Table of Contents

What Is Extended Hours Trading?

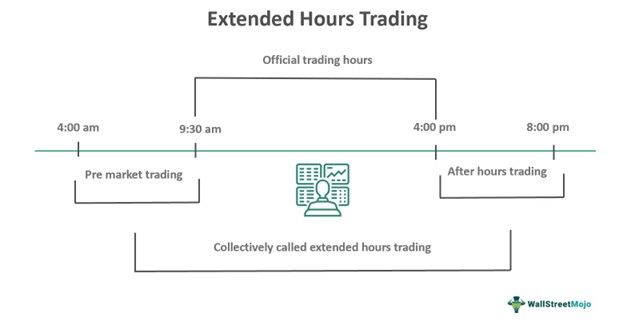

Extended-hours trading is trading that occurs outside the official trading hours and active market sessions. Every stock exchange is open and active for a limited number of trading hours every day. In the US, the market opens at 9:30 a.m. and closes at 4:00 p.m. EST. Any trading occurring outside this time frame constitutes extended hours of trading.

The main objective is to allow investors and traders to act quickly based on any news, events or rumors during the time the exchange is closed. Transactions that occur during extended trading hours indirectly influence and predict the open market direction. Such trades are commonly placed either at the beginning or end of the regular trading hours.

Key Takeaways

- Extended hours trading defines the trading activities performed outside the regular standard trading hours of a stock exchange.

- It can be done both pre-market opening and after-hours trading and together form extended hours trading. However, the US stock exchange timing is from 9:00 a.m. to 4:00 p.m. every day from Monday to Friday.

- Extended hours trading lets traders make an early move and take advantage of any form of news, events, industry updates, information or even rumors before the market opens.

- The typical risks of extended hours trading are uncertain and mismatched prices, volatility, liquidity and low trading volume, failures in execution and system delays.

How Does Extended Hours Trading Work?

Extended hours trading represents the trading allowed outside the regular market hours during which the stock exchange is active and opened for everyone. Every stock exchange predominantly represents its nation’s securities and financial market and likewise opens and closes as per their standard timing. In the US, the US stock exchange opens at 9:30 a.m., closes at 4:00 p.m. every day from Monday to Friday, and is closed on weekends, national and other pre-decided holidays. Such hours are present on both sides.

The extended trading hours are made up of two-time frames. Pre-market open and post-market close hours are also called after-hours trading. The former is from 4:00 a.m. to 9:30 a.m., while the latter is from 4:00 p.m. to 8:00 p.m. One thing to remember is that not every security is available for extended-hours trading.

Only eligible securities trade with low volume. It is enabled by Electronic Communication Networks (ECNs), a computerized system that automatically matches buy and sell orders of securities in the market. Brokerage firms are most often responsible for dictating the rules that apply in extended-hours trading; the rules, therefore, differ based on policies that apply during regular trading hours.

Examples

Below are two examples of extended-hours trading -

Example #1

Suppose Tiffany is a US stock market trader. She has been eyeing a stock for a couple of weeks. The company was international and used to release reports and statements very late in the night. One night, when the company released its annual revenue report, Tiffany was excited; she knew that the company had earned well and the stock would rally when the market opened.

Tiffany decides to take advantage of pre-market open trading. She enters the market around 6:30 a.m.a.m. and places an early buy order of the stock, purchasing a huge lot. Her order gets executed now. She just has to wait for the market to open.

As the market opened. The stock made an upward jump and Tiffany earned good profit on it. Now, it is a simple extended-hour trading example. In the real world, there are multiple factors, such as uncertain prices, volatility and liquidity issues coupled with order execution issues, failures and mismatched prices are to be considered.

Example 2

Example #2

In October 2023, eToro, a popular online trading platform, enabled after-hours trading for a raft of assets. The feature is only available to a set of assets. The schedule decided is pre-market trading from 6:30 to 9:30 ET, and after the regular market session, the after-hour trading will begin from 4:00 to 7:00 p.m. ET. The extended hours trading will be offered through a separate symbol and available as leveraged CFD only.

This will benefit investors as many companies release reports outside standard trading hours, which can lead to strong price fluctuations. This feature will allow traders to react immediately. eToro is a social trading and multi-asset investing platform headquartered in Central Israel.

Benefits

The benefits of extended hours trading are -

- Traders and investors move and act quickly on market news and global events that directly impact stock prices.

- By analyzing the extended hours of trading, the regular and standard opened market’s direction can be predicted.

- It gives traders a headstart when dealing with companies that release market reports and operate across multiple time zones.

- Combined, the extended hours of trading offer traders access to the market for approximately twelve hours.

Risk

The risks of extended hours trading are -

- Due to less trading volume, there is a lack of liquidity in extended trading hours.

- There are greater price fluctuations, and it becomes challenging to execute orders and get favorable prices due to volatility.

- Computer and system delays are common during extended trading hours. There are risks associated with failure to execute orders, cancel or change trades.

- Most people functioning during the extended trading hours are market professionals and experts with internal market information and access to data from market makers. Therefore, there is high competition during it.

- The stock prices in the extended hour trading may not reflect the actual market prices during regular trading hours. Hence, there is a degree of uncertainty.

Extended-Hours Trading vs Normal Trading

The key differences between extended hours trading and normal trading are -

- Extended hours trading occurs outside the regular trading hours. In comparison, normal trading is orders placed during regular trading hours.

- Extended hours trading can happen before and after the regular trading hours. In contrast, normal trading can only happen during active market sessions.

- Extended-hours trading is enabled by an electronic communication network (ECN), which only allows a limited number of order executions. On the other hand, with normal trading during regular hours, there is no limit or restriction on the number of orders placed.