The distinctions between marketable equity security and debt securities include:

Table of Contents

What Is An Equity Security?

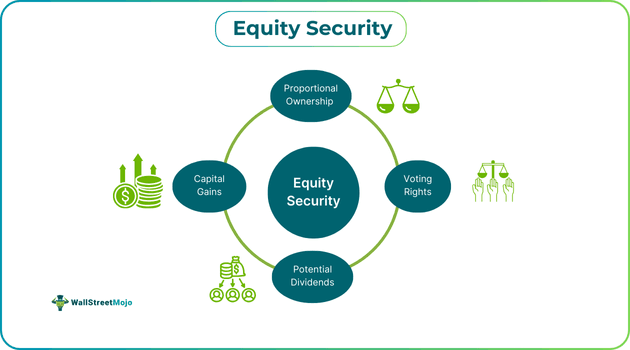

Equity security refers to any stock or other similar securities that result in the holder’s ownership of the company. These securities often generate regular passive earnings for the holder in the form of dividends. However, an equity security analysis shows that the base price of these stocks experiences upward and downward movements due to various internal and external factors.

These stocks or shares empower the holder with voting rights, potential dividends, and capital appreciation for security. However, they are not free of risks. If the company underperforms or fails to comply with regulatory requirements, investors have a chance of incurring losses. Nevertheless, investors employ a significant sum in these securities as they also have significant liquidity.

Key Takeaways

- Equity security refers to a stock or similar securities that give the holders ownership in proportion to the unit of shares held. These investments typically give investors voting rights in the company and potentially dividend income.

- In case of liquidity or bankruptcy, equity holders are repaid only after the debt security holders are repaid.

- Ordinary shareholders have a say in the corporate affairs of the company, such as appointing a board member or approving a merger.

- However, market volatility and other external factors add an element of risk to these investments, as investors might lose the amount invested.

Equity Security Explained

Equity securities refer to transferable ownership of a company in the form of common stocks, stock options, preferred stocks, and other similar securities. These securities give the holder voting rights, ownership, capital appreciation, and even dividends in some cases.

However, these securities are also subject to the push and pull of market forces of demand and supply. Hence, the holders might also experience profits or face losses based on the volatility of the stock and the market at large.

Equity as a form of security is one of the most common forms of investment globally. It comprises a majority of investors' portfolios. Despite its innate nature of being volatile, investors park a significant amount towards these investments as the probability of capital gains is high, and so is the liquidity. Hence, they can enter and exit at their discretion.

While investors get voting rights, they get to influence the decision-making process within the company. However, it is noteworthy that most forms of marketable equity security are given lower priority than other forms of capital raising, such as debt.

Investors' returns depend heavily on a company’s performance. If a company performs well and complies with all regulatory requirements, its stock price will most likely rise. On the other hand, if there are issues with regulatory compliance or overall performance, prices might fall.

Characteristics

The unique characteristics of equity security services attract the majority of its investment. A few of the most prominent ones are:

- Ownership: Equity security, by definition, signifies a share in ownership of the company. It gives the holder a stake in the company’s profits, assets, and decision-making. However, the extent of access to these factors is proportional to the number of shares they hold.

- Voting Rights: Common shareholders typically have voting rights and a say in the company's corporate affairs, such as approving mergers or appointing board directors. Usually, one share equals one vote. Therefore, large-volume holders can influence the manifestation of strategies and happenings.

- Capital Gains: The value of these securities rises typically with the company's good performance. Therefore, when an investor tends to sell the securities at a greater price than their purchase price, they can experience capital gains.

- Fluctuation Risks: The probability of capital gains comes hand-in-hand with the risk of losses due to fluctuations. Equity, by nature, is volatile. As a result, investors have a probable chance that their investment value might be depleted for various reasons.

- Liquidity: Most forms of equity, mainly those actively traded on major exchanges, possess high levels of liquidity. This means that they can be purchased and sold at the investor’s discretion.

- Potential Dividends: Some equity holders tend to receive dividends. Dividends are a part of a company’s profits that are distributed back among the shareholders. The amount and frequency of dividends can depend on company policy and performance.

Types

The three main types of marketable equity security have unique characteristics. Each of them is discussed below.

