Table of Contents

What Is Finance Automation?

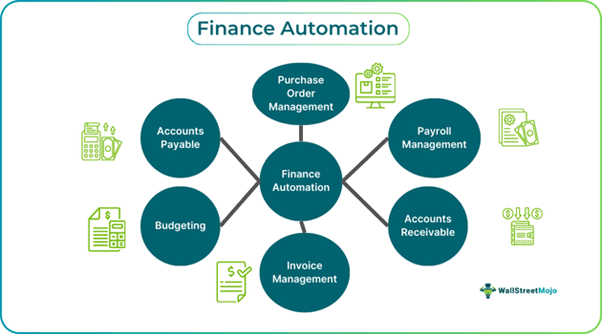

Finance automation refers to integrating technological tools like algorithms and software to eliminate the need to perform financial operations and processes manually. Invoicing, accounts receivable and payable, budgeting, financial reporting, and payroll are a few of the most common processes performed through finance automation software. While it saves time and effort, there are significant integration costs initially.

Automating financial processes reduces the need to repeatedly involve human effort in performing them, plummeting the chances of errors. Moreover, it allows organization decision-makers to concentrate on strategy and growth, as a massive portion of their time is freed up from performing monotonous tasks. In fact, it also reduces the long-term costs of performing these tasks.

Key Takeaways

- Finance automation refers to the process of integrating software or algorithms to limit or eliminate the need for human intervention in conducting finance processes or functions.

- Integration of automation reduces the probability of human error, increases operational efficiency, and boosts compliance accuracy.

- Payroll, accounts receivables, accounts payables, invoice management, budgeting, and purchase order management are a few of the most common functions businesses automate.

- Major challenges include the initial cost of development and integration, security concerns, and adverse effects on employee morale.

Finance Automation Explained

Finance automation reduces human efforts to perform a few manual tasks in the financial spectrum. Eliminating human intervention is cost-efficient, accurate, and time-saving. The use of algorithms, software, and other such technological tools to perform financial tasks has been on the rise and has been one of the leading carriers of the revolution in finance.

An accounts or finance department processes payments, generates invoices, matches them to purchase orders, and documents proof of receipt. Each of these tasks requires a number of systems, data, and, more importantly, people.

However, one major misconception about finance automation tools needs to be addressed. It is often considered that automating these processes is an attempt to eliminate humans and replace them with robots. These beliefs have become more prominent with the introduction of AI and Machine Learning. However, the contrary is true. These processes will only take care of the time-consuming, repetitive, and monotonous tasks.

Introducing automation with tasks such as payroll, accounts receivables and payables, budgeting, and financial reporting reduces the probability of errors and streamlines processes, improving efficiency massively. As a result, teams have more time to concentrate on the strategic aspects of business.

However, these systems are not free of challenges or shortcomings. The initial cost of developing and integrating these systems is significant. Moreover, they need to be more flexible in adapting to changing regulations.

Therefore, organizations must exercise caution against the wind while developing these systems and find the right balance between human touch and automation.

Which Processes Should Be Automated?

The idle way to approach professional or personal finance automation is to automate tasks that only require a little human intervention. Only processes that can be automated should be automated. Otherwise, businesses end up trying to fix something that was never broken.

A few tasks that can be automated include:

- Payroll: By adding all employee details into the system and linking them with their respective bank accounts, businesses can process payments without having to manually process salaries for each employee.

- Accounts Receivable: Cashflow is the lifeblood of any business, and customers represent significant arteries in that case. Therefore, it is vital to ensure that the amounts receivables are on track. Companies can pre-set recurring invoices and send payment reminders to customers who missed their due date.

- Purchase Orders: The purchase department can concentrate on the quality and process of the products procured by the company if they automate the process by linking inventory and the minimum quantity they wish to hold in inventory. Every time the product hits the minimum quantity, the system can independently place an order.

- Accounts Payable: Paying vendors on time ensures that goods are supplied on time and operations remain uninterrupted. Businesses can automate recurring payments and set reminders to help businesses allocate funds in time.

- Reporting & Analysis: One of the lesser-discussed aspects of automating these processes is generating reports and analyses regularly. It can generate real-time data by integrating data into APIs (Application Programming Interfaces).

Examples

Now that the concept's theoretical aspects are established, it is time to address its practical applicability through the examples below.

Example #1

Melinda is an HR executive at ABC Education Services, an e-learning company. They have about 50 employees in total, and Melinda processes their salaries with the help of an Excel sheet. However, upon attending a conference, she was introduced to the world of automation.

Upon discussing with a colleague who handled IT and related tasks within the company, I suggested simple tech integration. As a result, salaries were auto-credited to the correct accounts on time. Moreover, Melinda was able to concentrate on talent acquisition and employee engagement since this meticulous task was taken care of.

Example #2

The automation industry has been one of the fastest-growing industries globally. In fact, it grew to $846 million in 2018, a mind-blowing 63.1% growth from the previous year. The biggest adopters of technological advancements apart from personal finance automation were insurance companies, banks, utility companies, and telecom companies.

In the very next year, 2019, Robotic Process Automation (RPA) was pegged to grow to $1.3 billion, and it would only move further up in the years to follow.

Benefits

While the benefits of using finance automation tools have been explained in bits and pieces throughout the article, below are a few specific points that illuminate the advantages they provide to their users.

- Operational Efficiency: In the business world, where the phrase “time is money” is used frequently, automation tools can save businesses massive amounts of time and, therefore, money. Moreover, a smoother supply chain and established workflow give organizations a chance to attain their maximum potential.

- Consistency: Even with reporting and performance standards clearly set within the organization, two people might have completely different ways of doing the same task. Therefore, automating these tasks can improve the consistency of documentation.

- Reduction In Errors: Mistakes in manual data entry have significant repercussions in finance. Most of these errors are so easy to miss that they are only found once things blow out of proportion. Therefore, digitizing these processes shall significantly reduce errors.

- Analysis: One of the lesser-known or discussed facets of automating financial processes is that they can generate real-time reports and provide detailed analysis that can help organization leaders make strategic decisions based on data.

Risks

In spite of being widely used and accepted, finance automation tools are not free of risks or challenges to organizations. A few of the most prominent ones are:

- Employee morale might suffer as the introduction of technology is often interpreted as a scheme to reduce the number of jobs. Therefore, companies must clearly communicate such integration to avoid chaos and anxiety within the company.

- If these systems have innate errors, the scan reduces the quality of reports. Therefore, compliance standards might be missed, and companies might face fines, legal recourse, or sanctions due to these errors.

- Poorly designed systems can impact the overall IT infrastructure, which leads to repercussions on all levels of business.

- Bad automation designs can confuse employees and ultimately slow down processes. Therefore, robust internal controls and constant oversight are essential to ensure these faulty systems do not affect operational efficiency.

Best Practices

A few best practices for organizations looking to integrate finance automation software or already using them are:

- The data entered into the system for analysis or processing must be on the spot. As they are the foundation on which the automation will be built, companies must ensure that only clean data passes through the software or system.

- It is critical to ensure that processes are standardized before they are automated to avoid making errors and simplify the process.

- Despite being automated, managers must regularly monitor the performance to identify any discrepancies or errors.

- While companies invest in automation software and algorithms, they hardly spend time and effort training their employees. As a result, there is a gap that allows for errors and hinders operational efficiency.

- While incorporating these systems is an essential part of growing in today's finance world, it is equally important to incorporate corresponding cybersecurity measures to ensure the data remains safe.