Table of Contents

Introduction

Finding the best car loan deal feels like hunting for treasure in a crowded marketplace. You know it's out there somewhere, but where do you start looking? With the right approach and some solid knowledge, getting a great auto loan isn't complicated.

You can save thousands over the life of your loan by making smart choices. This guide walks you through everything you need to know about securing the best car loan deal. We cover what matters most to protect your wallet.

Understanding What Makes a Car Loan Deal Great

Not all car loans are created equal. Some deals look attractive on the surface but hide costs that add up fast. You must look at the complete picture to find the best car loan deal for your situation.

The annual percentage rate tells you what borrowing actually costs each year. This number includes the interest rate plus loan fees and other charges. It is the most accurate way to compare costs.

#1 - Interest Rates and How They Impact Your Payments

Lower rates mean you pay less over time. If you borrow $20,000 over five years, a 14% rate results in high monthly payments. Drop that rate to 9% and your costs fall significantly.

That reduction saves you money every single month. These numbers show why shopping around for a low auto loan rate is vital. Even a small percentage difference keeps money in your pocket.

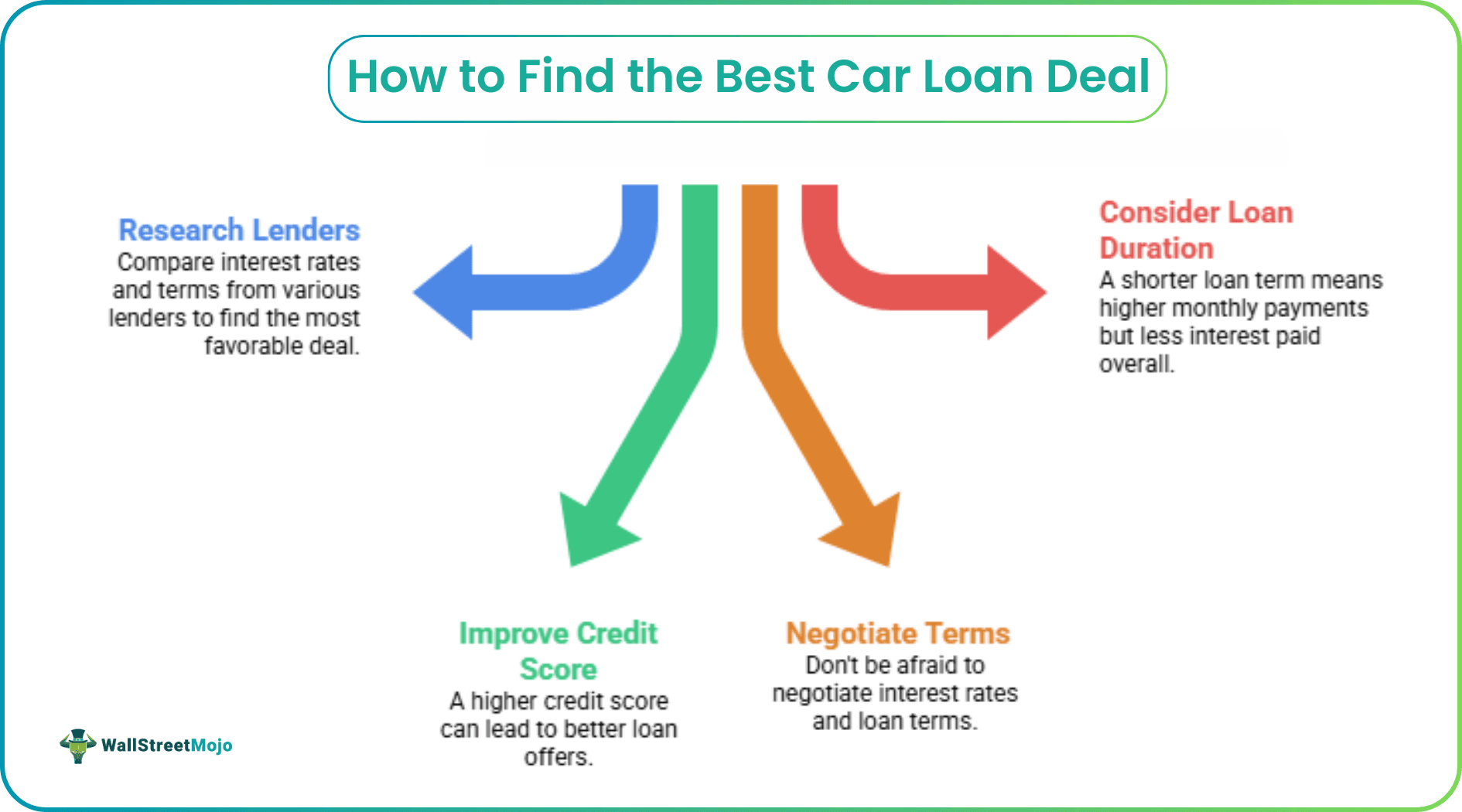

#2 - Loan Terms That Work for Your Budget

The loan term determines how long you will make payments. Most loan terms run between 36 and 72 months. Shorter terms mean higher monthly payments but less interest overall.

