How An Income Tax Calculator May Support Better Financial Planning

Table of Contents

Introduction

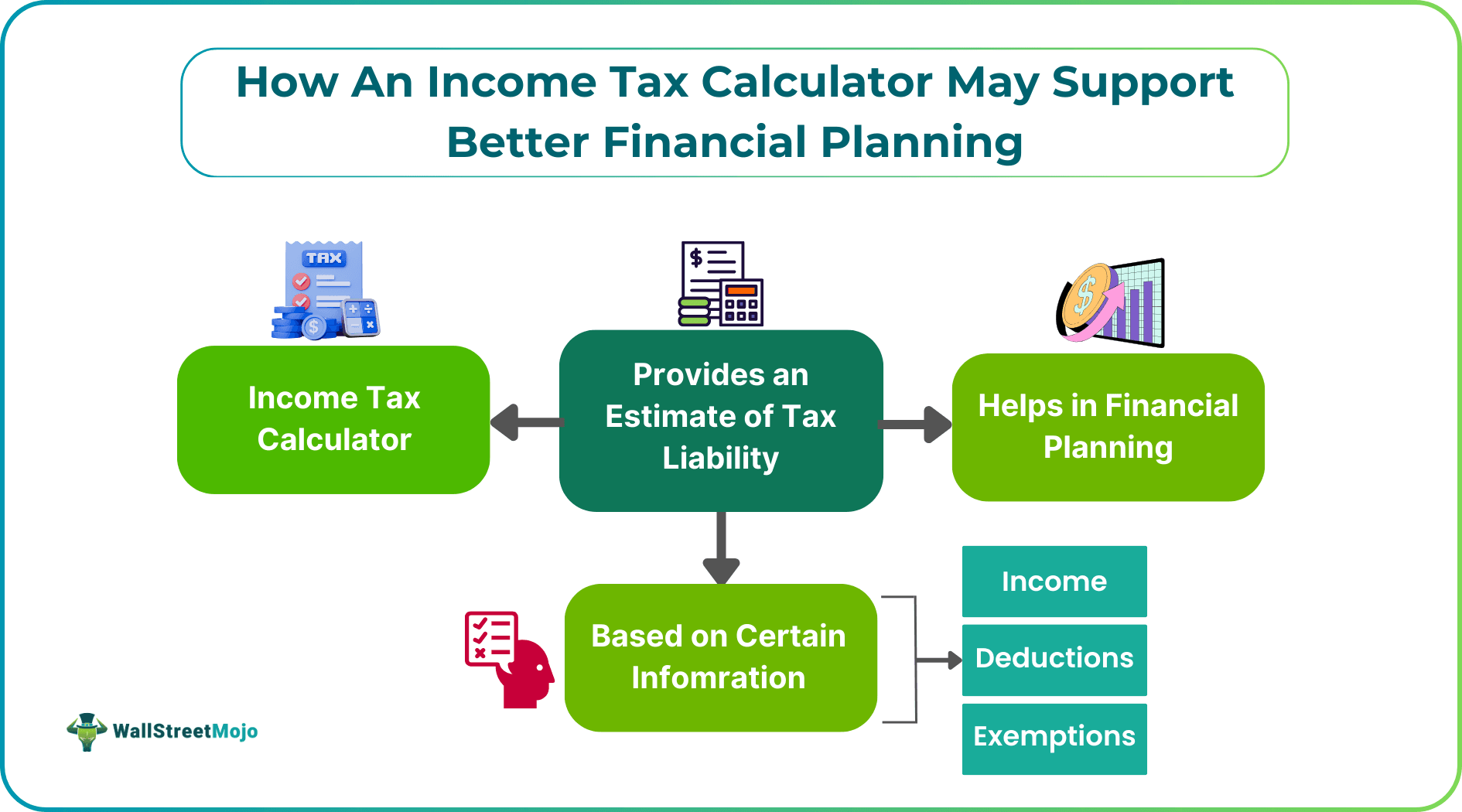

An income tax calculator may help you estimate your potential tax liability for the financial year based on your income, deductions and applicable tax regime. As tax rules evolve and individuals explore different ways to structure their finances, having a reliable estimate may support informed decision-making without relying on guesswork.

