Fixed Deposit Calculator Help You Plan a Monthly Income from Interest Payouts

Table of Contents

Introduction

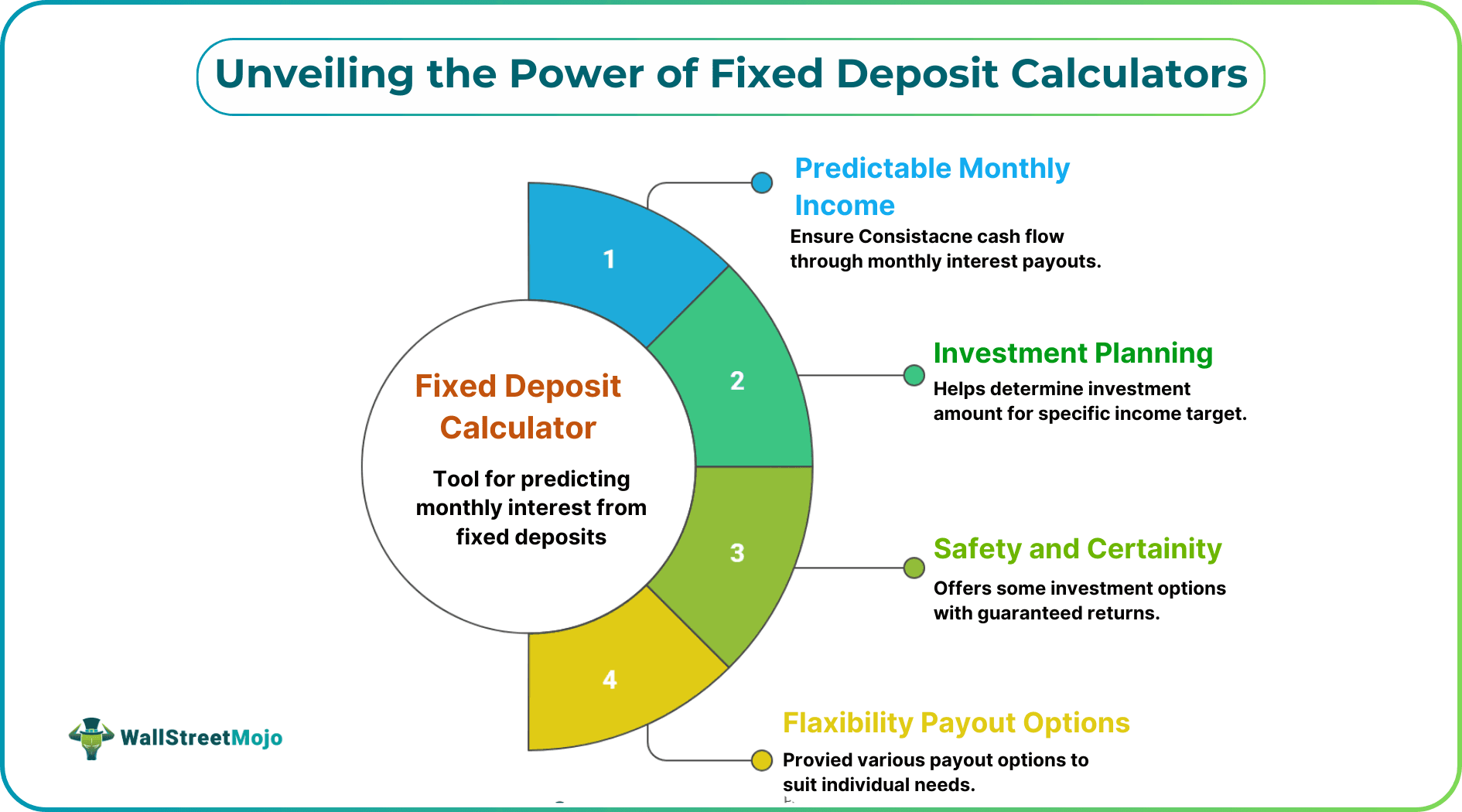

If you want predictable monthly cash flow, a fixed deposit calculator is one of the most useful tools you can use. It shows you exactly how much monthly interest you can earn from an FD, and how much you need to invest to meet a specific income target. For Indian savers who prefer safety and certainty, the Bajaj Finance FD combines strong rates with flexible payout options, which makes planning monthly income simple. In this guide, you will learn how to use a fixed deposit calculator, how monthly interest payouts work, and how to align your deposits to your income goals.

How a Monthly Interest FD Works?

An FD with a non-cumulative option pays out interest at a chosen frequency. You can opt for monthly, quarterly, half-yearly or yearly payouts. Your principal stays locked for the chosen tenure and is returned at maturity.

Monthly payout options use a specific monthly p.a. rate. The interest is calculated on the deposit amount at that annualised rate and then divided by 12 for monthly credit. Because interest is paid out during the tenure, the effective rate for monthly payouts is lower than the at-maturity p.a. rate, where interest compounds.

Bajaj Finance FD offers both cumulative and non-cumulative variants. If your priority is a dependable monthly pay cheque from your FD, the non-cumulative monthly option is designed for that need.