Longer terms spread payments out but cost more in total interest. You must balance what you can afford monthly against the total cost. Finding this balance helps maintain your financial health.

#3 - Down Payments and Their Power

Putting more money down upfront reduces what you need to borrow. A bigger down payment lowers your total interest charges significantly. This simple step transforms your car buying experience.

On a $50,000 vehicle, a 20% down payment drops your loan balance immediately. That reduction saves you money throughout the entire loan period. It is one of the fastest ways to improve your deal.

Getting Your Finances Ready for the Best Car Loan Deal

You cannot get a great deal without knowing where you stand financially. This means looking at your income and expenses clearly. You also need to understand how lenders view you.

Start by calculating all your monthly income from every source. Include your salary and any side income. This helps you determine a realistic price range.

#1 - Calculating Your Monthly Budget

Add up everything you earn each month. Then list all your monthly expenses, including rent, food, and credit cards. Be honest about what you actually spend.

Missing expenses throws off your entire budget. You do not want to commit to a payment you cannot make. A clear budget prevents future stress.

#2 - Understanding Your Debt to Income Ratio

Lenders look at your debt to income ratio carefully. This number shows how much of your income goes toward debt payments. You calculate it by dividing monthly debt by gross income.

Most lenders prefer seeing a ratio below 36%. Higher ratios make approval harder. Keeping this number low improves your chances of getting a good loan rate.

#3 - Setting a Realistic Car Payment Budget

Financial advisors often suggest keeping car expenses under 15% of your take-home pay. This includes your loan payment, insurance, and fuel. Your monthly payment is just one part of the total cost.

Using an auto loan calculator helps you figure out what you can afford. Run the numbers before you ever step foot on a lot. This prepares you for negotiations.

Where to Find the Best Car Loan Deal

Different lenders offer different advantages. Knowing where to look saves you time. You have several options for financing your car purchase.

Comparing multiple sources is necessary. Smart borrowers look at banks, credit unions, and online options. Here is a breakdown of where to look. If you are in the process of looking for a car loan visit Auto Finance Direct.

| Lender Type | Pros | Cons |

|---|---|---|

| Credit Unions | Lower rates, member-focused service. | Requires membership eligibility. |

| Traditional Banks | Convenient if you already bank there. | Rates may be higher than credit unions. |

| Online Lenders | Fast pre-approval, easy comparison. | Less personal interaction. |

| Dealership Financing | One-stop shopping convenience. | Often have higher markups on rates. |

#1 - Dealership Financing Options

Many dealerships offer financing directly through their office. This is convenient since you handle everything in one place. However, convenience often comes at a price.

Dealership rates can be higher than what you might find elsewhere. Always compare dealer offers against other lenders. Sometimes they offer 0% financing which beats everyone else.

#2 - Banks and Credit Unions

Traditional financial institutions often provide competitive rates. A credit union like Navy Federal often offers excellent deals to members. Their goal is serving members rather than maximizing profit.

Truist Bank and other major banks also compete for auto loans. Getting pre-approved at your bank gives you negotiating power. You shop as a cash buyer at that point.

#3 - Online Lenders and Buying Services

Online lenders have changed the game with quick approvals. A car buying service can also help you find financing. These platforms often provide a streamlined mobile app for managing your loan.

The digital lending landscape offers many borrower-friendly options. You can upload documents

Specialized Loans for Modern Vehicles

The type of car you buy impacts your loan options. Lenders are increasingly supporting green energy. You might find specific rates for a plug-in hybrid or electric vehicle.

Some institutions offer rate discounts for eco-friendly cars. This encourages the purchase of a vehicle loan for green cars. Check if your lender offers these specific incentives.

Always ask about discounts for setting up an autopay discount. Many lenders drop your rate by 0.25% or 0.50% for automatic payments. Every little bit helps lower the annual percentage cost.

How Your Credit Score Affects Your Deal

Your credit score is your financial report card. Lenders use it to decide what rates to offer you. Higher scores unlock better rates and terms.