You may find that using an income tax calculator is particularly helpful at the start of a financial year or when you are reviewing your salary structure, expected deductions or investment-related commitments. This may also help you plan your cash flows more effectively and assess whether your long-term allocation needs any adjustments.

The calculator is an aid, not a prediction tool. It may provide only an indicative picture.

How An Income Tax Calculator Works

An income tax calculator generally asks for details such as your income, applicable exemptions, deductions and the tax regime you prefer. Once these inputs are added, it estimates the tax payable for the year.

The calculator is an aid, not a prediction tool. It may provide only an indicative picture.

While using an income tax calculator, you may review how different choices influence your tax outcome. For instance, deductions under sections such as 80C, 80D or interest on home loans may reduce your taxable income. By comparing the old and new tax regimes, you may understand which aligns more suitably with your circumstances. This exercise may be useful if your income structure includes components such as bonuses, allowances or variable pay.

Why Reviewing Taxes Periodically May Help

Tax planning is not just an annual activity. Throughout the year, changes in your income, deductions, job role or investment behaviour may influence your final tax outcome. Using an income tax calculator at different points may help you understand whether your projected tax liability has shifted and whether you may need to make adjustments.

This periodic review may reduce the likelihood of unexpected tax outflows at the end of the year. It may also help you prepare documentation early and understand whether your contributions toward eligible deductions remain suitable for your goals.

Key Factors that Influence Your Tax Liability

Several elements determine the outcome shown by an income tax calculator. Reviewing these may help you interpret the results more effectively.

#1 - Income Atructure

Your taxable income depends on salary components such as basic pay, allowances and perquisites. Some components may be fully taxable, while others may offer partial exemptions.

#2 - Deductions and Exemptions

Deductions under different sections may lower taxable income. Examples include contributions to eligible instruments, medical insurance premiums or specific types of interest payments. You may review these options based on suitability rather than solely for tax reduction.

#3 - Choice of Tax Eegime

The difference between the old and new regimes may influence which approach is more suitable. The old regime offers deductions and exemptions, while the new regime provides simplified slabs with limited deductions.

#4 - Additional Income

Income from interest, rent or capital gains may add to your tax liability. Using an income tax calculator that includes these fields may help you estimate the total impact.

The calculator is an aid, not a prediction tool. It may provide only an indicative picture.

How An Income Tax Calculator May Help You Plan Ahead

A structured estimate of your tax liability may support better resource allocation throughout the year. Some individuals use this information to assess how much they may set aside toward long-term planning, while others use it to review their monthly spending pattern. Understanding your expected tax outflow may give you a more realistic view of your disposable income, which may influence how you plan your financial decisions.

For those who prefer a disciplined approach, an income tax calculator may offer clarity on how much flexibility they have for additional planning choices. The calculator is an aid, not a prediction tool. It may provide only an indicative picture.

Using Tax Estimation to Refine Your Investment Approach

Once you understand your expected tax liability, you may review how your broader financial plan aligns with your goals. Some individuals use this clarity to decide how they wish to allocate surplus income across different planning routes. At this stage, some may also evaluate whether they want to invest in SIP as part of their long-term planning approach, depending on suitability and comfort.

Conclusion

An income tax calculator may support you in maintaining a structured and informed approach to financial planning. By estimating your potential tax liability, reviewing deductions and assessing the impact of income changes, you may gain a better understanding of how to plan your cash flows for the year. While the calculator provides only an indicative estimate, it may still help you evaluate choices with greater clarity and align your planning with your overall financial priorities. Reviewing these projections periodically may help you stay prepared and make decisions that suit your long-term outlook.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.