Why Financial Institutions Must Rethink Data Sharing on Social Platforms

Table of Contents

Introduction

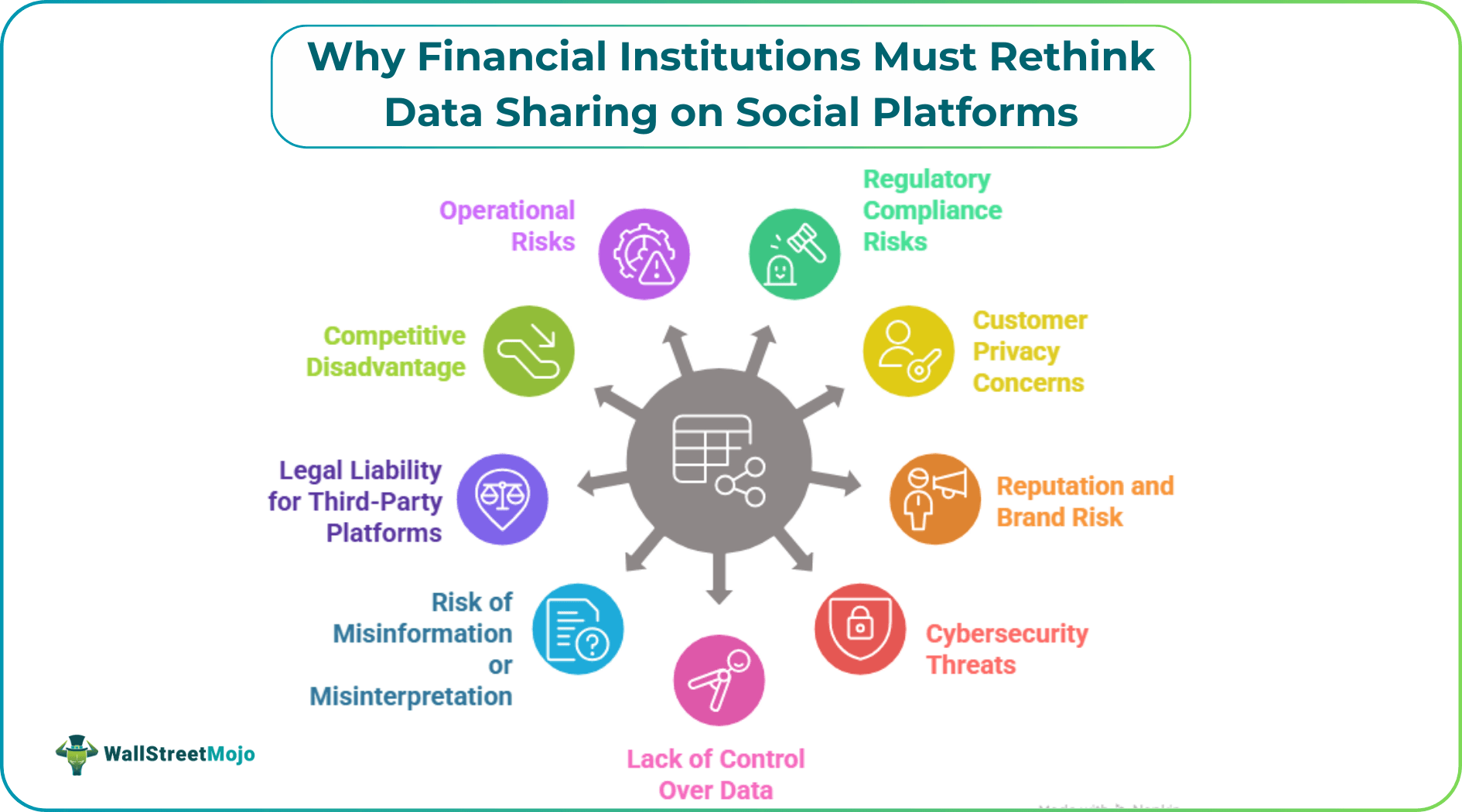

If you work in banking or finance, you already know how tempting social platforms can be for sharing updates, insights, or even customer stories. But every post or shared piece of data comes with risks. A single slip can damage trust, invite legal trouble, or even hurt your brand. Financial institutions handle sensitive information, and the rules around how it’s used are strict.

In this article, we’ll cover 10 reasons why banks and other financial organizations need to rethink what they share on social platforms and how doing so can protect both the institution and its customers.

