Table of Contents

What Is The Fast Market Rule?

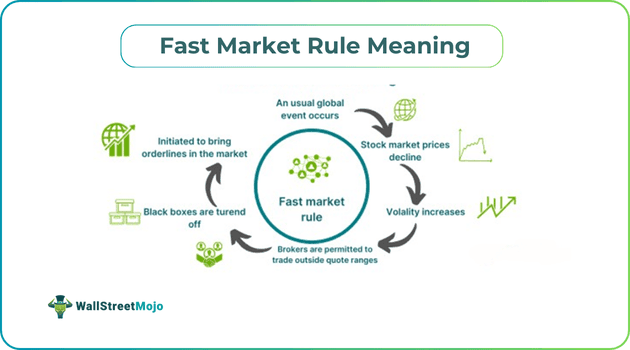

The fast market rule in the United Kingdom financial market allows the market makers to trade outside the quote ranges of the exchange. It is a crisis management strategy that is applied when the prices become sharp and it becomes impossible to keep them current and steady.

The rule is mostly observed in the London Stock Exchange when trades are going on in high volume, and things are getting out of control; primarily, the prices are becoming too volatile. Such a scenario is called a fast market; hence, the market rule enables the exchange to exercise its right to declare outside quote ranges trading.

Key Takeaways

- The fast market rule is primarily the London Stock Exchange when the exchange declares outside quote range trading for market makers.

- A fast market represents an extreme event that leads to high volatility in stock prices and chaos.

- Once the rule is declared, the market makers shut down their computerized trading systems and still have to make firm quotes.

- The opposite of the fast market rule is the circuit breaker, during which the exchanges slow down and halt trading for a specific period.

- A fast market is a rare scenario mostly triggered by positive or negative events such as elections, wars, and terrorist attacks.

Fast Market Rule Explained

The fast market rule permits the specific stock exchange to let market makers trade outside quote ranges when the market movements become sharp, and quotes are out of control. It is mostly associated with the London Stock Exchange and hence is treated as a UK rule. In an ideal scenario, shares trade within a certain price range bracket set by the highest price a buyer will pay and the lowest price a seller will accept. In a fast market scenario, the financial markets go through unusual volatility levels and unusually heavy trading.

During a fast market, it becomes virtually impossible to keep the market steady and keep up the ranges active. It is when the fast market rule is allowed to remove certain constraints from the market makers, letting them trade outside quote ranges. Since the computerized trading systems fail to comply in fast market situations, they are turned off, and during this period, the market makers do not quote share prices based on the stock exchange.

The common symptoms of a fast market are prices falling dramatically, there is ongoing high-volume trading, the whole market experiencing an unusual shift, and the prices are impossible to keep current. The single purpose of the fast market rule is to maintain orderliness in the stock market to survive the chaotic time frame. The computerized trading systems, also known as black boxes, are turned off because the heavy trading volume and high volatility confuse the brokers. In layman's terms, the rule is declared in effect when the market is facing chaos to ensure the trading orders are getting executed and no market participants suffer a loss.

Examples

Below are two examples of fast market rule -

Example #1

Suppose, in a hypothetical scenario, a country with a good stock market goes to war with another nation. This war induces multiple layers of panic, anxiety, and fear in people, and certainly, it gets reflected in the stock market. Nine days into the war, the country faces huge damage. This news creates an outburst in investors and market dynamics. The prices start falling dramatically, and at the same time, the market experiences heavy trading volume. The volatility skyrockets.

Finally, when things become uncontrollable, the exchange decides to initiate the fast market rule. The brokers quickly switch off their computerized trading systems and are permitted to trade and execute orders beyond quoted ranges. The core purpose of declaring a fast market rule is to maintain market orderliness and survive periods of sharp prices and high volatility. In this example, it is a fictional country, but the rule is majorly associated with the UK and the London Stock Exchange.

Example #2

When the attacks of 9/11happened, the European markets experienced a huge disturbance in the immediate aftermath of the attacks. The shock could be felt across the whole European financial markets in different countries. In Germany, the Dax index went down by 393 points, which was a decline of 8.5%. By early afternoon, the authorities had shut down all trading in the US-listed stocks.

The Dublin Stock Exchange declared a fast market to eliminate volatility issues. The exchange was expected to resume normal trading in a few days, but the ISEQ index came to rest at a down of 131 points, which was 2.35% for that day. The French shares plunged to their lowest since March 1999; likewise, other countries like Spain, Italy and Portugal suffered huge losses.

Benefits

The benefits of the fast market rule are -

- The exchange removes trading restrictions for market makers.

- The rule is a replacement of the circuit breaker, which is used to halt trading, but this rule keeps the exchange activities alive and moving.

- It can be observed as a crisis management strategy and technique to bring the market back in order and chaos-free.

- Although they are important for price quotes, the rule forces brokers to shut down their black boxes.

- Ensures smooth market functioning, do not let brokers get confused and stuck.