Table of Contents

What Is Exchange Rate Regime?

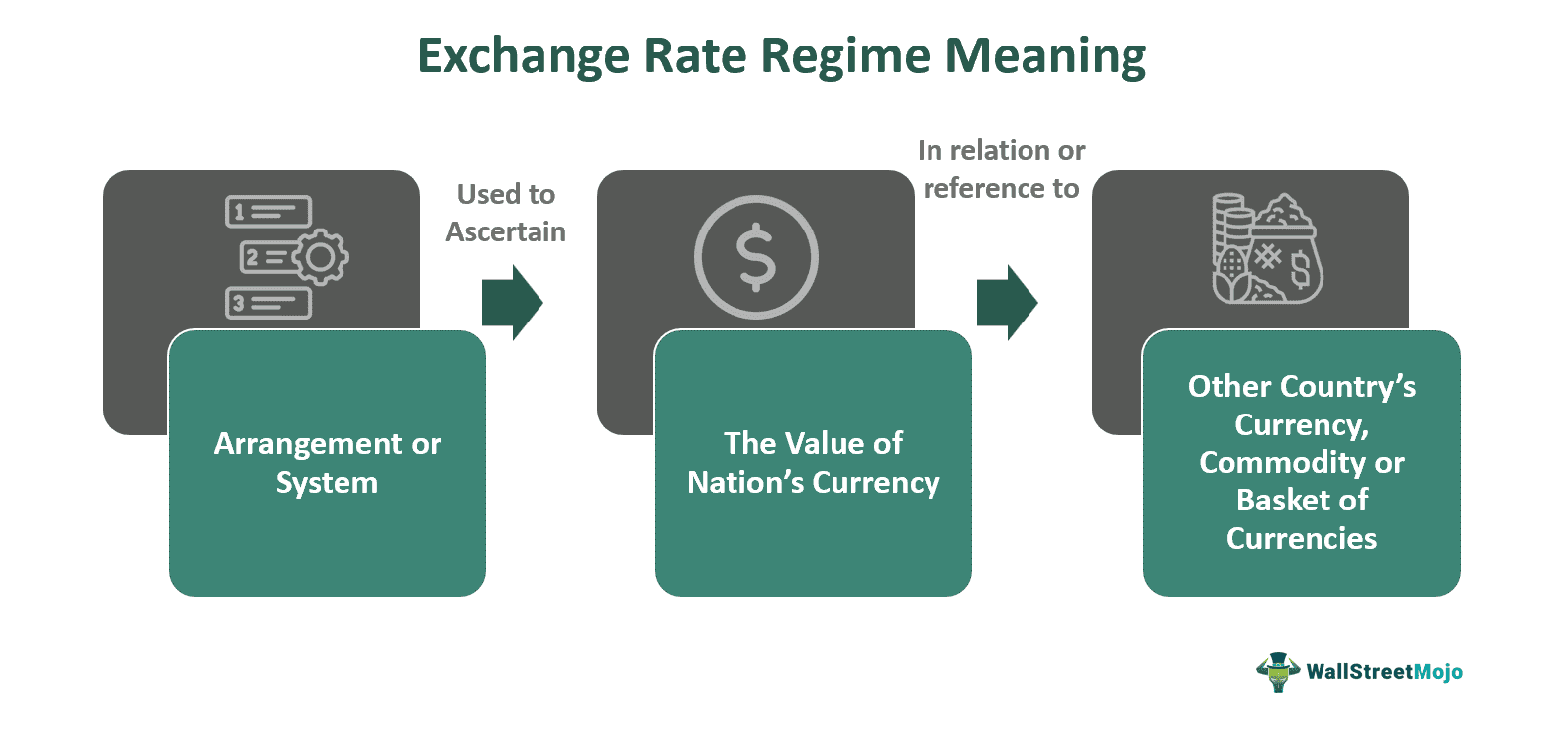

An exchange rate regime or currency regime is a mechanism in international economics by which a nation's monetary authority, i.e., the central bank or the government, ascertains the relative value of their country's currency with respect to the currencies of the foreign nations to manage the international monetary exchange effectively.

Every nation has a different currency mechanism. It is one of the critical aspects of the foreign exchange market since it shapes a nation's macroeconomic scenario by encouraging globalization and economic integration worldwide. The regime facilitates foreign investment, capital flow, international trade and competition, financial stability, and inflation rate stability on the global front.

Key Takeaways

- An exchange rate regime refers to a monetary arrangement adopted by a country's central bank or government to ascertain

- the value of its currency with reference to the price of foreign currencies, commodities, or a basket of relative currencies.

- Such an arrangement facilitates capital flow, economic integration, trade, investment, and globalization in the international market.

- Its purpose is to achieve financial stability and reduce inflation in the economy.

- Some of the prominent regimes identified by the International Monetary Fund (IMF) include fixed, floating, flexible, crawling peg, fixed parity, managed, monetary union, and currency board systems.

Exchange Rate Regime Explained

The exchange rate regime denotes an international arrangement for governing the price of a particular country's currency in relation to the currency of foreign nations. A nation's central bank or government is responsible for deciding its currency regime; however, such macroeconomic level decisions are based upon certain factors, which are explained below:

- The freedom of trade in a nation known as trade liberalization;

- The level of economic and financial growth in a nation ascertained through its GDP and other determinants;

- The prevalent economic policies within the nation, including the monetary and fiscal policies.

