Before You Borrow: How Smarter Consumers Are Estimating Loan Costs in Advance

Table of Contents

Introduction

Borrowing money can feel like navigating a maze. Interest rates, fees, repayment schedules, and hidden costs can quickly turn a simple loan into a complex financial commitment. Yet, increasingly, smarter consumers are taking a proactive approach: estimating the total cost of borrowing before signing on the dotted line. Understanding what a loan will truly cost in the long run can prevent unexpected financial stress and empower borrowers to make informed decisions.

In this article, we explore why forward-looking estimation matters, the methods consumers use to calculate costs, and the practical steps you can take before taking out a loan.

Why Estimating Loan Costs Matters

The most common pitfall in borrowing is underestimating total repayment costs. Monthly installments may seem manageable, but add interest, fees, and insurance, and the total sum can be substantially higher than the principal borrowed. By estimating loan costs upfront, borrowers can identify whether a loan is genuinely affordable or likely to strain their budget.

Financial institutions and consumer advocacy groups often highlight that understanding a loan’s full cost before committing is a key step in responsible borrowing. It’s not just about the numbers—it’s about predicting the impact on your cash flow and financial flexibility over months or years.

Enhancing Financial Confidence

Borrowing without a clear plan can create anxiety. On the other hand, having a precise estimate of costs allows you to compare lenders confidently, negotiate better terms, and make borrowing decisions aligned with your broader financial goals. Savvy borrowers treat loan estimation as a standard part of budgeting, much like factoring in rent or utility bills.

The Core Components of Loan Cost Estimation

When estimating loan costs, it’s important to consider all the elements that contribute to the total repayment.

- Principal: The principal is the initial amount you borrow. It may be tempting to focus only on this number, but it represents just the starting point. Understanding how interest and fees apply to the principal is essential for accurate estimation.

- Interest: Interest is the cost of borrowing expressed as a percentage of the principal. Annual Percentage Rate (APR) provides a more comprehensive view than simple interest, as it includes some fees associated with the loan. Comparing APRs across lenders gives a realistic sense of cost differences.

- Fees and Additional Charges: Many loans come with origination fees, late payment penalties, prepayment fees, or insurance requirements. Including these in your calculations ensures that your estimate reflects the true cost of borrowing. Failing to account for them can make an otherwise manageable loan unexpectedly expensive.

- Repayment Terms: The length of the loan directly impacts the total interest paid. Short-term loans often have higher monthly payments but lower overall interest, while longer-term loans reduce monthly payments but increase total interest. Consumers benefit from analyzing both monthly affordability and total repayment over time.

