How to Evaluate White Label Exchange Platforms

Table of Contents

Introduction

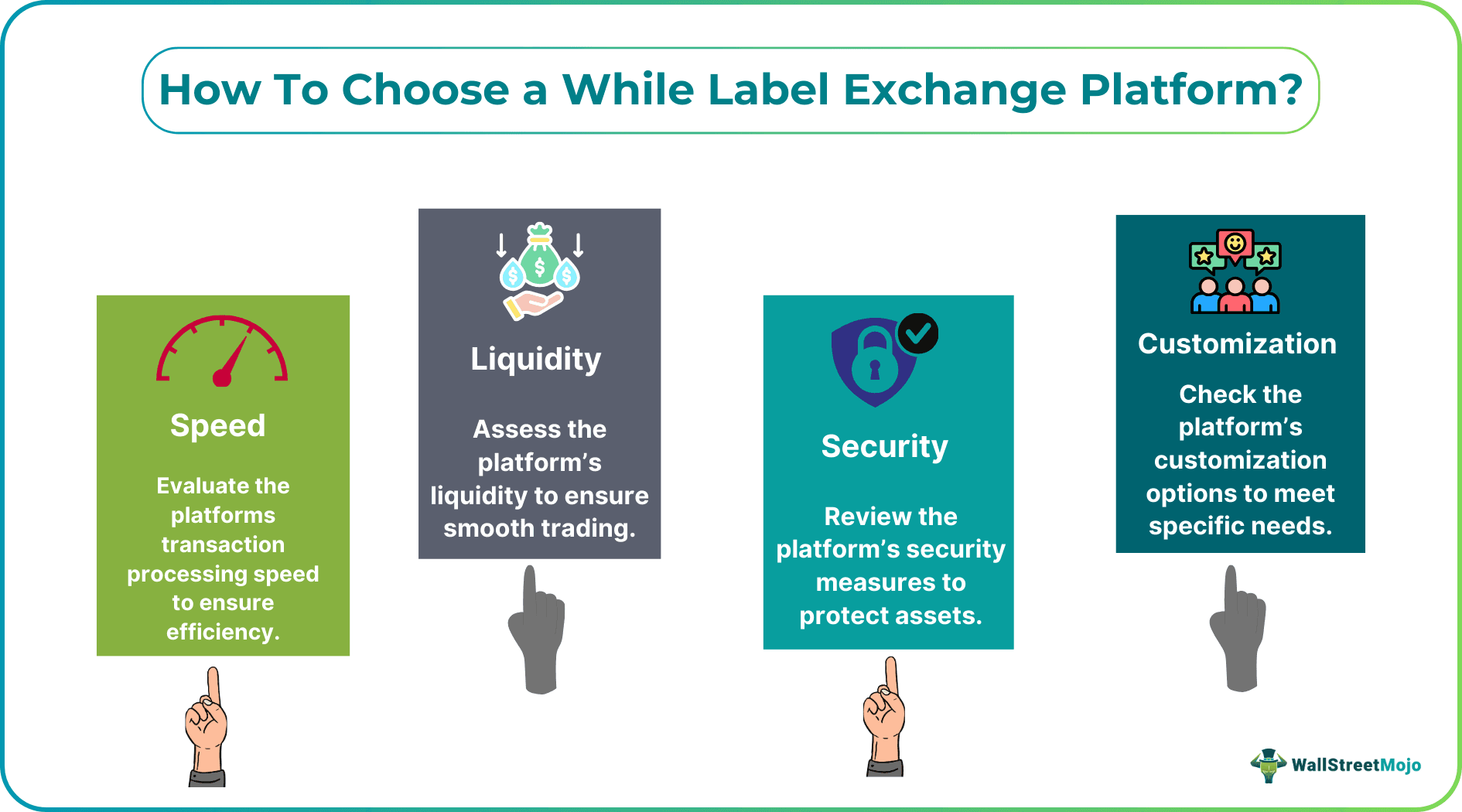

Choosing a white label exchange platform can feel like trying to read a menu written in code. Every provider promises speed, liquidity, security, and customization, but the real question is how to compare them in a structured, objective way. This guide breaks down the evaluation steps so you can build a shortlist with confidence and run a proper hands‑on test before making a commitment.