Now, moving on to a brief history of the system, the need for currency regimes can be traced back to the havoc caused by the World Wars in 1914 and 1939. Earlier in the 1870s, gold standards were adopted as a sole peg for currencies worldwide. However, the countries couldn't follow these standards for long. After the world wars, the Bretton Woods system came to the limelight in 1944 and conquered the currency exchange mechanism for around 20 years. Managed by the IMF, the system declined due to U.S. deficits. After its collapse, two other systems emerged, I.e., joint floating and independent floating. Currently, around 8+ currency regimes are identified by the IMF, and these are still evolving.

Types

The currency regime has evolved over the years in developing nations. The significant economies manage their currencies using the following different regimes:

- Fixed or Pegged: In such an arrangement, the monetary authority fixes the currency of its nation against another country's currency, a commodity, or a basket of currencies.

- Independent or Floating: Under this regime, a country's currency is priced according to the foreign exchange market operations or supply and demand of that particular currency.

- Managed Float: It is a balanced approach whereby the monetary authority maintains the currency value in relation to other currencies or groups of currencies but within a particular band or range.

- Currency Board System: It is a system whereby the currency valuation is done by a currency board that directs the monetary authority to back all domestic currency units against a foreign currency.

- Monetary Union: In the currency union, multiple nations have a single currency to facilitate exchange rate stability by giving up their national monetary sovereignty.

- Crawling Peg: This is an arrangement that ensures the fluctuation of a currency by having a fixed exchange rate within a specified range or band.

- Fixed Parity: Under a fixed parity regime, the monetary authority determines a relative currency value with the price of another currency or a basket of currencies, allowing the currency fluctuation within a predefined band or range of +1 or -1%.

- Fixed Parity With Crawling Peg: It aids the monetary authority to switch from fixed parity to incorporate more flexibility in their exchange rate management.

- Target Zone: This form of regime permits a broader band of currency fluctuation, say by +2 or -2% in a fixed parity.

Examples

Every nation has a different macroeconomic objective, and therefore, it follows distinct currency regimes to head its economy in the right direction. Given below are some of the examples of the nations' exchange rate arrangements:

Example #1

When talking about China's exchange rate regime, the nation followed a fixed system way back in 2005, which pegged against the U.S. dollar. However, with the need to bring more flexibility to international economic interaction, it adopted a more flexible system, i.e., the managed float exchange rate regime. The renminbi or yen is now valued on the basis of their market demand and supply in relation to a selected basket of currencies.

Example #2

The National Bank of Ukraine (NBU) has formally announced the end of the 18-month fixed exchange rate regime, transitioning to a "managed flexible" regime as of October 3, 2023. Ukraine experienced its first growth since the onset of the war 19 months ago, expanding by 19.5% in the second quarter compared to the previous year, with a corresponding decrease in inflation.

Under the new framework, the official exchange rate will undergo daily fluctuations, with minimal immediate changes expected. However, a gradual depreciation of the hryvnia is forecasted for 2024 and 2025, with an end-2024 exchange-rate projection of UAH42 per U.S. dollar. The shift by the NBU represents a move towards a more market-driven currency regime, supported by record international reserves of nearly $39 billion as of July 2023.

Although the fixed exchange rate provided stability during the conflict, it also led to an overvaluation of the hryvnia and contributed to external account imbalances. To address this issue, the NBU plans to maintain short-term hryvnia stability while gradually allowing depreciation to align with yields on hryvnia deposits. The NBU's substantial reserves, equivalent to over five months of future imports, offer a robust buffer against potential disruptions in international financial aid inflows. However, F.X. liberalization measures are expected to be cautiously implemented, with the hope of rapid liberalization of flows related to external private debt and foreign direct investment (FDI).

Advantages And Disadvantages

The currency regime is the way a country values its currency in comparison to the currency of other nations to facilitate foreign exchange. However, every currency arrangement has its pros and cons, as discussed below:

| Advantages | Disadvantages |

|---|---|

| This regime ensures the stability of capital flows and trade in the international market. | Adversely, a floating regime can result in more significant inflation as the currency rates depreciate. |

| It aims to achieve financial and inflation rate stability in a nation. | The floating and flexible arrangements can make the currency value unpredictable or volatile in the foreign market. |

| Also, such an arrangement promotes foreign investment, economic interaction, and globalization. | The floating exchange rate regime may even lead to competitive devaluation of a nation's currency. |

| The pegged exchange rate regime promotes international trade stability and investment and also curbs speculation and currency risks. | The flexible exchange rate regime can elevate the inflation rate, negatively affecting a nation's economy. |

| The flexible and floating arrangements facilitate the independent regulation of monetary policies. | Also, the fixed currency regime can foster the requirement of maintaining a higher foreign reserve by a country. |

| The flexible regime also ensures the automatic correction of the balance of payment. | It may negatively impact the nation's economic flexibility. |

| Moreover, the floating system helps maintain favorable economic conditions and capital mobility. | The fixed arrangement can even cause a higher or lower balance of payment. |