Table of Contents

What Is Financial Information eXchange(FIX)?

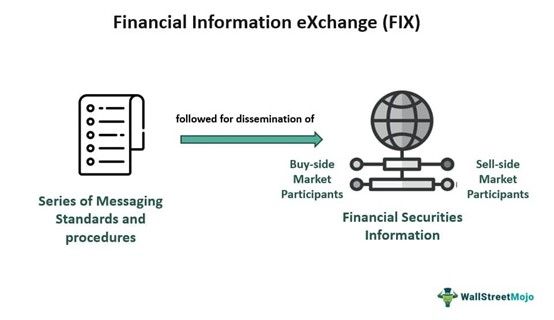

Financial Information eXchange (FIX) refers to a standardized procedure or conduct governing the global financial market, which facilitates the sharing of real-time financial securities transaction data and messages. The FIX Protocol Ltd. governs this protocol, and it is widely used across almost all popular networks.

This vendor-neutral series of messaging standards facilitates the global communication of information related to US regulatory reporting, trade, pre-trade, and post-trade of financial securities. Indeed, it is a widely used mechanism by the FIX Trading community, which functions as a non-profit organization comprising approximately 300 member firms, including investment banks, regulators, and trading platforms.

Key Takeaways

- The Financial Information eXchange (FIX) is a series of standard specifications for the messaging and communication of information on financial securities between the trader and the market.

- It is a vendor-neutral electronic communication standard that functions upon the text-based protocol to ensure seamless, efficient, and instantaneous transmission of trading data (related to pre-trade, trade, and after-trade activities) internationally.

- This system was discovered in 1992 by a group of financial firms with a motive to standardize the global trading mechanism.

- The FIX protocol is operated and managed by FIX Protocol Ltd., a UK-based non-profit organization.

Financial Information eXchange Protocol Explained

The financial information eXchange (FIX) is an international electronic communication system that aids in the transmission of real-time information on financial securities between traders and the markets. It is an open standard text-based protocol that is vendor-neutral and enables the transmission of the regulatory, trade, pre-trade, and post-trade data. Being an electronic system, it has considerably curtailed the unnecessary paper documents and telephone calls, which were otherwise a common practice in the sharing of quality information. Moreover, the system helps in the direct processing of trading and price information.

The FIX Protocol was introduced in 1992 by the member firms to standardize trading and price information in the international financial securities market. It was established under the administration of the FIX Protocol Ltd. However, the system has developed over time, transforming into different improved versions in terms of functionality and use. While the latest version is FIX 5.0, the most popular protocol is FIX 4.2. Also, many online websites provide Financial Information eXchange protocol tutorials to help the market participants learn about the FIX engine and messaging system.

The FIX community included around 300 member financial institutions and other organizations from different geographical locations. This system is popularly used by both the buy-side and sell-side participants in the financial securities industry. The FIX users include brokers, dealers, investment banks, regulators, electronic communication networks, and futures and stock exchanges. Moreover, it facilitates the informed transaction of stocks, bonds, derivatives, and other financial securities. Let us now gauge the FIX structure; in brief, it has a series of critical value pairs comprising a unique identifier and its related value.

Examples

Let us now have a look at the following examples to understand the functioning of the FIX protocol:

Example #1

BlackRock has introduced Financial Information eXchange (FIX) connectivity for authorized participants (APs) to streamline the creation-redemption process. This new system will automate and expand primary market orders, initially covering Undertakings for the Collective Investment in Transferable Securities (UCITS) and US 40Act ETFs, except for US commodities. Also, the company intends to add the share class switches to this protocol in Q1 2024, which will be followed by fixed-income custom basket orders later in the year.

BlackRock is the second European issuer to adopt FIX, following DWS in September 2023. The volume of primary market orders for iShares UCITS ETFs in Europe has surged by about 300% over the past five years. Indeed, FIX is anticipated to become the global standard for authorized participants (APs).

Example #2

On December 13, 2023, NASDAQ Inc. encountered a system malfunction that disrupted thousands of stock orders, impacting over 50 clients and resulting in some order cancellations as well. The problem originated at 14:31 ET (1931 GMT) due to a duplicate internal order ID fed in NASDAQ’s Financial Information eXchange (FIX)/RASH order handling system. To resolve the issue, NASDAQ reverted the application to a previous version. Although the FIX/RASH system was shut down for the rest of the day, other markets continued to operate normally, and the closing cross was completed.

This example indicates that the FIX system might be robust, but it is open to technical faults at the same time.

Importance

The Financial Information eXchange protocol is a robust mechanism for the transmission of trading information on the global front. It has the following significance:

- Globally Recognized Protocol: The FIX system is an internationally recognized protocol that efficiently transmits financial information across different global markets and geographical locations.

- Makes Trading Cost Effective: Since it integrates with the technological networks, it ensures cost-effectiveness due to automation and no manual processes.

- Reduces Errors: Since everything is processed automatically without any manual intervention, this system ensures no errors, financial losses, or trade breaches.

- Indicates Compatibility: Further, the FIX protocol is interoperable and can be easily integrated with other network technologies, platforms, and systems.

- Enables Rapid and Efficient Transactions: This system is highly efficient in the communication of financial information. Moreover, it is one of the fastest systems for transaction execution.

Challenges

Even after being a standardized messaging specification for real-time information transmission of the financial securities market, it is prone to the following limitations:

- Security Concerns: The FIX system is vulnerable to security threats, like cyberattacks and hacking, thus emphasizing the need for information protection and cohesion.

- Technicality: The system runs on the technical format. Thus, its management and implementation require technical expertise.

- Complex System: It is a complex electronic communication protocol that allows users to understand, use, control, and troubleshoot.

- Protocol Pitfalls: The verbose format of this protocol could be more efficient in communicating the volume of data. Moreover, since it is a text-based protocol, it requires a higher bandwidth.