How To Evaluate Bail Bonds as a Financial Product

Table of Contents

Introduction

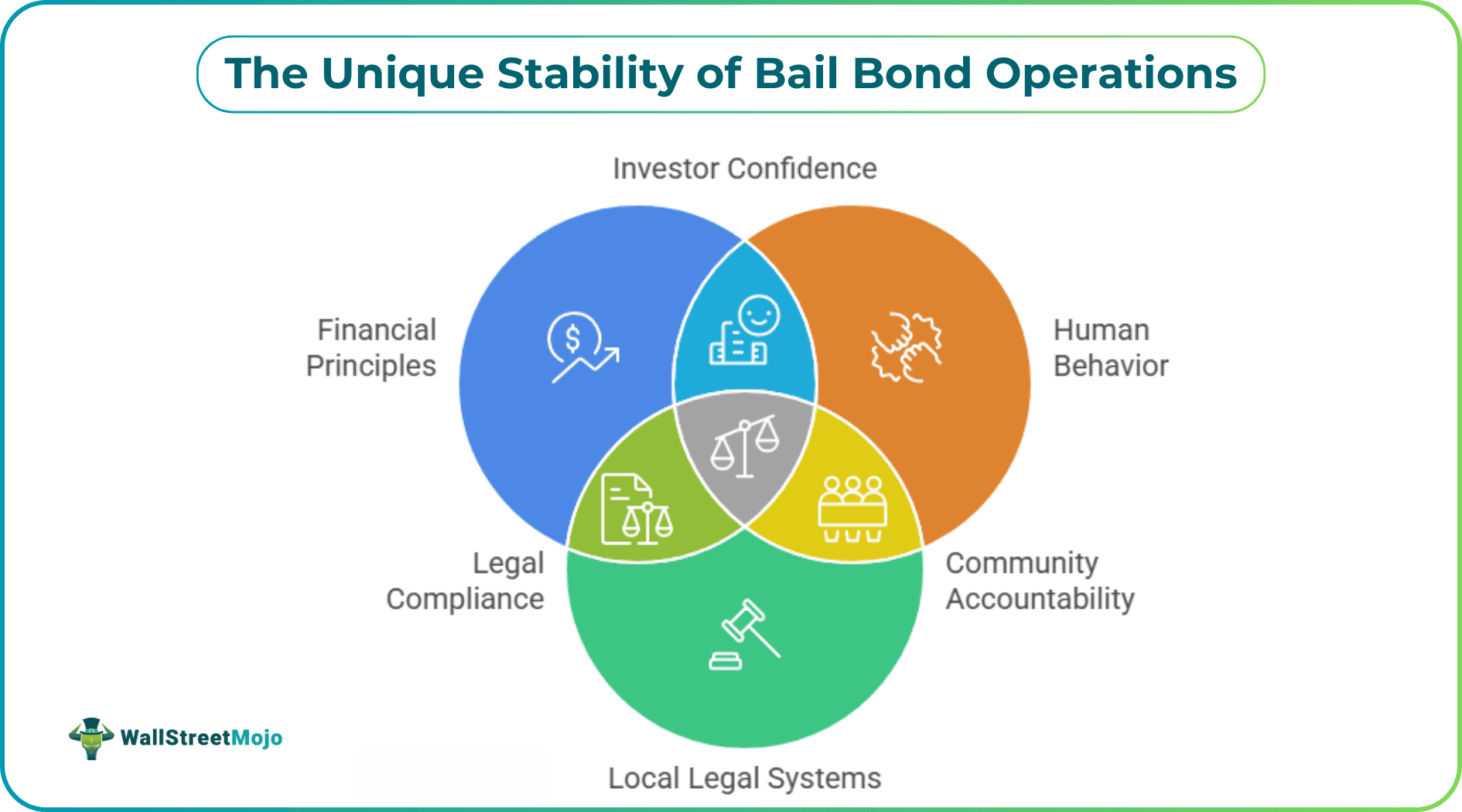

Evaluating bail bonds as a financial product might feel unusual at first, but the principles behind it are surprisingly familiar. You are still looking at risk, long-term value, predictability, and performance factors.

