Table of Contents

What Is Financial Forensics?

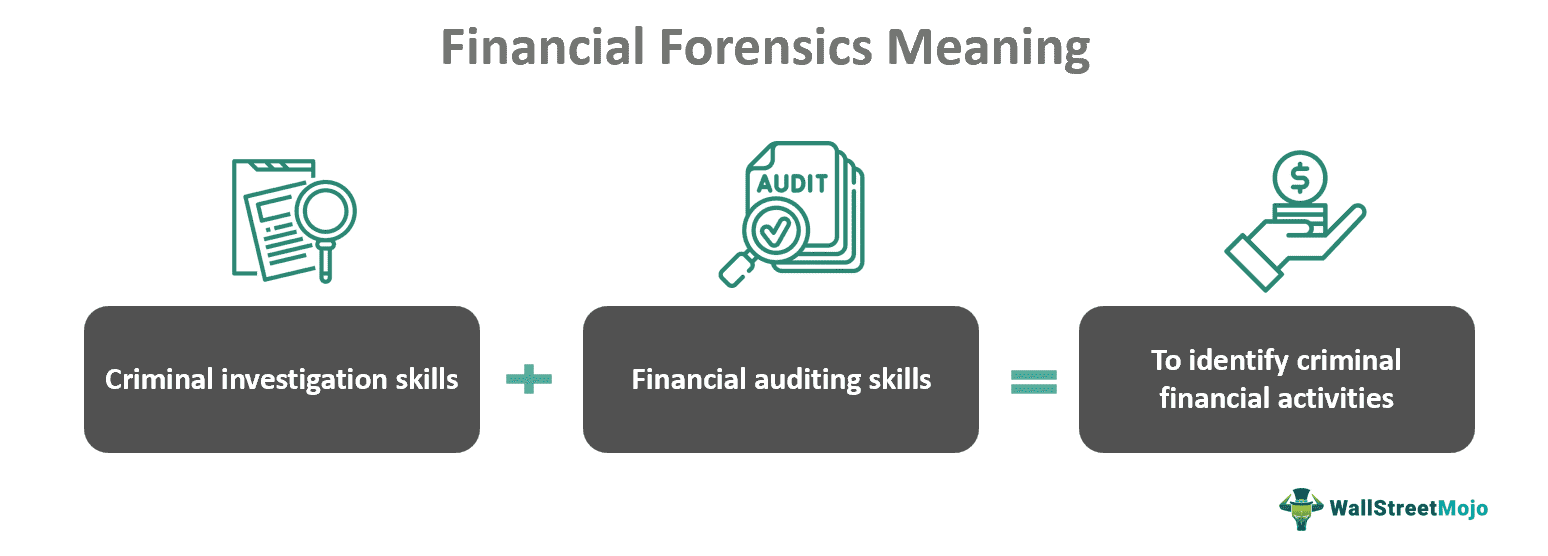

Financial forensics is a field concerned with the investigation of accounting and financial matters. This field is a combination of accounting and investigation. Thus, it helps in identifying fraudulent and criminal activities in audits in and out of the organization.

The financial forensics investigator is the profession involved in this field. They tend to investigate matters involving money as a prime factor. Also, they help prevent financial crimes and recover lost assets. Moreover, these experts have also proven fruitful in matters of money laundering and bankruptcy. However, becoming one involves certifications.

Key Takeaways

- Financial forensics refers to a field that investigates financial matters involving money in organizations and companies. It is a mixture of investigation and accounting fields.

- It is necessary to act as a forensic investigator who tracks, collects, investigates, and reports on any fraudulent activities and crimes.

- Likewise, gaining a certified public accountant (CPA) and certified financial forensics (CFF). Also, it is vital to have a bachelor's degree in accounting or finance.

- The average salary package for a forensic accountant is $83,039 per year, and the range is between $48,086 and $143,400 yearly.

Financial Forensics Explained

Financial forensics is the collective implication of accounting, auditing, and investigation based on financial matters. It tries to investigate and analyze the company's financials to detect any traces of fraud or criminal activities. Here, the financial forensics investigators aim to discover such crimes and report them to the concerned authorities. So, if any financial item or revenue contains manipulation, this technique can help in quick identification. In other words, it is a field akin to forensic accounting.

