Table of Contents

What Is Forex Money Management?

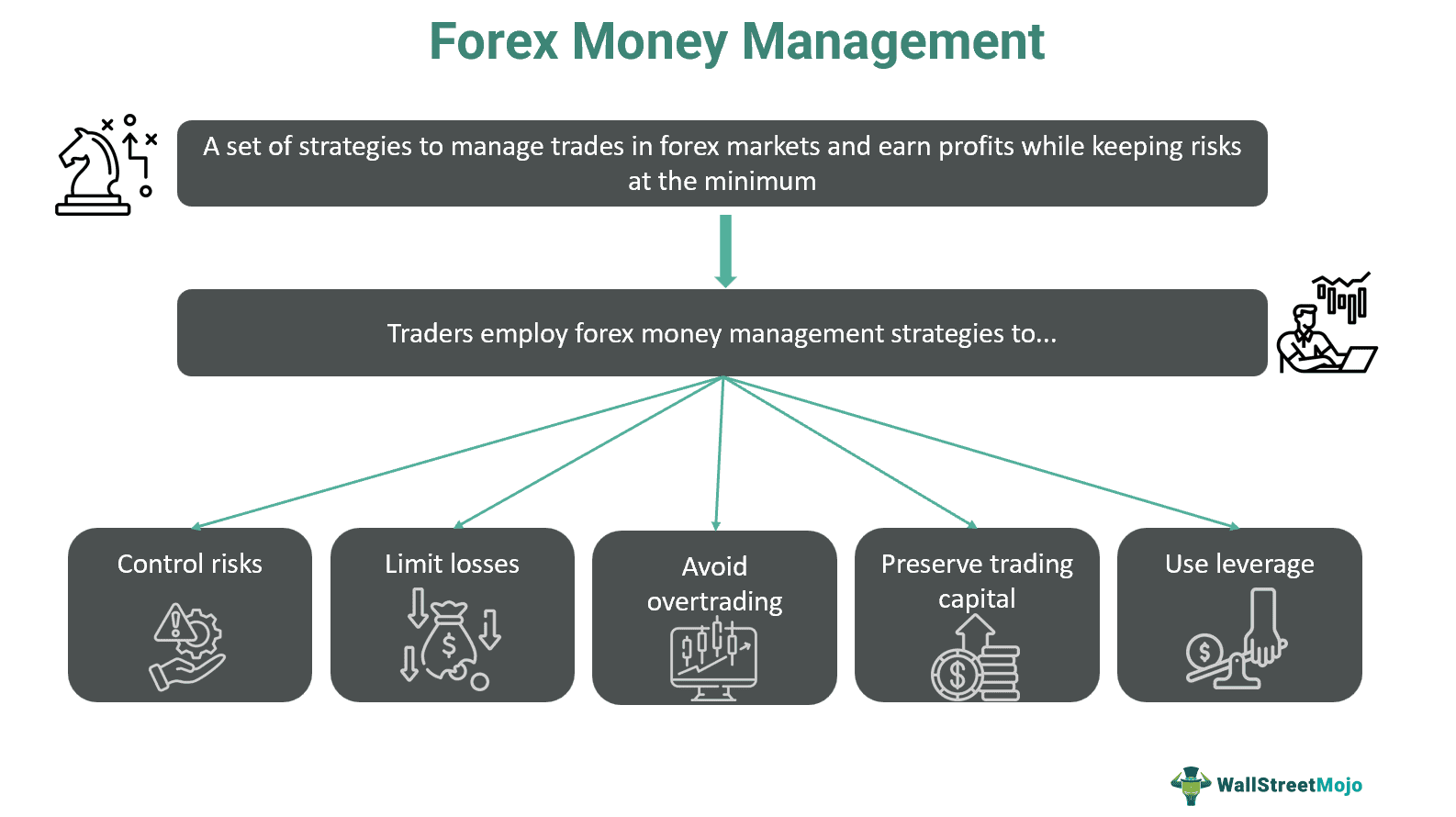

Forex Money Management refers to the methods, techniques, and strategies traders employ to manage their trading funds or capital while trading in the forex market. This function, undertaken as part of risk management, helps traders control risks, minimize losses, and boost long-term profitability. It optimizes the use of financial resources a trader has at their disposal.

