Investment Options in the UAE: Stocks, Real Estate, Gold, and ETFs Compared

Table of Contents

Introduction

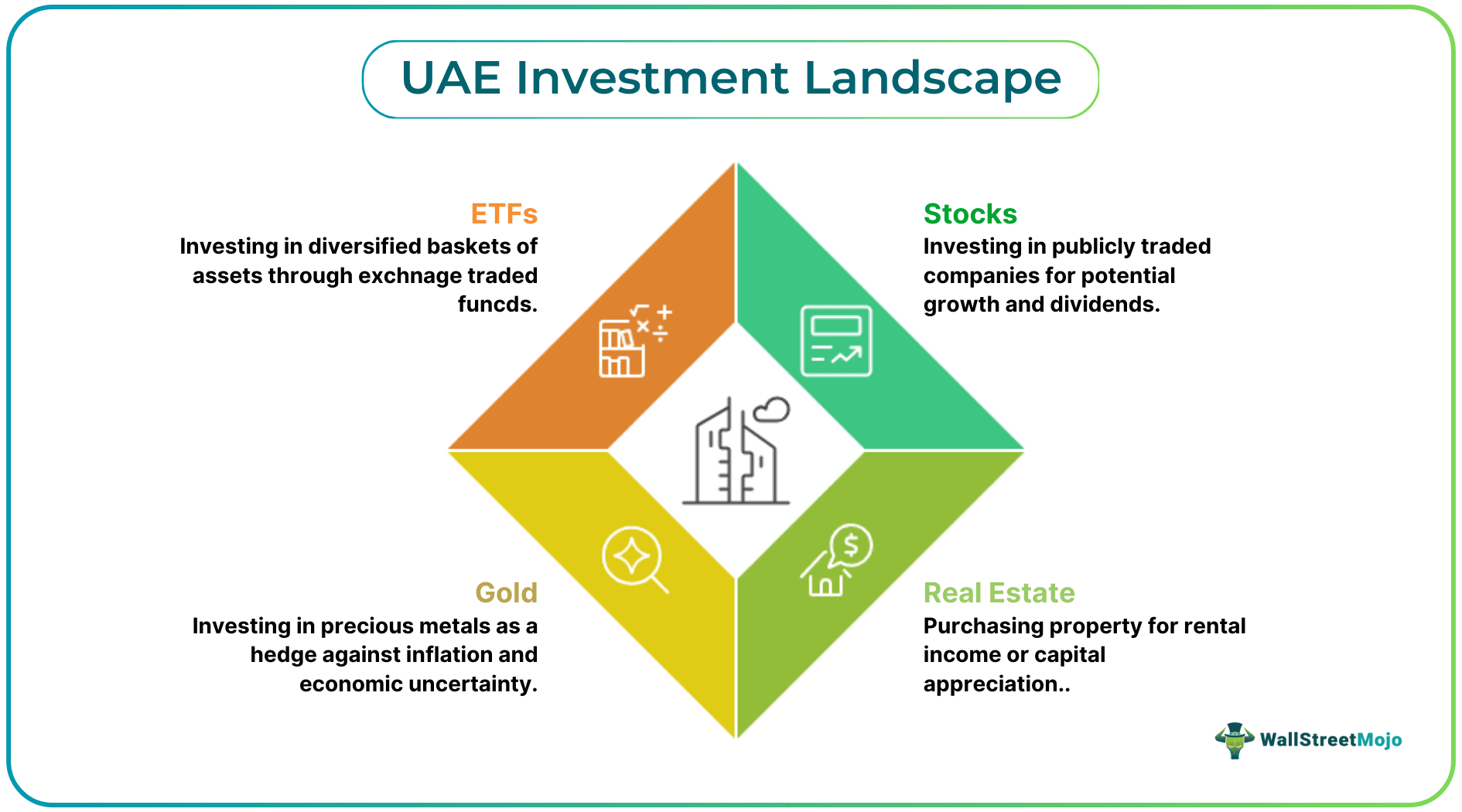

The UAE is a major global financial hub offering diverse investment opportunities for residents, expatriates, and international investors. The country’s unique tax environment, access to global markets, and opportunities for freehold land make it attractive for portfolio diversification. Investors most commonly choose between stocks, real estate, gold, and ETFs, depending on their overall investment strategy. Here’s a look at the four most popular investments, followed by a brief look at how UAE investors choose what goes in their portfolio.

UAE Stock Market Investors

Stock market investors in the UAE have a range of options available to them. They can choose the two local exchanges or invest internationally via brokers. Like investors worldwide, they still choose stocks based on sector exposures and risk profiles.

#1 - Local and International Stock Market Access

There are two stock markets in the UAE: the Dubai Financial Market (DFM) and the Abu Dhabi Securities Exchange (ADX). Both exchanges experienced growth in 2024; the ADX in particular hit record highs, driven by oil sector strength and economic diversification initiatives. In 2024, their combined market cap reached AED 3.905 trillion (over US $1 trillion). The largest company listed on the UAE stock exchanges is the International Holding Company (IHC), which has an AED 912 billion market cap—that’s 25% of the entire UAE market cap.

While most other international indexes are available in the UAE via brokers, the S&P 500 (SPX) and the NASDAQ (IXIC) in the US are the most popular. UAE residents are attracted to US tech giants (Apple, Tesla, and Amazon) and benefit from the USD-pegged dirham. Due to Shariah-compliant assets, political stability, and diverse property opportunities, the London Stock Exchange (FTSE) is the next most popular.

