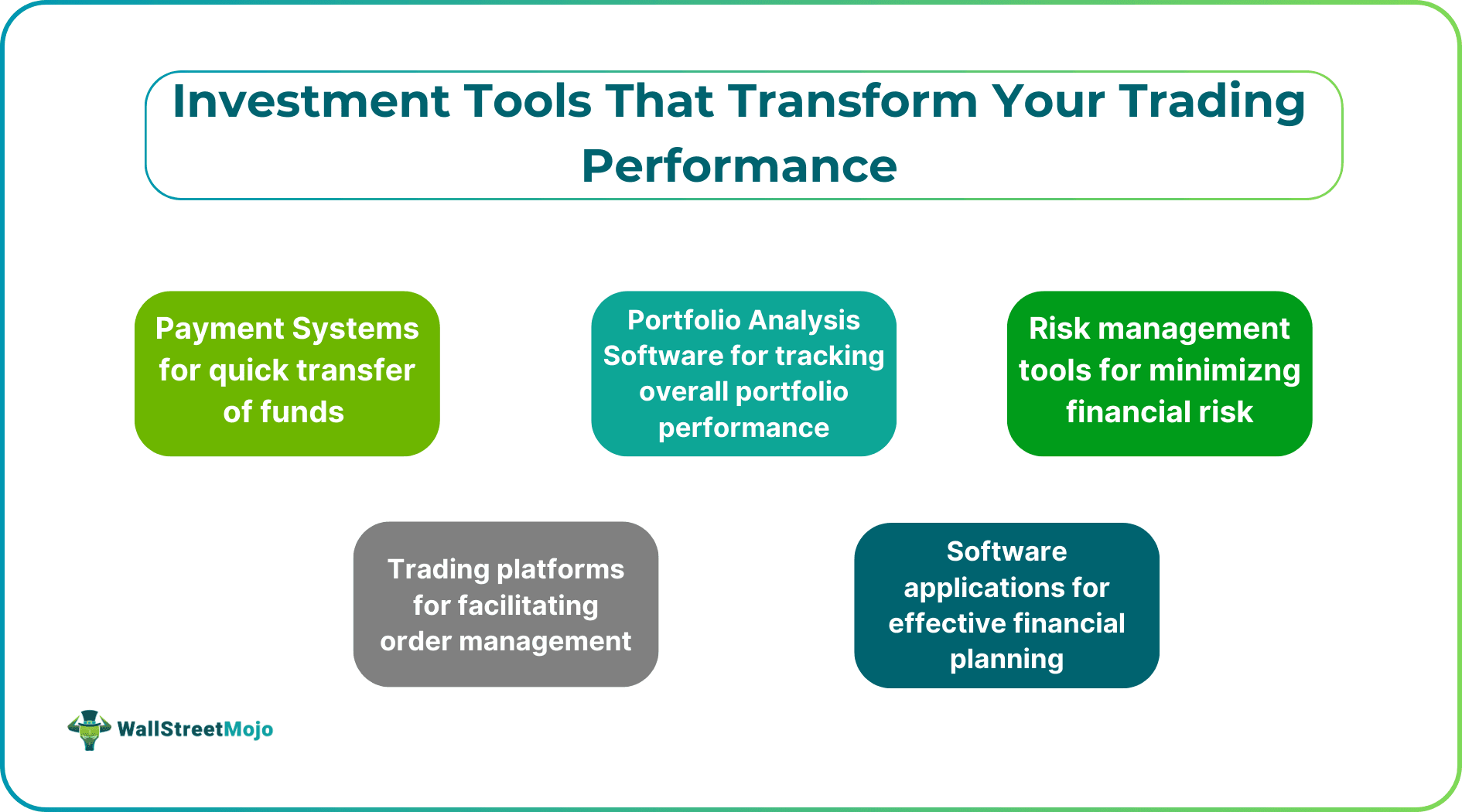

Investment Tools That Transform Your Trading Performance

Table of Contents

Introduction

Investors need to build on more than just luck or instincts in order to build wealth. Effective investors use certain tools to compute data, risk management, and trades. The choice of tools you will use may mean the difference between a steady income and expensive errors.

https://www.freepik.com/free-ai-image/financial-growth-presentation_420472865.htm

Payment Systems for Quick Account Funding

Getting money into your investment account fast matters. Traditional bank transfers take days, costing opportunities when markets move quickly. PayID technology represents one of the best solutions for Australian investors, enabling instant transfers using just a mobile number or email address.

Say the ASX drops 5% overnight, and you want to buy quality stocks at lower prices. With regular bank transfers, your funds arrive three days later when prices have recovered. PayID moves money instantly, letting you act on opportunities.