Lower scores mean you will pay more to borrow money. Understanding this relationship helps you manage expectations. It also shows where to focus your efforts.

#1 - What Credit Score Range You Need

Borrowers with excellent credit get the best terms available. Those with lower scores might face significantly higher rates. Even a small improvement helps.

Checking your credit before applying makes sense. You do not want surprises when you apply. Know your score so you can fight for the rate you deserve.

#2 - Improving Your Score Before Applying

Review your credit history for errors and dispute mistakes. Pay down existing credit cards to lower your utilization. Lenders like to see that you manage debt well.

Avoid applying for new credit cards right before shopping for a car. Each application can temporarily lower your score. Keep your credit profile stable during this time.

The Power of Pre-Approval

Getting pre-approved changes the entire car buying experience. You know exactly what you can afford. It puts you in control during negotiations.

Pre-approval tells you your maximum loan amount and interest rate. You avoid falling in love with a car you cannot afford. It also speeds up the process at the dealership.

Completing the Online Application

Most lenders offer an online application that takes minutes. You will need to provide your zip code and social security number. They may ask for your bank routing number for funding verification.

Pay attention to every checkbox label on the digital form. Sometimes a confusing checkbox label label error appears on older sites, so read carefully. Double-check that you select the correct loan type.

The lender performs a soft credit check in many cases. Within minutes, you know your status. This gives you time to shop for the perfect vehicle.

Smart Money Strategies for Borrowers

Taking out a loan impacts your broader financial picture. You need to balance this debt with your investing strategy. Do not drain your emergency fund for a down payment.

Consulting financial advisors can help you understand how a car loan fits your goals. They provide personalized guidance to help you navigate challenges. This is especially true if you are simplifying investing—for beginners.

Investment Considerations

Some people use smart money strategies to offset loan costs. If your loan rate is low, you might keep cash in high-yield accounts. This is a common tactic for those using self-directed tools.

True strategies for wealth involve managing both assets and liabilities. You want to be a confident investor while handling car debt. Digital investor's automated platforms make it easier to track net worth.

Consider your earnings –the goal is to keep them growing. Don't let a high monthly payment stifle your ability to invest. Use money strategies investments to keep your future secure.

Payment Processing and Security

When you choose a lender, consider how they handle your money. You want a trusted partner that can process payments securely. Security is paramount in the digital age.

Systems powered by companies like Global Payments process payments securely for many institutions. You want to make sure your lender uses robust technology. Look for portals that allow you to process payments quickly.

Whether it is global payments process payments or local transfers, safety matters. A good lender provides a secure portal for managing your account. This ensures your data stays safe every time you log in.

Negotiating the Best Car Loan Deal

Even with pre-approval, you can negotiate better terms. Lenders expect some discussion. Do not be afraid to ask for a lower rate.

Lenders want your business and will often compete for it. Use competing offers as leverage. Mentioning a lower rate from another bank often prompts a match.

#1 - Timing Your Purchase Right

The end of the month or year is a great time to buy. Dealers and lenders have quotas to hit. They are often more willing to offer deals.

New model year releases also create opportunities. Dealers need to clear out previous inventory. This gives you leverage simply because of when you shop.

#2 - Understanding Fees

Look beyond the rate to understand all fees. Some lenders charge for early repayment or administration. These add up over the life of your loan.

Ask for a complete breakdown before signing. Hidden costs turn a good rate into an average deal. Transparency is key to a good transaction.

Avoiding Common Car Loan Mistakes

Even smart people make mistakes when financing cars. Avoiding these protects you from costly errors. A little awareness goes a long way.

#1 - Focusing Only on Monthly Payments

Car Dealers love when buyers only care about the monthly payment. They can extend the loan term to lower the payment while increasing interest. Always consider the total amount paid.

A 72-month loan costs significantly more than a 48-month loan. Ask what the total cost over the loan's life will be. This reveals the true cost of the deal.

#2 - Borrowing More Than Necessary

Just because you qualify for a maximum minimum loan amount doesn't mean you should take it. Stick to borrowing only what you need. Extra debt burdens your monthly budget.

Avoid adding extras you do not need. Keep your loan amount as low as possible. This strategy saves you money and reduces financial stress.

Refinancing Your Existing Car Loan

If you already have a loan, you aren't stuck with it. Auto refinance options are widely available. Refinancing means replacing your current loan with a new one.

If rates have dropped, a refinance loan can lower your payment. A better credit score also qualifies you for better auto loan rates. It is worth checking your options periodically.

Compare the percentage rate of your current loan against new offers. If you can drop your rate by 1% or more, it usually makes sense. This is a simple way to free up monthly cash.