- Common Stocks: Common stocks are the gold standard of equities. They give the stockholders voting rights, ownership in the company, and a proportional share in profits in the form of dividends. However, market fluctuations might induce capital gains or losses.

- Preferred Stocks: As the name suggests, preferred stocks are given preference over common stockholders during liquidation or routine dividend payments. Typically, these types of securities do not give the holder voting rights. Therefore, they are best for investors looking for a stable passive income from an equity investment.

- Convertible Securities: These securities provide investors with a combination of fixed-income and capital appreciation prospects. Much like preferred stocks and convertible bonds, convertible securities can be converted into a pre-decided number of common shares.

Examples

A concept is a culmination of its theoretical aspects and practical applicability. Since the theoretical aspects have been well-covered thus far, the practical applicability will be addressed through the examples below.

Example #1

Mr Lee purchases 500 ordinary shares of ABC Enterprises at $10 per share. Shortly after, the company declared its quarterly report, and it exceeded the expected level of performance. In the next quarter, the company does even better, and the stock price rises to $25 per share.

If Mr Lee decides to exit the share at this point, he shall experience a profit of $7,500 ($15*500). Additionally, ABC Enterprises declared a $2 dividend per share. As a result, he gained an additional $1,000.

Example #2

In early 2024, the Indian stock market enjoyed an impressive rally. It moved up significantly, while its global counterparts could not replicate similar performance. However, by August 2024, the movement of equity security services slowed down.

Experts said the slowdown was caused by factors such as Yen carry trade and an impending US recession. Additionally, ocean freight costs, geopolitical tensions, and inflationary pressures could add to equity investors' woes.

Advantages And Disadvantages

The advantages and disadvantages, according to equity security analysis, are:

Advantages

- If the company performs well, shares give investors an opportunity to experience higher gains. If sold at a higher price, significant capital gains can be booked.

- Some stocks provide dividends in addition to capital gains. Companies disperse a portion of their profits back to investors, giving equity investors stability and a passive income—a feature akin to debt investments.

- Common shareholders have voting rights proportional to the number of shares they hold. They can have their say in the corporate affairs of the company, such as approving mergers or appointing a board member.

- Most shares, especially those listed on major exchanges, can be easily purchased and sold. Therefore, their liquidity gives shareholders flexibility that most other forms of investment cannot.

Disadvantages

- The benefit of experiencing higher gains comes with a significantly higher risk. Due to economic fluctuations and market volatility, they are considerably riskier than other forms of investments, such as debt securities.

- Unlike fixed-income securities such as bonds, equity does not guarantee a sure-shot return on investment. Moreover, depending on their structure or performance, companies might choose not to declare dividends.

- The issuance of fresh shares can lead to the dilution of existing shareholders. Ultimately, it can reduce the older shareholders' influence on the company's corporate affairs.

Equity Security vs Debt Security

| Basis | Equity Security | Debt Security |

|---|---|---|

| 1. Distinguishing Factor | They portray an ownership in the company. | It signifies a loan taken by the company. |

| 2. Risk | These investments carry moderate to high risk due to market fluctuations. | They are relatively low risk as they are given preference in repayment. |

| 3. Income | It provides investors with a potential dividend income and capital gains. | Debt securities give investors fixed interest payments. |

| 4. Potential Returns | Returns can be significantly higher if the company’s performance is exemplary. | Fixed returns shall be provided as per the pre-determined rate of interest. |

| 5. Voting Rights | Typically, it has voting rights that help investors have a say in the company’s decisions. | There are generally no voting rights connected to debt securities. |

| 6. Repayment Preference | These investors are given lower priority. They are paid after settling debt securities. | Higher priority is placed on their repayment, especially if the company files for bankruptcy or liquidation. |

Equity Security Vs Stock

The differences between equity security services and stock are distinguished by a relatively thin line. They are two pieces cut from the same cloth. The differences include:

- Equity in any form signifies that the holder has a particular proportion of stake within the company, irrespective of the ability to trade or not trade them. On the other hand, stocks refer to a company’s equity shares issued to the public through stock exchanges.

- Equity can be purchased at a specific price, hoping for an increase in its value. As a result, the holder can sell it at a profit. On the other hand, stocks involve the general public, so there is significantly more regulatory oversight.