Know What You Actually Need

Before looking at flashy features, get clear on your requirements. It helps prevent overspending and keeps the focus on what really matters for your business model.

- Clarify Your Operational Priorities: Ask what your platform must accomplish on day one and what can come later.

- Identify Core Technical Must‑Haves: Think API reliability, order execution speed, supported asset types, and modularity.

- Consider Your Growth Path: Your choice should scale with user growth, new trading pairs, and future integrations.

The strongest white label exchanges stand out not by their feature lists but by how smoothly they handle real trading conditions in sandbox tests, where execution speed, reliability, and usability reveal their true fit.

Compare Compliance, Coverage, and Technical Depth

Evaluating an exchange provider means more than checking whether it works. You want assurance that it will keep working under pressure, with users, regulators, and partners counting on it.

#1 - Compliance Coverage and Regional Fit

Compliance requirements vary significantly across jurisdictions. Some vendors include KYC/AML capabilities as add ons, while others embed regulatory functions throughout their systems.

A recent industry review from MarketSherald highlighted how major providers present their compliance features, offering helpful perspective for assessing regulatory alignment. That analysis from MarketSherald clarified common expectations for teams evaluating white label exchange options.

#2 - Liquidity and Aggregation Quality

Liquidity is one of the biggest differentiators. Strong providers aggregate from multiple venues, maintain internal pools, or connect you to institutional partners.

Consistent depth at the top of the book makes user execution feel smooth even during volatility.

#3 - UI, UX, and Branding Control

Design flexibility varies a lot. Some providers offer full theme control, while others allow limited cosmetic edits. Platforms highlighted in a Cryptonomist review also emphasize fast‑deployment front ends, which can help if you're launching quickly but still want brand polish.

At this stage of evaluating customization, it is also natural to compare broader solution types like white label crypto software to see how they handle UI layers, feature toggles, and modular upgrades. This helps you understand where each provider shines and whether their approach aligns with your product roadmap.

Evaluate Technology, APIs, and Total Cost

Technical performance and operating expenses determine the platform's long‑term viability. This is where you assess the engine under the hood.

#1 - API Architecture and Modular Build

Look for well‑documented REST and WebSocket APIs, clean versioning, and the ability to disable modules you don’t need. Modular design keeps your system lightweight and easier to maintain.

#2 - Fee Models, SLAs, and Hidden Costs

Pricing can include setup fees, monthly fees, basis‑point trading fees, support tiers, and add‑on modules. Ask explicitly about:

- Update and maintenance costs

- Optional compliance features

- Data feed pricing

#3 - Uptime Guarantees and Support Expectations

SLAs define uptime thresholds, response times, and incident handling. Providers examined in the ShiftMarkets overview highlight the importance of active monitoring and rapid support cycles for high‑volume environments.

Build a Smart Shortlist and Test in a Sandbox

With initial research done, it is time to narrow providers and actually test their systems.

#1 - Create a Lightweight RFP Checklist

Include categories such as:

- Compliance and jurisdiction alignment

- Liquidity and aggregation sources

- UI options and customization depth

Keep the checklist short enough to compare providers side by side without drowning in details.

Shortlists work best when you revisit your requirements after testing, platforms that seem ideal on paper often behave differently under real operational pressure.

#2 - Run Realistic Sandbox Scenarios

Most platforms offer a testing environment. Use it to simulate:

- Heavy order flow

- Multi device UI behavior

- API stress and failover

Track execution times, error rates, and how the system behaves under load.

#3 - Validate Operational Fit with Your Team

Let both technical and nontechnical team members interact with the sandbox. This gives you a clearer view of usability and operational demands.

Final Thoughts

Evaluating white label exchange platforms takes patience, structure, and actual testing. Start by defining what matters most for your launch, then compare providers using consistent criteria. The public overviews from ShiftMarkets, Cryptonomist, and MarketSherald can help frame the landscape, but the real differentiator is how each platform performs when you test it with your workflow and your users’ expectations.

Once you gather your findings, take time to revisit your requirements. A platform that looks perfect on paper can feel different in practice, so treat sandbox results as the deciding factor. And if you want more perspectives, feel free to explore additional industry blogs and technical breakdowns to deepen your shortlist.