Enroll in our M&A online course to receive training and multiple benefits in return. Get unlimited access to the M&A integration training modules for one year. Plus, watch these modules anywhere, anytime, with just one login. Also, with the case study on AlphaTech and others, upgrade your skills and industry knowledge on the concept and its relevant application. Nonetheless, you also receive a certificate of completion that further enhances your career opportunities in this field!

Mergers and Acquisitions Modeling Course!!

Build models with our Mergers and Acquisitions course | Learn to forecast future financials before recommending an M&A deal to clients | Sign up NOW!FLASH SALE!

Claim Your 60% + 20% OFF

FLASH SALE is here, and your chance to upskill has never been better.

💰 Get 60% +20% off (WSM20)

📈 Master financial modeling skills with expert-led training.

🕒 Learn anytime, anywhere, and boost your career prospects without breaking the bank.

🔥 Hurry - this FLASH SALE is live for a limited time only.

HIGHLIGHTS OF THE MERGERS AND ACQUISITIONS MODELING COURSE

Key Features & Highlights

365 Days Unlimited Access

365 Days Unlimited Access : Learn at your own pace with one-year access to course materials6+ Hours of Video Tutorials

6+ Hours of Video Tutorials : Self-paced learning with pre-recorded expert-led modulesDownloadable Excel Templates

Downloadable Excel Templates : Get hands-on with industry-standard M&A modelsCertification of Completion

Certification of Completion : Earn a recognized certificate to boost your careerCareer Enhancement

Career Enhancement : Develop expertise in M&A modeling and financial analysisExcel & Real-World Applications

Excel & Real-World Applications : Master Excel for building accurate M&A financial modelsHURRY UP!

Unlock Premium Course Benefits Worth $499+!

Expert-Led Training

Expert-Led Training : Learn from an ex-JPMorgan, CLSA Equity Analyst with 20+ years of experienceSynergies & Accretion/Dilution Analysis

Synergies & Accretion/Dilution Analysis : Master deal-making strategiesSensitivity Analysis

Sensitivity Analysis : Evaluate different deal scenarios with advanced modeling techniquesProforma Financials & Valuation Techniques

Proforma Financials & Valuation Techniques : Learn the key M&A valuation methodsExclusive Email & Chat Support

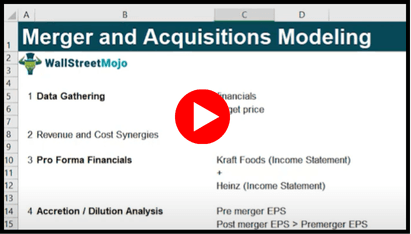

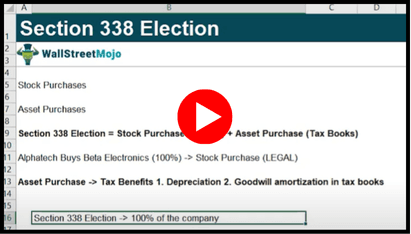

Exclusive Email & Chat Support : Get answers to your queries from industry professionalsMERGERS AND ACQUISITIONS MODELING COURSE PREVIEW

Sample Videos

PURSUE YOUR DREAM CAREER

Top Companies That Hire Professionals With Financial Modeling Skills

COURSE INSTRUCTOR

Learn Directly From The Industry Expert!

Dheeraj Vaidya, CFA, FRM is the Co-Founder & Course Director of WallStreetMojo.

With an extensive background as a former J.P.Morgan and CLSA Equity Analyst, Dheeraj brings expertise in financial modeling, forecasting, and valuations. Over the course of his nearly two-decade career, he has trained and mentored more than 100,000 students and professionals across various topics, including investment banking, private equity, accounting, and more.

SKILLS COVERED

What Will You Learn?

Take the leap and acquire the skills required to value companies for Mergers and Acquisitions with our M&A online course. Understand the financial items in the company statements and learn to model their prospects. Learn the accounting method to value assets before making a purchase. Nonetheless, delve into the ocean of synergies related to revenues and costs.

Furthermore, acquire skills to perform sensitivity analysis to be able to find the firm's true value. Develop an understanding of the market value of similar firms in the industry and check where a firm stands. Also, gain analytical and presentation skills, which further help in communicating the details to the stakeholders. With a strategic mindset, make informed investment decisions on vital projects or provide better recommendations to your clients on major transaction deals.

BENEFITS AND FEATURES

Benefits & Features of the Course

Here are some of the exclusive benefits you will receive on completion of our certification course on Mergers and Acquisitions Modeling.

#1 - Expertise:

Become an expert in analyzing companies to figure out if they are apt for Mergers and Acquisitions. With our M&A integration training program, learn to analyze which company is worth buying or selling. Also, you gain expertise in identifying the appropriate investments and evaluating the company’s real value.

#2 - Skills Development:

Transform your professional life and persona with the modeling skills earned with mergers & acquisitions online courses. Develop your ability to analyze the cash flows to value companies for mergers in general. This Mergers and Acquisitions training course brings a new source of confidence within you when it comes to building models for M&A analysis and valuation.

#3 - Real-Time Application:

With the real-world examples and case studies provided, witness a practical application of the concept in the industry and your corporate life. Nonetheless, you also learn about the popular Excel tricks, themes, and formulas to speed up your modeling work.

#4 - Career Enhancement:

Boost your career with this ground-level learning experience in valuing companies for Mergers and Acquisitions. With the knowledge received, you can soon practically include the concepts in your daily routine and assess companies . In addition, you can also apply for M&A jobs and open your doors to different career opportunities available in the business and finance sector.

