Table of Contents

What Is A Facilitating Payment?

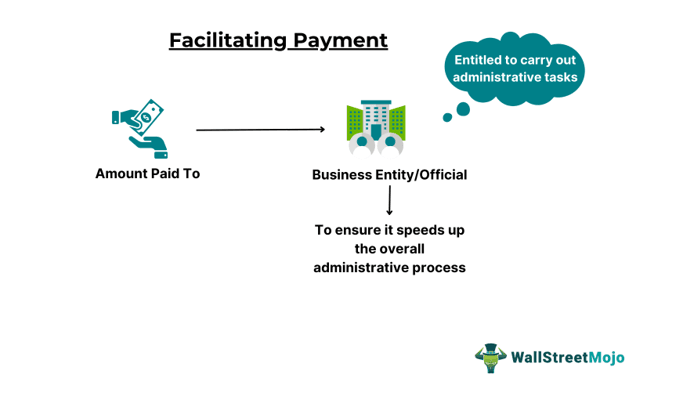

Facilitating Payment refers to paying a small amount of money to an official, expediting a process meant to benefit the payer in some way. The one who receives the payment is already entitled to carry out the task, but the payer, through this additional payment, attempts to make the government or legal proceedings swifter than usual.

Such payment is made to ensure the administrative processes become more efficient and the results or outputs are obtained within a duration shorter than the usual period. Facilitating payment and bribery differs as bribes are what force an entity to perform a task that it is not entitled or qualified to perform. However, there are instances where this additional payment provides undue advantages to recipient entities and hence takes the form of a bribe.

Key Takeaways

- Facilitating payment refers to paying a modest amount of money to an official or entity to expedite a governmental or legal activity that the latter is qualified and entitled to perform.

- It usually comes under a sign of gratitude for their collaboration and assistance; it ensures that the administrative handling of a task is completed quickly and effectively.

- The Omnibus Trade and Competitiveness Act of 1988 in the United States only enables it under very specific conditions, such as when it is necessary to accelerate normal government tasks or non-discretionary actions.

- It greatly helps speed up routine government tasks, such as issuing licenses or permits.

Facilitating Payment Explained

Facilitating payment, as the name suggests, is the payment one makes to facilitate a process or activity. It is also known as grease payment, which signifies that the amount acts as a greasing for an entity or official to make a process it is formally entitled to carry out smoothly and swiftly. It becomes difficult to differentiate between a bribe and grease money, given the additional advantage or incentive the payer provides to the payee in such instances.

However, making such payments is not allowed in all countries, with some even banning it, like the UK or Germany. This is because such nations identify these payments as bribes. In addition, in some regions, the same is considered as the cost of carrying out a process or business.

Moreover, the US Omnibus Trade and Competitiveness Act of 1988 permits grease payments in some rare extraneous circumstances. According to this provision of the act, one can make such payments to speed up routine government work involving non-discretionary acts like destroying houses due to earthquakes. It needs the necessary approvals as fast as possible for rehabilitating homeless people.

However, one must know what qualifies for the non-discretionary act-driven requirements. For example, if an amount showing gratitude is paid to a government official, it can be considered routine government work, which could be expedited using facilitating payment. On the other hand, if it is a payment made to ensure an award is received, it is not a routine administrative process being expedited. Instead, it is like buying recognition in exchange for money. Hence, it does not fall under routine government process.

Moreover, such payment is permitted under facilitating payments FCPA or the US Foreign Corrupt Practices Act so that the administrative processes are smoothly carried out. On the contrary, the same act calls it illegal to retain or obtain foreign business by paying foreign officials for it.

Examples

Let us use a few examples to understand the facilitating payment meaning better.

Example #1

Suppose traveler Joseph has to get his baggage delivered to the plane he is to board. Hence, it contacts a baggage attendant to get it done in a smooth and fast manner. To ensure this, he pays some extra cash as a facilitating amount to the baggage attendant. As a result, Joseph’s baggage is safely delivered to the designated plane.

Example #2

Suppose a baseball exporter’s merchandise gets stuck at the border of Country X, thereby raising doubts about the consignment being stuck there for weeks or even months, which could thereby delay product delivery to concerned outlets, affecting customer clearance. Therefore, under such an extraneous situation, the firm decides to pay a grease amount to the foreign customs officials.

As a result, the foreign officials expedite the process of baseball release to the foreign market immediately. This way, the company saves its goods from becoming non-productive and is able to sell baseballs across the border, adding huge revenues to its finances..

Example #3

In April 2024, an article discussed the new Foreign Extortion Prevention Act (FEPA) and its implications, thereby emphasizing the need for required changes in the internal controls and exemption clauses of the act. The report stated that FEPA does not have any exception rule for facilitating payment, as FCPA does. This lack of an exemption rule, therefore, confuses the payment made to expedite a routine government procedure with FEPA-driven payments, which rule the demand side of the payments made. Further, the article suggested how including specific internal controls and providing proper training could ensure the avoidance of FEPA violations.

Benefits

Facilitating or grease payment has multiple benefits, which make entities and individuals smooth the processes they want. Let us have a look at them below:

- It speeds up the processing of legal or government administrative documentation.

- It expedites routine government work, like licenses and permits, to a great deal.

- In force majeure situations, an entity or person can use it to secure livelihood and obtain government facilities, which otherwise may have taken a long time.

- In the United States, such payments can be used for any government work involving non-discretionary acts, including speeding up the process of building houses in an earthquake, justifying the facilitating payment ethics.