Some examples of this forensics include financial theft, money laundering, valuation disputes of companies, and tax evasion. In addition, it also includes divorce matters that include money. So, if a couple demands a divorce, the attorney or investigator will check their financial status and the assets owned by them. Likewise, other organizations like the SEC (Securities and Exchange Commission), the IRS (Internal Revenue Service), the Federal Bureau of Investigation (FBI), and others also benefit from this.

The daily work of such forensics involves many steps and procedures. Let us understand them in detail:

- Data Collection: The foremost step in this process is to collect the company's financials before analyzing them. The investigators may refer to the audit reports or annual statements for investigation. Once the data gets organized, the next step is to prepare it for investigation.

As experts try to scrutinize the documents, they might come across some financial frauds or irregularities.

- Findings: The next stage is to collect enough evidence on the fraud using digital forensics or digital devices. It acts as a strong proof of evidence, which can be later reported to investors, management, and authorities.

- Analysis And Reporting: As the investigators identify irregularities in the audit reports, they may ask for a reason or further inspect on their own. Later, they may issue a seal of approval on it.

How To Get Certified In Financial Forensics?

The field of forensics is similar to the forensic accounting field. However, to be certified in this concept, certain qualifications and requirements are needed. Let us look at them:

#1 - Educational Requirements

Among the prime requirements to get certified in financial forensics is to complete a bachelor's degree in finance or accounting. Furthermore, taking some undergraduate courses in financial accounting, costing, business law, taxation, and financial statement analysis can also prove fruitful. However, after receiving the bachelor's degree, the next stage is to become a certified public accountant (CPA). In short, it lays a foundation for financial forensics certification.

In the later stages, a person can prepare for the Certified Financial Forensics (CFF) exam. It is provided by the American Institute for Certified Public Accountants (AICPA). Any person passing this exam can easily become a CFF.

#2 - Additional Certification

The first requirement for becoming a CFF is to pass the application exam. Later on, they must attempt the CFF Credential Application. Once cleared, there are further requirements. Let us look at them:

- Earn at least 10000 hours of business experience in this field within five years.

- Complete 75 hours of continuous professional development (CPD) in forensic accounting.

Thus, if a person is able to complete both exams within five years, they can gain financial forensics certification.

#3 - Skillset

In addition, there are some skills vital for becoming a CFF. It includes investigation skills, communication, presentation, analysis, attention to detail, knowledge of industry standards and regulations, observation, and others. They help a CFF detect any fraud happening in and out of the organization quickly.

#4 - Experience

Lastly, the candidate must have relevant experience in this field. To achieve this, they can work as an intern or take a job after education.

Examples

Let us look at some examples to understand the concept in a better way:

Example #1

Suppose John owns a company and is interested in the technology sector. The firm has gained ample levels of growth in recent years. However, as a part of the upgrade, the company got listed and has now started incorporating audits in the business. In addition, even Lauren, a forensic investigator, was present to work in sync. After two weeks, Lauren and auditor Kevin found some glitches in the financial items. On investigation and discussion, it was found that the sales figures are unexpectedly shot in a week. Thus, Lauren started further inspecting this case.

After conducting the forensics, Lauren found that the company suddenly had announced a partnership with Lonimen Ltd. However, in reality, the deal was yet to take place. Yet, the firm still recorded the transaction amount as sales. On further investigation, Lauren and Kevin concluded that they did this to hide a bribery amount from an unknown investor. That is how Lauren, as a CFF, was able to unveil this money laundering case.

Example #2

According to a recent news update as of September 2023, the CFF Frank Dery has joined the Berkeley Research Group (BRG) as a managing director of the forensic accounting practice. In recent times, they have been hiring new talents to help identify any fraudulent crimes in the organization. However, this forensic practice started around four years back in 2020.

Salary

On an average basis, the salary of a certified forensic accountant is $83,039 per year. However, it can range from $48,086 to $143,400, depending on the experience level. At the same time, the hourly rates for the same are between $21 and $48. This exact range can vary depending on the geographic location and demand factors.

For instance, in the United States, the highest salary offered to a financial forensics job in Los Angeles is $99,967 yearly. It is then followed by Texas and San Francisco, which offer $95,592 and $93,330 per year.