#5 - Email & Chat Support:

After you enroll in the course, you can get course-related support via email as well as chat. Our team will ensure that all your queries are resolved as quickly as possible.

QUICK FACTS

Industry Trend

PROGRAM OVERVIEW

Course Description

As popularly stated by famous investment banker Roger Altman, “Mergers generate substantial synergies.” This means, to a greater extent, detecting the right M&A firms can create a positive synergy for the firm. On the other hand, if the same goes wrong, it will be yet another bad investment. To avoid this, knowing and understanding about Mergers and Acquisitions modeling becomes important.

In this online certificate course in Mergers and Acquisitions Modeling, learn how to build models to predict a company's performance before indulging in M&A.

Delve into the world of M&A and find the popular mergers and acquisitions that have happened in the past. Additionally, the case studies are to dive deep to understand the concept in a better way. Not only that, you also learn the financials required to perform the entire modeling process in Excel.

ROLES FOR FINANCE

Careers With Investment Banking Skills

#1 - Financial Analyst:

A financial analyst is a finance professional involved in creating financial models and forecasting financial statements of companies. They make certain assumptions to determine the future performance of a company. Usually, they are hired more by well-known companies like JPMorgan Chase, WellFargo, Amazon, Deloitte, and similar others. For the job role offered, the analyst receives around $61,037 to $73,682 (as of July 29, 2024) annually, depending on the seniority level .

#2 - Equity Research Analyst:

These professionals analyze financial information along with the different trends of the different organizations and industries and then give their opinion in the equity research report based on the analysis conducted. This verdict helps clients with making investment decisions and cracking transaction deals. Some of the popular hiring companies include Goldman Sachs, MorningStar, Barclays, Crisil, and others. They earn around $96,899 to $126,711 (as of July 29, 2024) per year, plus some additional benefits.

#3 - Investment Banker:

These investment banking analysts have a similar job role as equity analysts. They mostly work with investment banking firms. Their role is to prepare financial models, perform financial analyses of companies relatively, and advise clients on buy or sell decisions. Additionally, they prepare pitchbooks for client meetings, including M&A and LBO pitchbooks as well.

Here, large investment banks like CitiGroup, JP Morgan Chase, HSBC, Credit Suisse, and others hire them with a salary ranging between $68,047 and $93,388 recorded as of July 29, 2024.

#4 - Private Equity Analyst:

It is just a sub-category of equity analysts that is more concerned with private firms. It means analysts here conduct research, forecast the performance of private firms (not listed on the stock exchange), do ratio analysis, and give interpretations on private companies. They are mostly hired by Goldman Sachs, Blackstone, General Atlantic, and other private equity firms. The average salary range is between $83,488 and $109,159 on an annual basis per data collected until July 29, 2024 .

#5 - Merger and Acquisition Analyst:

M&A analysts are responsible for overseeing the execution of transaction deals (regarding buying and selling of companies). They assist in merger or takeover while negotiating and completing the deal on the client’s behalf. Mostly, investment banks like Goldman Sachs, Morgan Stanley, JPMorgan Chase 7 Co., HSBC, Barclays, etc., hire them. These analysts receive an annual compensation of $79,500 to $103,670 per records until July 29, 2024 for their position.

Got questions?

Still have a question? Get in Touch with our Experts

WHAT WILL YOU GAIN IN THIS COURSE?

Course Curriculum

Introduction

Case Study

Data Gathering

Synergies

Decipher the best deals for Mergers and Acquisitions with our M&A certification online. It covers topics that provide a step-by-step approach to the financial modeling of firms involved in M&A. Learn to gather relevant data for modeling and make assumptions for the same. Additionally, have a conceptual understanding of the topic and have learned M&A through various case studies. Nonetheless, gain insights on concepts like synergies, proforma financials, and purchase methods of accounting as well.

Along with the topics mentioned above, our merger and acquisition certification course also covers accretion and dilution analysis. Understand whether your company’s EPS will increase or decrease post-transaction deal. Learn to decode breakeven synergies and also how to maintain investment grade for credit. Lastly, delve into sensitivity analysis and asset purchase to make investment decisions with our M&A certificate programs.

CERTIFICATION

Earn a certificate on completion of this course

Complete all modules and related exercises to get one step closer to receiving a certificate on completion of our best Financial Modeling And Valuation course bundle. It evidences your knowledge gained on the subject matter of M&A modeling and similar concepts. Also, you will gain unlimited access to the course content, Excel templates, and other resources with 1-year validity.

For any further information or queries, feel free to contact us by writing to us at support@wallstreetmojo.com and get them resolved. Become the next financial modeler or valuation analyst and chase your aspirations today. Enroll now!

BUNDLE COURSES

Discover the benefits that Bundle courses bring to your learning journey.

Skill Diversification

Flexibility to Learn

Comprehensive Curriculum

No Major Prerequisites

Cost Savings

Benefit from flexible learning and gain comprehensive skills with an online certification bundle, offering a cost-effective way to boost your career credentials. Enjoy access to diverse, expert-led courses and valuable resources anytime, anywhere.

WHAT SHOULD YOU KNOW?

Prerequisites For Mergers and Acquisitions Modeling Course

At WallStreetMojo, make your learning easy with our mergers & acquisitions classes that come with some eligibility criteria. Having basic financial knowledge of financial state

- Basic understanding of financial statements, accounting principles, key ratios, and related concepts

- Familiarity with financial markets and company-related information

- A device to access the courses

- Good, stable internet connection

- Access to Microsoft Excel or trading platforms like TradingView