#1 - Regulatory Compliance Risks

Financial institutions must follow strict rules when they communicate with customers or share information publicly. Laws require banks, credit unions, and investment firms to protect customer privacy, keep clear records, and avoid giving misleading information. Social platforms like Facebook, X, LinkedIn, or Instagram make it hard to meet those rules because content spreads fast and isn’t archived in a compliant way by default.

Regulators treat social posts just like any official communication. That means every comment or reply could be subject to record‑keeping, disclosure, and review requirements. If a firm can’t produce those records when regulators ask, it can face fines and legal actions.

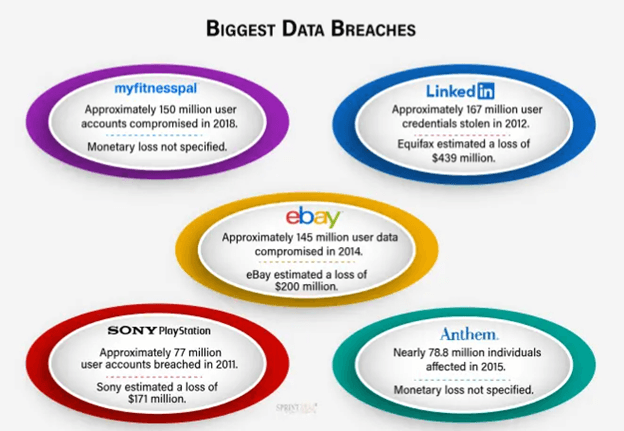

Social media also carries broader cybersecurity risks that regulators are watching closely. We have seen time and again that these platforms are not bulletproof. Take LinkedIn — a primary tool for many professionals.

Source: Sprintzeal

In 2012, they suffered a breach where 167 million user credentials were stolen, resulting in an estimated $439 million loss. And it’s not just them; eBay saw 145 million records compromised, and Sony PlayStation lost 77 million accounts. When you rely on third-party platforms, you are inheriting their vulnerabilities.

#2 - Customer Privacy Concerns

When financial institutions share data on social platforms, customer privacy is one of the biggest concerns. Banks and financial firms hold detailed personal and financial information, including account activity, investment history, and contact details. Customers trust these firms to keep that information safe, and any slip online can erode that trust.

Even if a post doesn’t include direct financial numbers, indirectly revealing customer details is surprisingly easy. Replying to a customer’s comment with account information, transaction details, or internal processes can expose private data. Regulatory frameworks in many countries also require financial institutions to safeguard personal information wherever it appears — including social media.

Rameez Ghayas Usmani, Award-Winning HARO Link Builder & CEO of HARO Link Building, adds, “Every piece of content shared online represents your brand and your customers’ trust. Even subtle oversharing can compromise privacy and damage reputation, which is why we treat digital communications with the same diligence as high-value link-building campaigns.”

By treating online posts and responses with the same rigor as traditional customer data protection, financial firms can maintain credibility, ensure compliance, and foster lasting trust with clients. Proper guidance, review processes, and training for social media teams make it possible to communicate effectively without putting sensitive information at risk.

Social platforms also make it hard to control who sees the content. A post meant for a small audience can quickly be shared, screenshotted, or forwarded beyond the institution’s control. Once private information is out, it’s almost impossible to take it back. This can lead to complaints, investigations, and loss of customer confidence.

Moreover, customers today are more aware of privacy issues than ever. Many people check a company’s online behavior before deciding to open an account or invest. If a financial institution ever appears careless with privacy — even indirectly through social platforms — it can affect long-term relationships.

#3 - Reputation and Brand Risk

A financial institution’s reputation is one of its most valuable assets. Trust and credibility form the foundation of any bank, investment firm, or insurance company. Once that trust is damaged, rebuilding it can take years. Sharing messages on social platforms without careful review puts that reputation at risk.

"Even small miscommunications online can quickly affect confidence and decision-making. Posts about market trends or platform updates need precision, since readers often interpret every detail through a highly analytical lens," adds Noam Friedman, CMO of Tradeit.

Social media moves fast, and missteps spread even faster. A post that is misread, contains an unclear statement, or is taken out of context can go viral, attracting criticism from customers, regulators, or competitors. Public posts are visible to the entire ecosystem, and even general statements about growth or updates can influence how stakeholders perceive reliability and competence. Clear, thoughtful messaging reduces misunderstanding and helps maintain long-term trust.

