Table of Contents

What Is A Fannie Mae Loan?

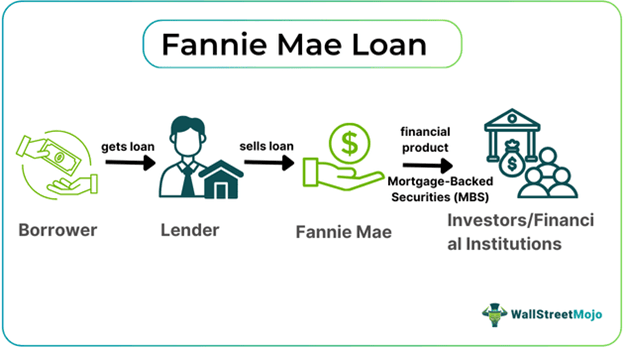

Fannie Mae loans are mortgage loans offered to people seeking to buy their first homes, primary residences, second homes, or investment properties. However, Fannie Mae operates primarily as a mortgage investor. It is a government-sponsored enterprise (GSE) that does not directly originate or provide mortgage loans to borrowers but purchases them from lenders.

The company turns these mortgage loans into mortgage-backed securities (MBSs) to sell to bond investors. The funds generated by Fannie Mae allow lenders to issue more mortgage loans to borrowers. Fannie Mae loans come with strict requirements, limitations, and qualifying criteria. Fannie Mae is short for the Federal National Mortgage Association.

Key Takeaways

- Fannie Mae is a government-sponsored enterprise that buys mortgage loans from various lenders, turns them into mortgage-backed securities, and sells them in the secondary mortgage market.

- Congress created it in 1938 to provide affordable housing and ensure the home mortgage market remains active, facilitating the flow of funds to generate more loans and products.

- Following the housing market crisis in 2008, Fannie Mae came under the authority and regulation of the Federal Housing Finance Agency (FHFA).

- Today, most conventional loans in the U.S. are backed by Fannie Mae, which is one of the two major purchasers of mortgage loans in the housing market; the other is Freddie Mac.

How Does A Fannie Mae Loan Work?

Fannie Mae loans are designed as housing programs to assist homebuyers, homeowners, and even renters. Fannie Mae, chartered by Congress in 1938, plays a crucial role in the US housing market. Before its creation, obtaining a mortgage often required a 50% down payment and stringent terms, which could allow lenders to take over a property if the borrower missed even one payment. During the 2008 housing market crash, Fannie Mae faced severe challenges and has been under the conservatorship of the Federal Housing Finance Agency (FHFA) since late 2008.

Fannie Mae functions as a mortgage investor, meaning it doesn’t originate or provide direct loans to borrowers but buys mortgages from various banks, lenders, credit unions, and financial institutions. It bundles these loans into mortgage-backed securities (MBSs) and sells them to bond investors in the secondary mortgage market. This process helps keep funds circulating in the housing market, allowing for new loans and other home-financing products. Insurance companies, investment banks, and pension funds often buy the MBSs created by Fannie Mae. Fannie Mae guarantees the principal and interest payments on its MBSs. It is one of the two major buyers of secondary market mortgages, the other being Freddie Mac, which stands for the Federal Home Loan Mortgage Corporation.

Requirements

The following are the requirements for a Fannie Mae loan:

- The borrower’s credit score is crucial in determining their creditworthiness. The borrower must have a FICO score of at least 620.

- For individual borrowers, the qualifying score is the median of the three credit bureaus: TransUnion, Equifax, and Experian.

- If there are multiple borrowers on a loan, the average of their median credit scores is used as the qualifying score.

- The borrower’s debt-to-income ratio (DTI) must be less than 50% to qualify for a Fannie Mae loan. DTI is the comparison of a borrower’s monthly debt payments to their gross monthly income.

- For a Fannie Mae loan, the down payment for a single-unit primary residence ranges from 3% to 6%. For investment properties or second homes, higher down payments are required.

- Lastly, reserves, which represent the number of mortgage payments saved, may be required. For Fannie Mae loans, reserves can be up to six months’ worth of payments. Reserves are typically not required for primary residences but are necessary for investment properties or second homes.

Limits

The limitations of the Fannie Mae loan are as follows:

- The requirements and limitations for Fannie Mae are set and regulated by the Federal Housing Finance Agency (FHFA).

- These limits are known as conforming loan limits, which apply to mortgage loans guaranteed by Fannie Mae.

- The FHFA releases annual conforming loan limit values that apply to all conventional loans backed by Fannie Mae.

- The limits include both baseline and high-cost area loan limits, with the latter varying based on geographic location.

- As of 2024, loan limits have increased for all areas except for five counties, including Guam, Hawaii, and the U.S. Virgin Islands.

- Twelve counties shifted from high-cost areas to baseline loan limits, while one county moved from baseline to high-cost area limits.

- High-cost areas are located in states such as Maryland, New York, Washington, California, Colorado, Florida, Idaho, Pennsylvania, New Jersey, West Virginia, Utah, Tennessee, Massachusetts, Wyoming, New Hampshire, and the District of Columbia.

- Fannie Mae has developed several housing programs to assist buyers, homeowners, and renters, including HomeReady, HomePath, RefiNow, the Tenant-in-Place Rental Program, HFA Preferred, and the Mortgage Help Network.

Examples

Here are two examples of Fannie Mae loans -

Example #1

Suppose there is a bank that offers mortgage loans to borrowers. Fannie Mae is a firm that buys a bundle of mortgage loans from the bank, converts them into mortgage-backed securities, and sells them in the secondary mortgage market to various investors. They then use the funds collected from different lenders, banks, and financial institutions to lend more mortgage loans to borrowers.

This whole process keeps the funds flowing and the home mortgage market active with new loans, creating liquidity for lenders to fund or underwrite additional mortgages. From a borrower’s perspective, there are preset limitations and qualifying criteria, along with other requirements, that determine the loan approval process. While this is a simple example, many factors are considered in the real estate market.

Example #2

Fannie Mae reported a net income of $4.3 billion for the first quarter of 2024. It also filed its first-quarter 2024 Form 10-Q with the Securities and Exchange Commission. Fannie Mae and Freddie Mac are seeking to impose strict rules for brokers and commercial property lenders following the regulatory crackdown on fraud in the multi-trillion-dollar market.

Under the new rules, lenders will need to independently verify their financial information linked to borrowers for apartment complexes and other properties. Lenders are likely to face tougher requirements for confirming a borrower’s adequate cash and their source of funding. Fannie Mae also released its August 2024 monthly summary.

Fannie Mae Loan Vs FHA Loan

The key differences between Fannie Mae and FHA loans are as follows:

- Fannie Mae refers to the Federal National Mortgage Association (FNMA), while FHA stands for the Federal Housing Administration.

- Fannie Mae loans require a higher credit score, typically around 620, with stricter qualifying criteria. In contrast, FHA loans are more lenient, allowing borrowers with credit scores as low as 500 to qualify.

- FHA loans are generally more profitable for lenders than Fannie Mae loans due to government backing and lower risk.

- From a borrower’s perspective, first-time homebuyers often prefer FHA loans due to their more flexible credit and down payment requirements compared to Fannie Mae loans.