Why a Fixed Deposit Calculator is Essential

A fixed deposit calculator helps you:

- Estimate monthly interest you will receive from an FD for a given amount and tenure

- Work backwards from a target monthly income to the deposit you need

- Compare monthly, quarterly, half-yearly, yearly, and cumulative options objectively

- Align investments to life goals like household expenses, EMI buffers or retirement income

It reduces guesswork, avoids manual errors, and lets you fine-tune your plan in minutes. When paired with the current rates of Bajaj Finance FD, the output is precise and actionable.

Current FD Interest Rates for Income Planning

Below are the current published FD rates you can use with a fixed deposit calculator. These rates apply to Bajaj Finance FD booked for the stated tenures and payout frequencies.

#1 - FD rates for customers above the age of 60 (Senior Citizens)

| Tenure | At maturity (p.a.) | Monthly (p.a.) | Quarterly (p.a.) | Half-yearly (p.a.) | Yearly (p.a.) |

|---|---|---|---|---|---|

| 12 – 14 months | 6.95% | 6.74% | 6.78% | 6.83% | 6.95% |

| 15 – 23 months | 7.10% | 6.88% | 6.92% | 6.98% | 7.10% |

| 24 – 60 months | 7.30% | 7.07% | 7.11% | 7.17% | 7.30% |

#2 - FD Rates for customers below the age of 60 (Non-Senior Citizens)

| Tenure | At maturity (p.a.) | Monthly (p.a.) | Quarterly (p.a.) | Half-yearly (p.a.) | Yearly (p.a.) |

|---|---|---|---|---|---|

| 12 – 14 months | 6.60% | 6.41% | 6.44% | 6.49% | 6.60% |

| 15 – 23 months | 6.75% | 6.55% | 6.59% | 6.64% | 6.75% |

| 24 – 60 months | 6.95% | 6.74% | 6.78% | 6.83% | 6.95% |

Using the Fixed Deposit Calculator Step by Step

- Select customer type: Choose senior citizen if you are 60 or above, else non-senior

- Choose tenure: Pick between 12 and 60 months

- Select payout frequency: Monthly, quarterly, half-yearly or yearly

- Enter the deposit amount: Principal you plan to invest

- Review results: Monthly payout, total interest and maturity amount are displayed

Most calculators also allow reverse planning, where you input a target monthly payout and get the required deposit amount. The Bajaj Finance FD platform mirrors this journey clearly.

Choosing the Right Tenure and Payout Frequency

Your choice should reflect time horizon, rate advantage and income needs.

#1 - Tenure Selection

- 12 to 14 months offer flexibility but slightly lower monthly p.a. rates

- 24 to 60 months generally offer better yields for long-term income planning

#2 - Payout Frequency

- Monthly: Ideal for regular expenses

- Quarterly / half-yearly: Slightly higher p.a. than monthly, fewer credits

- Yearly: Highest p.a. among non-cumulative options

- Cumulative (at maturity): No interim income, interest compounds

For retirees and families managing monthly budgets, the monthly non-cumulative option of Bajaj Finance FD provides clarity and convenience.

Advanced Strategies to Optimise FD Income

- Laddering by maturity: Split corpus across multiple tenures

- Staggered booking dates: Smoothen monthly cash flow

- Mix cumulative and non-cumulative: Income + growth balance

- Senior citizen advantage: Higher monthly p.a. rate reduces required principal

- Coordinate with other income sources: Align all inflows to one monthly target

Common Mistakes to Avoid When Using a Fixed Deposit Calculator

- Using the at-maturity p.a. rate for monthly income calculations

- Ignoring post-tax income while planning

- Locking into unsuitable tenures

- Overlooking TDS thresholds

- Concentrating the entire corpus in a single FD

How Bajaj Finance FD Supports Monthly Income Seekers

- Competitive monthly p.a. rates across 12 to 60 months

- Non-cumulative payout options: monthly, quarterly, half-yearly, yearly

- Simple online journey with built-in fixed deposit calculator

- On-time interest credits and clear statements

- Highest safety ratings of ICRA AAA (Stable) and CRISIL AAA / Stable, indicating a very strong capacity to meet interest and principal obligations

Tax and TDS Considerations

- Interest earned on fixed deposits is taxable as per the investor’s income tax slab

- TDS at 10% applies if total FD interest exceeds Rs. 50,000 for non-senior citizens and Rs. 1,00,000 for senior citizens in a financial year (FY 2025–26)

- Section 80TTB deduction (up to Rs. 50,000) applies only to bank and post-office deposits under the old tax regime, not to NBFC FDs

- Bajaj Finance provides interest certificates to help investors manage tax filing efficiently

Conclusion

A fixed deposit calculator lets you move from broad estimates to precise numbers so your FD plan works in real life. With clear monthly p.a. rates, flexible tenures and multiple non-cumulative payout options, Bajaj Finance FD makes it straightforward to receive predictable income while safeguarding capital. Start by entering your target monthly payout into a fixed deposit calculator, compare senior and non-senior rates, and structure your FD ladder for stability. When done right, this approach delivers a steady, tax-aware and easily managed income stream for Indian savers.