#4 - Cybersecurity Threats

Cybersecurity threats are a big reason financial firms need to be careful about what they share on social platforms. Public channels are easy targets for hackers and scammers who want to steal money or sensitive information. Financial firms are attractive targets because they hold valuable customer data, and a single breach can cause serious problems, explains Justin Schnitzer, Founder & Managing Partner at The Law Office of Justin Schnitzer.

Social platforms can expose accounts to risks like phishing, fake profiles, and account takeovers. Hackers can create profiles that look like a bank’s official page to trick employees or customers into sharing passwords or other private details. Even simple actions, like clicking on a link shared in a message, can let attackers install malware or steal login information.

Cyberattacks are constant. Studies show one happens every 39 seconds.

Image Source: Astra Security

And social platforms are often part of how attackers reach people. For financial firms, this means even a small misstep on social media can turn into a big problem.

To stay safe, firms need clear rules about what can be shared, proper training for employees, and monitoring tools to spot suspicious activity quickly. By taking these steps, banks and other financial institutions can reduce risks, protect customer data, and avoid costly cyber incidents.

#5 - Lack of Control Over Data

When financial institutions post or share content on social platforms, they give up a lot of control over how that data spreads. Unlike internal systems or official websites, social channels allow anyone to copy, share, or save posts instantly. Once information is out there, it’s almost impossible to take it back.

Even carefully crafted updates can be misused. A post intended for customers can quickly end up on blogs, forums, or competitor sites. Employees might also share content across personal accounts without realizing it creates risks for the institution. For example, a quick reply to a customer query could be screenshotted and shared widely, exposing operational details or internal policies.

This loss of control matters because financial institutions are held accountable for all the information they make public. Regulators, customers, and stakeholders can react negatively if something spreads that wasn’t intended. Unlike email or internal communications, social platforms don’t provide a reliable way to retract content once it’s been shared.

To manage this, institutions need strict rules about who can post, what can be posted, and how it is monitored. Using monitoring tools and content approval processes ensures that information stays under control and limits the chance that sensitive details fall into the wrong hands.

#6 - Risk of Misinformation or Misinterpretation

Even well-intentioned posts can be misunderstood or misinterpreted on social platforms. A financial institution might share market insights, investment tips, or updates about products, but readers may take them out of context or misread the message. Misinterpretation can lead to complaints, legal issues, or damage to the firm’s reputation.

In an interview, Edward Tian, CEO of GPTZero, said, “Much like AI tools help identify content that might be misleading or inaccurately generated, financial institutions need systems to catch posts that could be misread. Ensuring clarity and context in every message is essential to maintain trust and avoid misinterpretation.”

Social media encourages short, quick posts. This can make complex financial information appear oversimplified or incomplete. A post summarizing interest rate changes, for example, might be read as personalized advice, even if it was meant as general information. Customers may act on the post without realizing the nuances, leading to frustration, financial losses, or reputational issues for the firm.

Misinformation also spreads easily. Once a post is shared or commented on, other users can change its meaning, add false details, or amplify errors. A small misunderstanding can go viral, creating bigger problems than the original post. Firms should implement clear review processes, layered approvals, and context-checking strategies to prevent errors from proliferating.

In fact, 75% of people who have suffered from cyberbullying say it happened on social media, showing just how fast and widely harmful content can spread if not carefully managed.

Image Source: Exploding Topics

To reduce this risk, institutions should carefully review all posts before publishing, clarify that content is for informational purposes only, and avoid making promises or specific predictions. Training employees to communicate clearly and consistently on social channels is also critical. Clear guidelines and oversight help ensure that posts are accurate, responsible, and less likely to be misinterpreted.

#7 - Legal Liability for Third-Party Platforms

Financial institutions can face legal liability for anything shared on social platforms, even if the platform itself is hosting the content. Laws and regulations often treat online posts the same as official documents or communications. This means banks, insurers, and investment firms are responsible for any misleading statements, privacy violations, or false information shared publicly.

Rachel Sinclair, Acquisitions Director at US Gold and Coin, highlights, “Even seemingly minor disclosures on public platforms can carry serious consequences. In the financial and investment sector, sharing trends or client-related content without rigorous checks can expose a company to reputational and legal risks.”

Beyond the legal frameworks, using social platforms requires institutions to implement robust internal controls. Staff need training on what constitutes sensitive information, how to handle user-generated content, and the protocols for third-party endorsements.

Automated systems can help flag potentially risky posts, while archiving tools ensure records meet regulatory requirements. Institutions also need to monitor responses and comments continuously to prevent inadvertent violations. The combination of technology, employee awareness, and formal approval processes reduces exposure and ensures that social media engagement aligns with both regulatory expectations and customer trust.