A forex money management plan helps traders manage their capital, risk exposure, and the size of trades in forex markets. It serves as a tool to determine trading strategies and the average lot size for trading. It also helps limit losses on trades to ensure adequate funds are available for future trades.

Key Takeaways

- Forex money management refers to the approach used to protect trading capital by controlling risks associated with forex trades and minimizing losses.

- It helps traders effectively use financial resources and not risk all their capital on a single trade. These techniques serve as a tool to limit losses and manage trade positions.

- Popular strategies used in the forex market include issuing stop-loss orders, monitoring reward-risk ratio, avoiding greed and fear, fixing position sizing, and avoiding overtrading.

- Fixed-percentage and martingale strategies are other methods of controlling risks while trading in forex markets.

Forex Money Management Explained

Forex money management is an approach employed by forex traders to limit their risk exposure and maximize profits while trading in forex markets. By adopting certain strategies for specific trading lot sizes, they can minimize their losses over a period. Employing a studied trading approach steered by effective money management enables traders to stay disciplined and facilitates deposit growth.

Through focused risk management, traders can compute the risks associated with forex trades, which could otherwise lead to considerable downturns or account wipeouts in extreme cases. Typically, they abide by certain rules while implementing a money management plan. Some key principles of such money management include risking only a fraction of capital and applying leverage in the forex market to boost their returns on investment.

Leverage means being able to work on a significant trading position/s in the forex market with a relatively lower amount of money. However, leverage must be used with caution, as the risk of incurring losses is high in adverse situations.

Traders can work with a fixed lot size or gradually increase it step-by-step as the deposit amount increases. This is known as the martingale strategy of trading in forex markets. Operating in the forex market with a defined lot size facilitates future trades and enables traders to book profits. However, the chances of losing the entire deposit are high. Another method called the fixed-percentage strategy enables traders to allocate a fixed percentage of their trading capital per trade irrespective of other factors like account size.

To record all their trading activities, traders use a forex money management sheet, also called the trading journal. It shows how a trader handles capital. Such sheets typically include various aspects of trades executed in forex markets, such as trading goals, buy or sell positions, currencies involved, trade duration, risk management strategies, lot size information, transaction outcomes, etc.

10 Best Strategies

Trading currency pairs in the forex market can expose traders to high volatility and potential losses. However, with a proper, well-defined strategy, traders can leverage their portfolios. The following are considered some of the best strategies that may enable traders to maximize their profits.

- Strategy #1 - Determine the amount of risk to be taken: A key rule that most traders follow is to determine the risk level in advance, also called the risk-per-trade technique. It helps traders determine what portion of their account they are risking with each forex trade. The general rule of thumb suggests not to risk more than 2-3% on trades.

- Strategy #2 - Avoid overtrading: Traders should operate with caution to avoid overtrading in the forex market. Not all days are good, and if market conditions are highly volatile, they might incur losses. Overtrading is known to diminish returns due to ill-informed or misguided decisions.

- Strategy #3 - Cut short on losses: Experienced forex traders typically close their losing positions quickly to ensure they do not incur further losses in the hope that the tide will turn in their favor. However, not all traders follow this strategy. By cutting their losses short, traders protect their capital and reduce risk exposure. This practice requires trading discipline and patience.

- Strategy #4 - Use stop-loss orders: In situations where the chances of losses are high, traders can issue stop-loss orders. The purpose of a stop-loss order is to close a position once the price reaches a specific level outlined by a trader. For this, identifying the right price at which such stop-loss orders should be issued is crucial.

- Strategy #5 - Compute reward-risk ratio: Traders should prioritize trades that have a reward-risk ratio of 1 or more. This ensures that the gains (profits) beat the associated risks (losses).