The difference is that bail bonds sit at the intersection of finance, human behavior, and local legal systems. Understanding how these pieces work together helps you see how stable or risky a bond operation really is.

Understanding Market Behavior and Industry Trends

Even though bail bonds operate within the justice system, they are influenced by market forces, just like other financial products.

Paying attention to trends in technology, regulations, and consumer expectations gives you a sense of how the landscape is shifting.

The industry is becoming more digital. Tools that automate reminders, track cases, and streamline paperwork are now standard. These improvements help reduce manual errors and tighten financial operations, which directly affects long-term stability.

It also helps to look at the broader surety world. According to research by The Business Research Company, global surety markets have been expanding thanks to better risk modeling and increased digital adoption.

While bail bonds are just one part of the picture, the same push for more efficient and predictable underwriting affects expectations in this space as well.

Here are some quick indicators to watch:

- Shifts in industry technology.

- Changes in market size or agency consolidation.

- New compliance expectations.

Assessing Risk, Liability, and Liquidity

Risk is the central factor in evaluating bail bonds. Unlike traditional bonds backed by institutions, the risk here depends on whether individuals show up to court.

This makes local court processes, reminder systems, and enforcement practices key to the financial outcome of each bond.

Because these factors vary by region, people often look at established local providers to understand how those rules work in practice.

For example, services offering California bail bonds operate under specific state regulations concerning things like premiums, collateral, and forfeiture procedures.

These local rules shape how predictable bonds are and how much exposure an agency might face.

When you view bail bonds as a financial product, the local procedures around processing and enforcement are part of the financial profile, not just the legal one.

Liquidity is another important consideration. Bail bonds cannot be traded, so your liquidity depends on how quickly cases move and how reliably payments are collected.

Counties with long delays or frequent continuances tie up capital, while faster-moving courts improve cash flow.

Digital underwriting tools are helping agencies manage these variables more effectively.

Market insights point out that digital surety platforms reduce manual errors and create more consistent risk assessments, which can strengthen financial outcomes.

Evaluating Regulatory and Economic Influences

Bail bonds are deeply affected by regulation. Policy changes can reshape fee structures, underwriting rules, and forfeiture processes without much warning.

If you want to treat bail bonds like a financial product, it is important to understand how vulnerable they are to legislation.

Shifts in compliance standards can change the overall structure of financial markets.

Although these reports often focus on traditional bonds, the same principle applies here. When lawmakers adjust court procedures or fee limits, the entire financial model of a bail bond operation can shift.

Adjacent markets provide helpful clues as well. Regulation-heavy financial products can swing quickly as rules evolve. Bail bonds have similar sensitivities. Proposed reforms, premium caps, or changes to forfeiture timelines can all influence financial reliability.

Areas to monitor include:

- Legislative updates and bail reform proposals.

- Court processing practices and rule changes.

- Economic conditions that affect caseloads or court speed.

Measuring Performance and Long-Term Value

Bail bonds do not pay interest like traditional investments. Instead, financial performance comes from premium income, efficient operations, and strong recovery practices.

When evaluating their long-term value, it helps to focus on operational performance rather than yield.

One useful approach is to compare premium revenue with forfeiture losses. If forfeitures routinely outweigh premiums, the financial structure is unstable.

Another factor is how quickly cases move through the system. Faster case resolution improves cash flow and reduces operational drag.

Efficiency plays a major role, too. Agencies that use automated communication tools, digital risk assessments, and clear documentation processes tend to operate more predictably and avoid unnecessary losses.

Financial products backed by risk perform best when the operation behind them is disciplined and consistent. The same principle applies to bail bonds. Strong management and clear processes lead to more stable outcomes over time.

Useful performance indicators include:

- Premiums collected compared to forfeiture payouts.

- Average case duration and the time to recover funds.

- Operational efficiency supported by digital tools.

Conclusion

Evaluating bail bonds as a financial product means looking at more than just premiums and forfeitures. Market trends, local rules, regulatory changes, and operational strength all influence whether a bail bond operation is financially stable or unpredictable.

When these factors are viewed together, you get a clearer picture of how these unique products function and what drives long-term value.