Table of Contents

What Is Expedited Funds Availability Act (EFAA)?

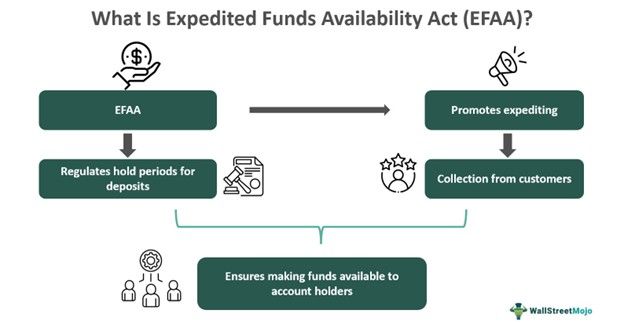

Expedited Funds Availability Act refers to the law that regulates the quick availability of the deposited funds to make it accessible to account holders. The act ensures that individuals have prompt access to their funds while also protecting banks against potential risks, such as check fraud and insufficient funds.

It allows account holders to access and use their deposited funds more quickly. This is especially important in situations where immediate access to funds is necessary, such as for paying bills, making purchases, or covering unexpected expenses. It enhances the overall convenience and flexibility of managing personal finances.

Key Takeaways

- The Expedited Funds Availability Act (EFAA) is a United States federal law that governs the availability of funds deposited by consumers in banks and other financial institutions.

- It was enacted in 1987 to establish specific standards and timelines for the availability of deposited funds, providing consumers with quicker access to their funds.

- It provides consumers with important information about when deposited funds will become available for use and helps prevent potential misunderstandings or delays in accessing funds.

- The hold types include statutory hold, new account hold, large deposit hold, and exception hold.

Expedited Funds Availability Act Explained

The Expedited Funds Availability Act (EFAA is a US federal law that governs the availability of funds deposited in transaction accounts. Enacted in 1987, the EFAA provides guidelines and regulations for banks regarding the hold duration applicable for deposited funds before making them available for withdrawal or use by customers. Federal Reserve's Regulation CC oversees the implementation of this Act in the banking and financial sector.

The hold periods for different types of deposits differ widely. For a local check, which is to be drawn in the same bank or the banks belonging to the same region, the hold period is one business day. On the other hand, for a non-local check, i.e., the checks to be drawn at a bank from a different region, the period of hold for deposits is two business days. In the case of electronic transfers, however, it is swifter and takes a maximum of one business day.

Moreover, there are penalties for violating the provisions of the Expedited Funds Availability Act. According to a source, if an institution is found guilty of non-compliance with the EFAA, it might cost it around $552,500 or 1% of the institution's net worth, whichever seems more.

Though the conditions associated with the holding period and policies of deposits made by an account owner are expected to be conveyed to an account owner, the banking institution must crosscheck if the same happens. Moreover, if any changes are introduced in the policies, the customers must be communicated the same at the earliest.

Hold Types

The Expedited Funds Availability Act regulates the duration of the hold period for deposits in banks or other financial institutions to be available to customers. As the hold period differs from one type of account to another, the hold types also exist in different forms. Let us have a look at some of them below:

#1 - Statutory Hold

This hold type is most prominent among insurance companies. However, it is not confined to that sector only. Such kinds of hold can cover any kind of deposit with a condition that the institutions pay $200 on the immediate next working day of making deposits, $600 on the second working day after the filing of deposits, and the remaining amount on the third working day. Moreover, for this kind of hold to be relevant, it is essential that the deposit in question does not include any other hold type on it.

#2 - New Account Hold

According to the EFAA, an account with a bank is considered new for 30 days. This is the period when the account owner cannot open any other account with any other depository account. Therefore, the new account hold is set on the deposits of the account for 30 days from the creation of the account. This hold type is lifted or removed from an account on the ninth working day after a deposit is made.

#3 - Large Deposit Hold

This hold type applies when an account holder deposits over $5,000 in one business day. The rules that apply for the first two days are the same, i.e., on the immediate next day of deposit, the institution must have $200 available for payment. However, on the third day, it must make $4,800 accessible to the account owner. In addition, the remaining balance that the account owner already had must be made available on the seventh business day after the deposit is made.

#4 - Exception Hold

An exception hold is set on a deposit if the account owner's activities are suspicious. For this type of hold to apply, large amounts of transactions for six consecutive days should be recorded. Besides this, such kinds of holds are applicable in cases where the banking or financial institutions suffer a power outage or system failure and are unable to function as usual.

Examples

Let us look at the scenarios below to understand the federal Expedited Funds Availability Act better:

Example #1

In a hypothetical example, let us consider Mary, who is a customer at XYZ Bank. She deposits a local check into her checking account. According to the EFAA, XYZ Bank is allowed to place a maximum hold period of one business day on local checks. As a result, Mary visited her bank in the morning to withdraw the money she had received, but she found that the funds were still not available. She raised her voice against the banking institution's functioning, which, per EFAA, was her right. The bank, after the protest, promised the customer that her funds would be accessible by the second half of the day.

This example shows how customers are given sufficient rights per EFAA so that they can question a bank if the funds are not available within the stipulated duration.

Example #2

Suppose Sarah, a customer at ABC Bank, receives a non-local check from her freelance client. The check is drawn on a bank located in a different state. Sarah deposits the check into her checking account through an ATM owned by ABC Bank.

According to the EFAA, the maximum hold period for non-local checks is generally five business days. However, ABC Bank has a policy of providing expedited funds availability for non-local checks deposited through their ATMs. They have reduced the hold period to two business days for such deposits, ensuring quicker access to funds for their customers.

In this example, ABC Bank's policy of expedited funds availability allows Sarah to access the funds from her non-local check within two business days rather than waiting for the maximum hold period specified by the EFAA.

This demonstrates how banks can go beyond the EFAA requirements to provide enhanced customer service and quicker access to deposited funds, depending on their own policies and risk management practices.