This is an elite online course for you to learn Excel finance with a long and in-depth analysis of basic to professional skills, commands, formulas and reporting of financial figures, values and variables in Excel. These skills will assist you in transforming raw information and data into valuable insights. Enroll today and take charge of the new financial learnings and knowledge coupled with certification and career advancement opportunities.

Excel for Finance Course!!

Master Finance-Specific Excel Formulas & Functions | Automate Complex Calculations & Data Analysis | $499+ in Exclusive Benefits | Essential Excel Skills for Investment Banking & Corporate FinanceFLASH SALE!

Claim Your 60% + 20% OFF

FLASH SALE is here, and your chance to upskill has never been better.

💰 Get 60% +20% off (WSM20)

📈 Master financial modeling skills with expert-led training.

🕒 Learn anytime, anywhere, and boost your career prospects without breaking the bank.

🔥 Hurry - this FLASH SALE is live for a limited time only.

HIGHLIGHTS

Highlights of the Course

Hands-On Excel Training for Finance

Hands-On Excel Training for Finance : Master financial modeling, and data analysisElite Wall Street-Level Training

Elite Wall Street-Level Training : Learn Excel functions used in investment banking, etc.1,000+ 5-Star Ratings

1,000+ 5-Star Ratings : Highly rated by finance professionals, analysts, and students worldwidePre-Built Excel Templates for Finance

Pre-Built Excel Templates for Finance : Apply real-world financial models, valuation templatesSelf-Paced, Career-Focused & Job-Ready

Self-Paced, Career-Focused & Job-Ready : Gain industry-relevant Excel expertiseCertification

Certification : Earn a prestigious Excel for Finance certification to enhance your resumeHURRY UP!

Unlock Premium Course Benefits Worth $499+!

Advanced Logical & Lookup Functions (Benefits Included)

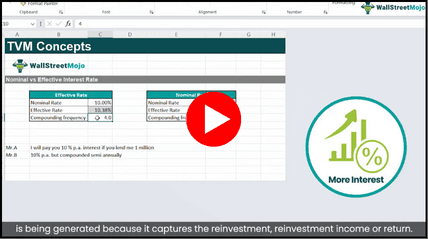

Advanced Logical & Lookup Functions (Benefits Included) :Time Value of Money & Financial Calculations (Benefits Included)

Time Value of Money & Financial Calculations (Benefits Included) :Pivot Tables & Data Analysis (Benefits Included)

Pivot Tables & Data Analysis (Benefits Included) :Excel Shortcuts & Efficiency Boosters (Benefits Included)

Excel Shortcuts & Efficiency Boosters (Benefits Included) :Data Validation & Conditional Formatting (Benefits Included)

Data Validation & Conditional Formatting (Benefits Included) :EXCEL FOR FINANCE MASTERCLASS COURSE PREVIEW

Sample Videos

BENEFITS AND FEATURES

Benefits & Features of the Course

Here are some of the essential benefits that you will gain with this Excel For Finance course in terms of your career and future growth -

#1 - Rudimentary knowledge:

This course will make you acquainted with MS Excel from the very basic fundamental level so that you understand how Excel is used in the finance industry, its scope and vastness regarding different job roles and applications with different requirements.

#2 - Adaptable learning:

Whether you're a beginner or a seasoned professional, this course has something for you. Beginners will learn the basic skills commonly used in MS Excel, while seasoned professionals can refresh their knowledge and identify fundamental concepts they may have forgotten over time. In both cases, you'll enhance your working style with new skills.

#3 - Better career prospects:

The course rewards you with an online certification that highlights and validates your skills and knowledge among your peers and colleagues and adds merit and value to your abilities, offering a competitive advantage that eventually opens new job opportunities and career advancement options in the future.

#4 - Excel for the future:

Excel is a crucial tool used across industries, and this course will prepare you for a variety of roles. It serves as a stepping stone to advanced courses, equipping you with the knowledge and skills needed to become industry-ready.

QUICK FACTS

Industry Trend

SKILLS COVERED

What Will You Learn?

This Excel in finance course assists you with basic calculation functions and finance formulas to calculate and process financial data. For example, even if you are not a finance professional, you will be able to derive personal financial calculations, for example, EMI calculations, loan nd mortgage payments. The functions can even help in investment analysis and decision-making. At the same time, you will get familiar with sensitivity analysis, goal seeking and solving. What are you waiting for? Enrol today and start your learning journey.

PROGRAM OVERVIEW

Course Description

Starting from the rudimentary information, the course gradually dives deep into the core understanding and practical applications of Excel in finance. The entire course is designed keeping in mind that it remains accessible and comprehensive to people coming from different walks of life and is relevant for a beginner and, at the same time, useful for a finance professional. This feature is what makes this course one of the best Excel courses for finance available online. The program covers everything from tips and tricks, formulas, charts, commands, tables and shortcuts, including every single function that is a core necessity for financial analysis, modeling and practical applications.

ROLES FOR FINANCE

Careers With Financial Modeling Skills

#1 - Investment Banker:

Investment bankers are professionals equipped with in-depth knowledge of financial markets and all sorts of financial products and instruments across all asset classes. The Excel For Finance Course helps them manage portfolios, create reports, and derive future investment values through complex calculations and financial analysis. Such professionals are appointed by CitiBank, Goldman Sachs, JP Morgan Chase, Barclays and other global financial firms with an average compensation package of $80,245 as of June 27, 2024.

