trade was a slow and complicated process, often requiring phone calls or physical paperwork. Now, with just a tap on your smartphone, you can buy or sell shares instantly within seconds.

Simplicity

The simplicity of online trading is another important perk! Transactions are faster, the interface is user-friendly even to amateurs. There is direct control over your accounts with complete ease of use. However, the small disadvantage that can lead to impulse decisions and mask inherent market risks.

Education and Empowerment

Before one jump into the world of modern investment strategies, they must get educated on their nitty-gritties. Many digital platforms have given access to financial courses empowering individuals to take control of their financial futures.

The advantage of online trading platforms is that they provide articles, interactive tutorials, and webinars, to teach investors financial concepts band market dynamics.

Besides, these platforms give access to real-time market data, news and many analytical tools. This levels the playing field by providing retail investors with professional-grade capabilities once only available to institutional investors. To present complex financial insights and learning materials more effectively, the best ai for powerpoint helps convert market data and educational content into clear, structured presentations that enhance understanding and informed investment decisions.

Affordability

Online trading platforms usually charge much lower brokerage fees than traditional brokers. This helps you save more and boost overall returns. This is very useful for those who are deeply involved in digital age investing. There are no overhead costs involved as with physical offices. Hence, they can offer bigger commissions. Plus, trading online removes many paper-based and stamp duty charges that come with traditional methods.

Potential Drawbacks

Its not all roses when it comes to online trading! It does have its potential drawbacks. Some of them include security of online trading risks, a high potential for losses, and the pressures of information overload. While it is definitely convenient, online trading can also lead to impulsive and undisciplined behavior.

#1 - Choice Overload

The flip side of online trading is that investors have access to a lot of information. While information is good, excessive information can lead to overload and making impulsive decisions. It can lead to emotional buying and selling and can be overwhelming especially if you are new. To help investors understand current market trends and helping them spot potential opportunities, several digital investing platforms offer real-time market information, which could be a bane.

#2 - Technical Challenges

Online trading depends heavily on technology, so any technical glitches can disrupt your trading day. Issues like system outages or slow internet can prevent you from placing trades or accessing your account, which can be frustrating and may cause you to miss good investment opportunities.

#3 - Cybersecurity Risks

Online trading is similar to online banking. While this digitization, has revolutionized the world, it is a hub for hackers to access passwords, accounts, and other sensitive information. Any flaws in cybersecurity can put investors' personal at risk. However, such issues can be handled with the usage of strong passwords, two-factor authentication, and complete logging out after use. However, with their huge money-making potential, online trading accounts are prime targets for cyberattacks. Many traders have experienced hacking, phishing scams, and data breaches. Despite security measures like encryption, vigilance is still required from the user.

#4 - Recklessness

The accessibility of online trading makes one vulnerable to making rash decisions on an impulse. The constant access of investors or traders to information may result in them making rash decisions when things are not going their way. Market volatility and fluctuations can lead to poor trading decisions. This can give lower returns or also make for a loss-making trade.

Final Thoughts

Online share trading is empowering a new generation of investors. It’s simple, affordable, and filled with information. These platforms have made the stock market more accessible than ever before. Whether you’re an experienced investor or a beginner, online trading is worth exploring if you are interested in trading. It could open the door to new financial opportunities in India’s fast-changing market.