Using third-party platforms adds another layer of risk. Social networks do not guarantee compliance with financial regulations, and they do not automatically archive content in a way that meets record-keeping requirements. If regulators request records of public interactions and the institution cannot provide them, fines and legal action can follow.

Raj Dosanjh, CEO of RentRound, notes, “Property management and rental services are increasingly leveraging social media to engage clients, but regulatory compliance is critical. Sharing unvetted information — even community updates or listing promotions — can create legal exposure if not properly reviewed.”

Institutions must also be careful with endorsements, third-party links, and user-generated content. Sharing content from external sources without proper review can inadvertently expose the firm to legal risk. Establishing clear policies, approvals, and monitoring is essential to reduce exposure while using social media.

#8 - Competitive Disadvantage

Sharing too much information on social platforms can give competitors a clear advantage. Even posts that seem innocuous—like updates on growth, product launches, or team achievements—can reveal strategies or metrics that rivals can analyze and exploit. Competitors often monitor social channels to piece together internal processes, market moves, or customer trends.

According to Kenny Philliips, Founder & CEO of Inbound Suits, "Every piece of online content is part of a brand’s digital footprint, but in SEO and digital marketing, oversharing can inadvertently reveal business strategy. Competitors can track public campaigns or client success stories to adjust their own approach,"

For example, posting a client success story or highlighting a new operational workflow might seem like standard engagement. But competitors can study these posts to infer internal processes, service capabilities, or customer behavior patterns.

Even broad information like revenue trends or product adoption rates, when shared publicly over time, can allow rivals to anticipate business moves. Social media amplifies these risks because content spreads instantly, making any insight available to observers outside your organization.

"Content strategy isn’t just about reach, it’s about control. In career and employment content, oversharing candidate or client trends online can expose operational insights. Structured review processes and strategic messaging ensure you engage audiences while keeping proprietary information secure," added Karen Noryko, Career Content Director at Jobtrees.

By implementing internal approvals, social media policies, and employee training on what can be shared publicly, organizations protect sensitive information without compromising engagement. This approach maintains competitive positioning while allowing businesses to use social platforms effectively.

#9 - Operational Risks

Using social platforms for customer interactions introduces operational challenges. Unlike internal systems, these platforms are not built for structured, secure communication. Public posts, messages, or responses can cause mistakes, inconsistencies, or delays, particularly when multiple employees engage with the same customers.

"Every interaction online carries operational weight. In PR and press distribution, a single miscommunicated message can spread widely, impacting client trust and internal workflows. Structured approvals and centralized review ensure accuracy and consistency," said Alison Lancaster, CEO of Pressat.

Beyond the immediate risk of errors, using social platforms requires careful coordination across multiple teams. Marketing, customer service, compliance, and even product teams must all stay aligned, ensuring that information shared publicly is accurate, consistent, and compliant with regulations. Workflow inefficiencies, delays in approvals, or miscommunication can amplify small mistakes, turning them into larger issues that affect brand perception, client satisfaction, and even legal liability.

Plus, platforms are subject to outages, glitches, or unexpected updates, which can disrupt real-time communication and slow response times. Organizations must also balance engagement with oversight — responding quickly to customers while maintaining control over the accuracy and tone of messaging. Without robust systems in place, the workload on employees grows, and the risk of mistakes escalates, making operational oversight a critical component of any social engagement strategy.

For example, when multiple team members respond to inquiries differently, customers may receive conflicting information. Handling sensitive requests or guidance publicly increases risk, and downtime or technical issues on third-party platforms can disrupt communication flow. Social media also adds workload for marketing, compliance, and customer service teams, requiring constant monitoring to ensure accurate and timely responses.

Noah Lopata, CEO of Epidemic Marketing, adds, "Accounting is all about precision and risk mitigation. Online customer interactions are no different — mistakes in messaging or workflow can create financial or compliance risks. Implementing structured oversight and clear task ownership reduces operational errors and ensures reliable service.”

Conclusion

Financial firms have to be careful about what they put on social media. Every post, reply, or update can bring real problems — rules to follow, keeping customer info safe, cyber risks, and losing control over what’s shared. Even small mistakes can spread fast or be misunderstood.

The best way to stay safe is to set clear rules, watch what goes out, and make sure staff know what they can and can’t share. Social media is useful, but only if it’s handled carefully. Doing this protects customers, keeps the business out of trouble, and builds trust over time.