Table of Contents

What Is Leverage Trading?

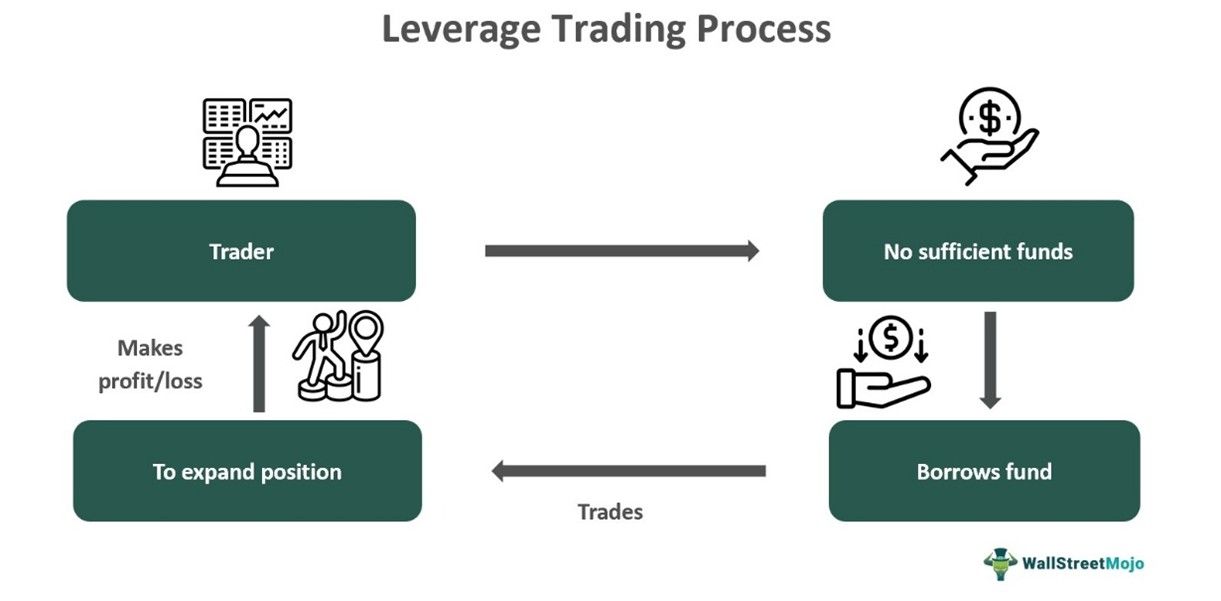

Leverage trading, otherwise known as margin trading, is a trading strategy that allows investors to borrow funds to purchase securities. The brokers lend the funds. This fund, in addition to the funds they already possess, helps traders control larger market positions.

The method can be used to trade a variety of instruments. It helps the trader enjoy gains when the market moves toward the direction favored by the trader. However, this also makes it riskier, as the loss amounts are heavy. The leverage a trader uses depends on their risk tolerance and strategy.

Key Takeaways

- Leverage trading is an arrangement where the trader can borrow additional funds from brokers to obtain larger market positions with small initial investments.

- It provides access to premium stocks with small capital. Additionally, trades can be profitable even in low volatile conditions.

- High-leverage trading can lead to higher losses and hence, traders have to be careful while dealing with such trades.

- It can be applied to various instruments such as stocks, commodities, indices and currencies. They are better suited for short-term trading.

How Does Leverage Trading Work?

Leverage trading is a process or trading strategy employed to buy or sell financial assets through funds borrowed from a broker or exchange. The process is akin to borrowing from banks; the asset becomes the collateral. Here, the securities or the money on the user's balance is taken as collateral.

The strategy is employed to make high returns. Companies use them to fund their securities, instruments or assets. Companies use them to help with debt financing to invest in varied operations and increase variations in equity. This type of trading offers long (buy) and short (sell) trades. It is best suited for traders who trade short-term. For traders to trade using leverage, they will need to put in their capital as collateral and this is called a margin. The amount to be deposited varies according to the platforms.

They apply to a number of markets, such as stock, forex and even cryptocurrency. In stock markets, it can be used in bonds, stocks, currencies, funds, metals, options and futures. The leverage ratio is calculated following the risk rates by taking into account the risk-evaluated amount of the trading instrument (both long and short) and the initial trading capital.

Strategies

Given below is a set of general instructions for the beginners to understand the process:

- Choosing a trading platform for leveraging is the first step.

- Traders shall be aware of the actual fee to be paid and if there are any overnight funding costs. The borrowed funds shall also have interests.

- Traders shall then leverage their desired ratio. This also determines the capital is to be borrowed for the trader's risk tolerance.

- Choosing assets is important as this is the base for trading. Funding a margin account is also important.

- Plan the exit and entry strategy. Traders shall time their entry and exit perfectly to gain maximum benefit of leverage.

Examples

Let us look into some examples to understand the concept better

Example #1

Suppose Dan has $5000 in his trading account and wants to trade a stock at $10 per share. Without additional funds, he could buy only 500 shares (5000/10). Imagine he has an option for leverage where his broker offers a ratio of 10:1. This means he can borrow $9 for every $1. So he can just put in $5000 and source the $45000 from the broker to buy a larger position of $50000 from the earlier $5000, resulting in a profiting trade. He used the leverage trading technique before picking up trading in it, and this saved him money.

Example #2

Suppose a trader, Chad, also has $5000 and wants to try leverage trading crypto at $10 and he could only buy 500 tokens now. He chooses to leverage with the ratio of 20:1, where he could now buy 10,000 tokens with a position of $100000 ($5000 from his funds and $95000 from the broker) and say the price later decreases from 10 to $9, and the total investment will now be $4500 (9*500) as opposed to the earlier $5000(500*10). The total investment then goes down to $90000. He is now at a loss and must pay $95000, again an additional $5000 liability. Unfortunately, Chad did not use the help of any leverage trading techniques to assess potential losses.

Pros And Cons

Given below are some of the pros and cons of the strategy

Pros

- Traders can increase their exposure fivefold within their manageable range, making them less burdensome. They can leverage high profits and be capitally efficient even with small margins.

- There is a high chance of making good profits even if the underlying asset price does not move much.

- There is a huge number of platforms that support this.

- Traders can make more money even if the market faces low volatility.

- Access to additional funds helps in buying stocks that are considered premium.

Cons

- Unfavorable movements of asset prices can result in huge losses.

- Traders are required to have a minimum balance or the initial margin to be able to afford such trades. Loss may happen to such trades if they are not careful.

- There is an interest charged for borrowing funds it is high in high-leverage trading.

- It can lead to emotional decision-making due to the volatile markets. This involves emotional trading and impulsive decision-making.

Leverage vs. Margin vs Spot Trading

The differences between these concepts are given as follows

Concepts

- Leverage trading is the trading method that involves gaining additional funds from brokers or institutions to open a larger position than what the capital possessed allows.

- Margin trading is using one's funds to open larger positions than what their capital allows.

- Spot trading is a process of trading a foreign currency or financial instrument for instant delivery.

Source of Funding

- Leverage trading allows access to additional sources that a broker will provide.

- The margin trading process involves the use of one's funds.

- Spot trading also requires a trader to have their funds.

Flexibility

- Leverage trading allows greater flexibility in fixing larger positions as additional funds are available.

- Margin trading has trade sizes limited to the amount of capital a trader has.

- Spot trading is also limited by the capital the trader has.