#2 - Financial Analyst:

Financial analysts are professionals with a regular requirement of Excel software, its functions and applications. They are responsible for performing data analysis, strategy building, and decision-making regarding investments, projects and portfolio building for companies and clients. They are required to have strong analytical and mathematical skills, and Excel assists them in that regard. The average salary for this job role in the US is $66,630 US dollars annually. This data is reported by salary.com as of June 27, 2024.

#3 - Auditor:

Firms and government agencies appoint auditors to perform an audit. This is a reputed designation, and many world companies can have their auditor appointed in the office. They hold specific certifications and regulatory authority and sometimes belong to top audit firms such as Deloitte, Grant Thornton, EY, Baker Tilly, PwC and more. Excel in finance helps them create reports and charts and interpret insights while auditing financial statements and accounts. The average salary for auditors is approximately $98,921 annually. This salary figure is taken from salary.com as of June 27, 2024.

#4 - Loan Officer:

Loan officers, as we all know, are the finance professionals who help us in the whole process of applying for a loan. Sometimes, every client is allocated a loan officer. That said, even a single loan officer handles multiple clients. If you are planning to become a loan officer at a reputed organization, this Excel finance course can help you achieve your objective. After completing the program, .you may get appointed in top firms such as Envoy Mortgage, PNC Bank, Wells Fargo, Coastal Credit Union and many more with an annual salary of 66,733 US dollars on average as of June 27, 2024, per salary.com.

#5 - Insurance and Tax Advisor:

As the designation explains itself, such individuals hold specialized knowledge about insurance and tax regimes and help people regarding their tax filing and savings advisory. Similarly, an insurance advisor advises people on which policy is best for them. With Excel finance salary of such job roles is $94,383 on average per year. Individuals are hired by companies like KPMC, BDO, PwC, Deloitte and so on. This data is taken from salary.com as of June 27, 2024.

#6 - Accountant:

Accountant is one of the top finance designations and holds a special place in both private and public sector companies and firms. Although there are still offices that use traditional accounting methods, there are some that use advanced accounting software in the workplace. Excel training for finance helps accountants maintain financial records and reports in an orderly manner. Again, with an extensive course like this, individuals stand a chance of getting hired in the Big Four Deloitte, EY, KPMG, and PwC firms. In the US, the average annual salary of accountants is $62,727. This data is taken from salary.com.

Got questions?

Still have a question? Get in Touch with our Experts

WHAT WILL YOU GAIN IN THIS COURSE?

Course Curriculum

Naming Cells and Range

Basic Math

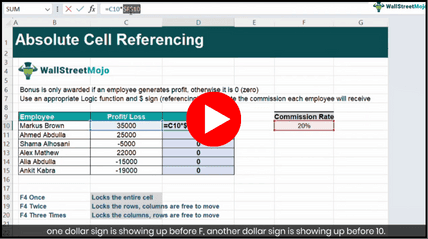

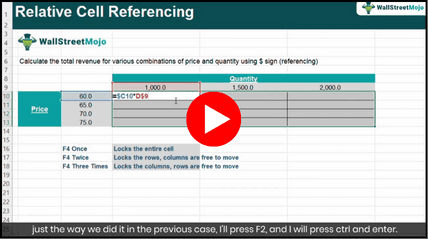

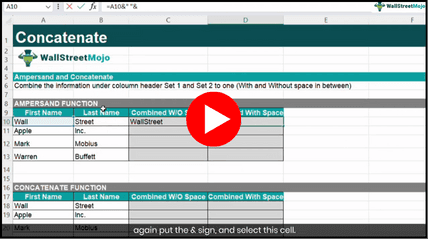

Absolute Cell Referencing

Logical Functions

Along with video content covering the above topics, the course has downloadable Excel templates. Moreover, the instructor is an industry expert who takes a practical approach to solving complex financial problems using different techniques in Excel. While you learn Excel for finance online, this entire curriculum will make sure that the moment you are done with it, you are a better professional with hands-on knowledge about using Excel and knowing all the shortcuts, tips and tricks that you once thought never existed. The most important feature of this Excel crash course in finance is that it does not rely on theory and bookish knowledge but allows you to test your learnings practically so that you always remember what you learned.

CERTIFICATION

Earn a certificate on completion of this course

This course comes with an Excel for finance professionals certificate that you shall receive once you complete the entire learning program. Note that one must watch all the course videos, clear the MCQ-styled tests, and, lastly, pass the final assessment to obtain the certificate. This certification will help you stand out among other candidates when it comes to appearing in competitive job interviews and taking part in the hiring process in the finance industry. You can learn more about the course and clear your doubts by checking out the ‘Frequently Asked Questions’ section.

BUNDLE COURSES

Discover the benefits that Bundle courses bring to your learning journey.

Skill Diversification

Flexibility to Learn

Comprehensive Curriculum

No Major Prerequisites

Cost Savings

Benefit from flexible learning and gain comprehensive skills with an online certification bundle, offering a cost-effective way to boost your career credentials. Enjoy access to diverse, expert-led courses and valuable resources anytime, anywhere.

WHAT SHOULD YOU KNOW?

Prerequisites for Excel for Finance Course

The prerequisites and Excel for finance eligibility criteria for this course are as follows:

Anyone with a basic knowledge of computer operations trying to begin learning Excel or b for their

- A desktop computer or laptop to begin with

- A stable internet connection

- Microsoft Excel software (installed and working actively)

- Basic knowledge of spreadsheets, rows and columns, charts and formulas