Practical Tools for Estimating Loan Costs

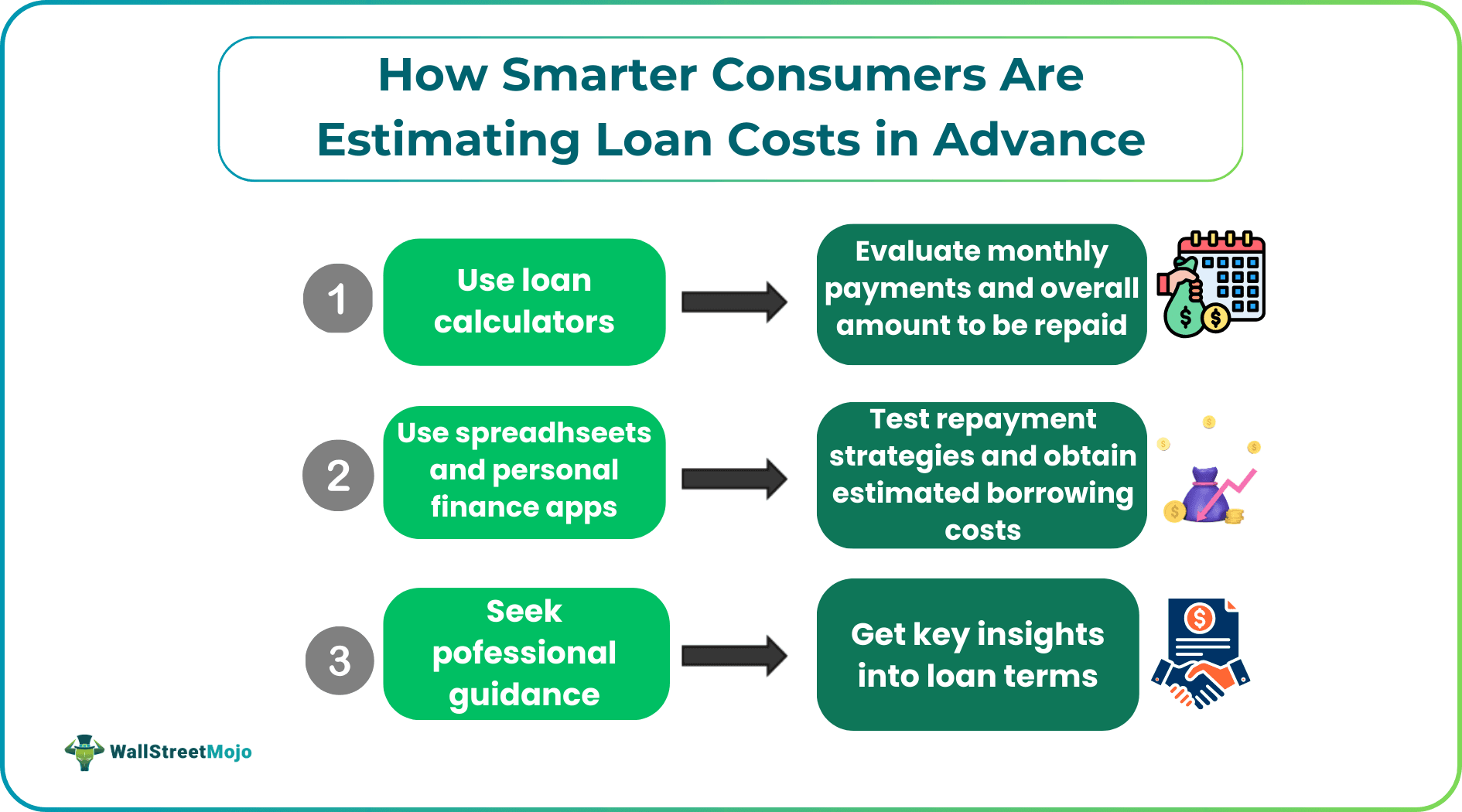

One of the most efficient ways to estimate costs is through online loan calculators. Tools like the car title loan calculator allow borrowers to input loan amounts, interest rates, fees, and repayment schedules to see a full breakdown of monthly payments and total repayment. Using such calculators helps visualize different scenarios and identify loans that align with your financial comfort zone.

#1 - Spreadsheets and Personal Finance Apps

For those who prefer a hands-on approach, spreadsheets can provide detailed breakdowns and allow you to test different repayment strategies. Personal finance apps often include loan estimation features and can integrate these calculations with your broader budget, showing how borrowing affects overall financial health.

#2 - Professional Guidance

Financial advisors or consumer credit counselors can provide insight into loan terms and offer strategies to reduce borrowing costs. While not every loan requires professional input, consulting a qualified expert can be particularly valuable for larger loans or complex borrowing situations.

Steps to Take Before Borrowing

Before committing to any loan, taking a few deliberate steps can help ensure you borrow wisely and avoid unexpected financial strain.

#1 - Define Your Budget

Start by understanding how much you can afford to borrow without jeopardizing other financial commitments. Include all monthly obligations and leave a buffer for unexpected expenses.

#2 - Gather Detailed Loan Information

Request full disclosure from potential lenders, including interest rates, fees, and repayment schedules. Make sure you understand whether rates are fixed or variable, and clarify the conditions for early repayment or refinancing.

#3 - Use Estimation Tools

Input all gathered data into a calculator or spreadsheet to see how different loan amounts, interest rates, and terms affect total repayment. For auto loans or car title loans, a dedicated loan calculator can provide tailored insights.

#4 - Compare Options

Don’t settle on the first loan offer. Compare multiple lenders and loan types, considering both short-term affordability and long-term cost. Sometimes, a slightly higher monthly payment can save significant interest over the life of the loan.

#5 - Plan for Contingencies

Life is unpredictable. Make sure your loan plan includes a margin for emergencies so that temporary income changes don’t push you into missed payments or penalties.

Conclusion

Borrowing money doesn’t have to be a leap in the dark. By estimating loan costs in advance, consumers gain insight, control, and confidence. From understanding principal and interest to factoring in fees and repayment terms, each step builds a complete picture of what a loan will truly cost. Utilizing tools like online calculators, spreadsheets, or professional guidance allows for careful planning and informed decision-making.

In an era where financial products are abundant and sometimes complex, taking a proactive approach is what separates cautious, savvy borrowers from those who face avoidable financial strain. Before you borrow, estimate your costs, compare your options, and plan for contingencies. Smart borrowing starts with a clear understanding of what lies ahead—and it can make all the difference in maintaining long-term financial health.