- Strategy #6 - Calculate position size: Using a position sizing strategy can prove fruitful. By fixing a forex money management lot size, traders can match the trades with their risk tolerance levels. For instance, if the risk-per-trade is $200, with a stop loss of $10, the position size is 20 pips per trade. Pips refer to the percentage in point or price interest point, which is the smallest expected price movement at a given exchange rate.

- Strategy #7 - Cautiously trade on leverage: Trading on leverage can be a risky tool to deploy in forex trades. It can help traders earn good profits, but the odds of incurring losses are also significant. Hence, it is important to study the positions well and be cautious when putting leverage to work in forex markets.

- Strategy #8 - Avoid greed and fear: Dodging greed and fear in the hopes of earning more is important. Both greed and fear can lead to losses by hampering decision-making and prompting traders to adopt incorrect trading strategies. The fear of missing out can prove detrimental as it makes people vulnerable to emotions.

- Strategy #9 - Use of trailing stops: In situations where a strong trend is visible, traders can use trailing stops. In a bullish market, the stop loss trails just behind the rising price in order to lock profits. In a bearish market, it stays constant or trails just behind the falling price to safeguard traders against risks and consequent losses. Thus, it protects traders from market fluctuations.

- Strategy #10 - Understand Currency correlations: It is important to understand the correlation between currencies to understand their effects on the market. In this context, currency correlation refers to how different currencies interact with each other. A correlation between -1 and 1 depicts the direction and strength between a currency pair. A correlation number close to 1 signifies a positive correlation, while a negative correlation is seen when the correlation figure moves closer to -1.

Examples

Let us study some examples of forex money management strategies to understand the concept in detail.

Example #1

Suppose Joanna is a trader who frequently trades in the forex market. Since she understands currencies and their interactions, she finds trading convenient. Over the years, Joanna has accumulated around $1 million in profits by deploying forex money management strategies.

Through comprehensive technical, fundamental, and market sentiment analysis, Joanna analyzes and interprets market trends. She identifies lucrative trading opportunities and employs risk management techniques while trading. She limits her risk exposure to 1% of her trading account balance per trade. Due to this, she has set stop-loss orders at 2% below her entry price. Joanna is also a highly practical and focused decision-maker, and she does not allow her emotions to come in the way of trading.

By the end of 2023, Joanna executed a total of 200 trades, and her average profit was $500 per trade. With her wise trading strategies and judicious risk management, Joanna was able to maintain and boost her profitability across all her trades consistently.

Example #2

According to April 2024 data about the interactions between the US Dollar (USD) and the Japanese Yen (JPY), the USD recently reached a rare high against the JPY. The USD-JPY currency pair saw a significant rally, with its value crossing 152, which last happened back in 1990.

Based on this news, let us independently analyze this situation and see what this means for forex traders in the US and how it might impact their forex money management strategies or forex money management plans. The following things may happen or can be expected:

- This change in USD-JPY currency pairing brings both opportunities and challenges for US forex traders. Traders in the US who hold long positions might be able to make significant gains as the value increases, and they time their exits to book profits.

- The change in the USD-JPY interaction also means more volatility, which indicates risk management strategies will need to be adjusted.

- Traders will also be required to monitor relevant interest rates since interest rates play a key role in ascertaining position sizes.

Benefits

In this section, let us discuss the benefits of money management in forex trading.

- Risk reduction: These techniques help minimize risks and potential losses for traders placing trades in forex markets. It insulates traders from extreme market volatility and fluctuations.

- Capital protection: Traders can preserve their capital by controlling risks, placing stop-loss orders, and using leverage to earn profits through effective money management.

- Position sizing: With position sizing, traders can pace themselves while trading and ensure only a reasonable portion of their capital is spent on each trade. Traders can safeguard their capital and future trades through position sizing.

- High return potential: These techniques help market participants achieve consistent returns in the long run. It prevents them from overleveraging and risking their financial resources.

- Effective decision-making: Traders are able to make effective trading decisions by employing this approach.