#2 - Sector Exposure and Risk Profiles

Stock market investors globally, including in the UAE, take opposing views. Some conservative investors choose blue-chip and steadily growing stocks in industries like finance and energy because they’re traditionally stable and pay dividends. Then you have investors who favor tech stocks, which have more volatility but can result in high returns.

Sector stocks change due to cycles; for example, energy stocks are tied to oil prices, real estate to interest rates, and banking to lending growth. Significant fluctuations in any of these areas are reflected in the stock price immediately. The key to a better-performing portfolio is to diversify across many different sectors to create a more balanced investment spread. Keep the high-risk ones to a minimum, though, as issues such as regulatory changes can have a massive impact, like the next example.

#3 - Gambling-Related Stocks as a Heavily Regulated Option

Gambling stocks trade on major exchanges and can generate strong revenues, but this industry is heavily regulated, so geographic restrictions, social policies, and regulatory changes can significantly impact these stocks.

An example here is Entain, the owner of Ladbrokes, Coral, bwin, and PartyPoker. It’s listed on the FTSE and in September 2021 reached its all-time peak of £25.00 per share. In August 2022, the company faced regulatory issues, which resulted in it paying £17 million to the UK Gambling Commission for anti-money laundering failure. Its stock plummeted to £13.56, the largest drop on the entire exchange that day. Ongoing regulatory checks and investigations from Australia and the Netherlands caused a further lack of confidence with investors, and by April 2025, the stock had settled at £4.53, an 80% drop from its peak almost four years earlier. This is just one example of how stocks in a heavily regulated industry like iGaming can be a risky investment. Reading up on industry experts like EmiratesCasino is recommended before investing.

Real Estate Investment in the UAE

A popular long-term investment in the UAE is property. Locals get government assistance if required, and foreigners can outright own land in dedicated freehold zones. However, investors should be aware of several considerations.

#1 - Real Estate Opportunities for Locals

The UAE has a booming real estate ecosystem. Residents can buy property across the seven Emirates, not just in their own. There are government housing opportunities like the Sheikh Zayed Housing Programme, which are grants or interest-free loans, or other federal housing assistance programs. Property investment in the UAE is viewed as long-term, benefiting the family into the future.

#2 - Freehold Zones and Foreign Ownership

Real estate investment in the UAE isn’t just for locals. The country has designated freehold zones where foreigners can own land outright. The most popular are in Dubai: Dubai Marina, Downtown Dubai, and the Palm Jumeirah. In Abu Dhabi, there are the Al Reem, Saadiyat, and Yas Islands, and in Ras Al Khaimah, there’s Al Hamra Village.

Already, being able to buy land in a foreign country outright is a huge incentive, and there are other benefits. There is no property tax on purchase, capital gains tax on disposal, or inheritance tax if passed on to future generations. There are also visa opportunities. For example, if you buy a property worth AED 750,000+ (about US $204,000), you get a renewable residence visa for you and your family. Even better, properties over AED 2 million can qualify you for the 10-year Golden Visa.

#3 - Liquidity, Costs, and Market Cycles

Real estate holdings in the UAE are best viewed as long-term investments typically requiring multi-year holding periods to realize significant returns. When trying to dispose of them, investors discover they’re not as liquid as stocks. Even though there are no property taxes, there are registration fees, and on top of that, there are agent commissions, which could be anywhere from 2-5% of the purchase price.

Like most global real estate investments, UAE property is cyclical. In 2020, there was a dip in sales, but since then, the market has recovered. Some of the challenges in the industry are the oversupply risks in certain segments and the intense rental market competition; high vacancy rates in certain areas mean finding tenants isn’t guaranteed, and properties can sit empty.

Gold and ETFs as Investment Options

UAE investors benefit from a spread of options; two other considerations are gold and ETFs.

#1 - Why Gold Appeals to UAE Investors

The UAE is one of the world’s largest gold markets. Gold features prominently in architecture, cultural events like weddings, and as gifts. Investors treat gold as a tool for wealth preservation over something that provides high returns.

Gold can be purchased in several ways. Physically, it can be sourced in the form of bars, coins, and jewelry. The primary challenge with the physical options is that secure storage is required, especially for large bars. The alternative is to invest in digital options such as gold ETFs and online platforms. These eliminate storage concerns and allow buying or selling with a few clicks.

#2 - ETF Options in the UAE

Exchange-traded funds (ETFs) are baskets of stocks or bonds that are traded as if they were single stocks but provide instant diversification. The ADX is the most active and liquid ETF market in MENA, making these baskets of stocks extremely accessible to all traders. The most popular types are global equity, Shariah-compliant, and commodity ETFs. They’re popular with all levels of investors, but especially those new to the market, as they’re low-cost and their concept of simple diversification negates the need to pick individual stocks.

Portfolio diversification, where a portfolio contains different asset classes like stocks, property, gold, and ETFs, is one of the most effective ways to minimize risk and achieve more consistent returns.

How to Choose the Right UAE Investment

When choosing where to put their money, investors should consider their priorities. If they’re looking for something that, despite its higher risk, may pay significant dividends and can be quickly liquidated if needed, stocks and ETFs are their preferred choice. If investing for the long term is the priority, then property generally makes up the lion’s share of the portfolio. Finally, if conservative, steady, and stable yet low growth is preferred, gold investment makes sense. The key to successful investment in the UAE, as recommended by most brokers, is to choose a spread of stocks, property, gold, and ETFs.