Beyond investment accounts, PayID has gained popularity across Australia's digital economy. The payment method works seamlessly with various online platforms, from everyday payments to entertainment activities. Australians use PayID for online casinos and gaming, as shown in this PayID pokies list. Mark Hoover states that the payment option is popular among iGamers due to its fast transaction speed, bank-grade security, and the overall quality gaming experience it provides. It's equally popular for splitting restaurant bills with friends, completing Facebook Marketplace purchases, and buying items on Gumtree.

The instant settlement feature becomes particularly valuable during volatile periods when timing determines whether you capture profitable trades or miss them entirely.

Portfolio Analysis Software

Tracking individual stock prices doesn't tell you much about your overall investment performance. Real portfolio analysis means understanding your asset allocation, sector exposure, and how different investments work together.

Quality portfolio tools calculate your actual returns, including dividends, fees, and taxes. They show whether you're overweight in certain sectors or companies without realizing it. Many investors think they're diversified when they actually own multiple technology stocks across different funds.

These platforms also measure the correlation between your holdings. During market crashes, seemingly unrelated investments often fall together, destroying the diversification you thought you had. Good analysis tools warn you about these hidden connections before they hurt you.

Rebalancing features suggest specific trades to maintain your target allocation. When one asset class outperforms others, the software shows exactly what to buy or sell to restore balance.

Effective diversification now requires balancing traditional risk measures with environmental factors, as many institutional investors discovered their portfolios were more concentrated than expected.

Research and Screening Platforms

Making smart investment decisions means breaking through the mass of market noise to locate valuable information. Professional services address this issue through data collection that involves SEC filings, earnings calls, and financial statements, and/or presentation in easy-to-digest formats.

Investment research shows that most institutional investors are making environmentally-friendly considerations—not just financial ones—and real-time analytics are becoming the norm. The change implies that the modern platforms combine traditional financial data with the metrics of sustainability and real-time market sentiment.

Screening tools search thousands of stocks using your criteria. Looking for companies with minimal debt and dividend growth? Software delivers results instantly rather than requiring hours of analysis.

Sentiment tracking monitors news coverage trends around stocks. This reveals market psychology beyond price movements. Stocks drop despite good earnings because expectations were excessive, or rally on disappointing news.

Industry comparison tools show which companies lead their sectors. You can compare profit margins across retailers or identify banks maintaining the strongest capital positions without diving through individual reports.

Risk Management Tools

Most people worry about risk after losing money. Smart investors measure risk beforehand. Risk software runs stress tests showing what happens during crashes, rate spikes, or recessions.

Value-at-risk calculations estimate the maximum probable loss over specific periods. If your portfolio has a 5% chance of losing more than $10,000 next month, you decide if that risk level works.

Correlation analysis reveals dangerous concentrations you might miss. In 2008, many "balanced" portfolios crashed as real estate stocks, banks, and mortgage companies collapsed together. Risk analysis would have spotted this.

Position tools determine how much to invest in each opportunity. They calculate sizes based on risk tolerance and volatility.

Investment Tracking Applications

Managing multiple accounts gets complicated fast. Your 401k, IRA, taxable account, and cryptocurrency holdings need unified tracking to understand your true financial position.

Good tracking apps connect to all your accounts automatically and calculate performance across your entire portfolio. They handle the complex math for stock splits, dividend reinvestment, and partial position sales.

Performance attribution shows which investments help and which hurt your returns. You might discover that your "safe" bond fund has been your worst performer, or that one small position accounts for most of your gains.

Tax features calculate realized and unrealized gains and losses throughout the year. This information helps you make strategic decisions about which positions to sell for tax optimization.

Trading Platforms and Order Management

Basic buy and sell orders work for long-term investing, but active traders need more sophisticated tools. Advanced platforms provide stop-losses, limit orders, and conditional orders that execute automatically based on predetermined criteria.

Stop-loss orders automatically sell positions when prices fall below set levels. Research analyzing market data found that stop orders represented significant trading activity across different participant types and asset classes. You can set a 15% stop on your Apple shares, and they'll sell automatically if the stock drops that much, protecting your downside without requiring constant monitoring.

Options analysis tools help evaluate complex strategies by displaying profit and loss scenarios under various market conditions. These platforms calculate break-even points and show how option values change as expiration approaches.

Level II market data reveals the complete order book, showing all pending buy and sell orders.

Financial Planning Software

Investing without clear goals rarely works. Planning software starts with your specific objectives, like retiring at 60 or funding college tuition, then calculates what you need to achieve them.

Monte Carlo simulations run thousands of scenarios to estimate your probability of success under different market conditions. They account for volatility, sequence of returns risk, and varying economic environments.

Retirement calculators show how long your money lasts under different withdrawal rates. Taking 4% annually from $1 million gives you $40,000 yearly income with good odds of lasting 30 years. Increase that to 6% and you might run out in 20 years.

Asset allocation tools match your investment mix to your timeline and risk tolerance, then adjust recommendations as you age or circumstances change.