Although liquidity mining and staking generate rewards for providers, they function differently. Plus, they also bring equal liquidity mining risks with them. So, let us look at their differences:

Table of Contents

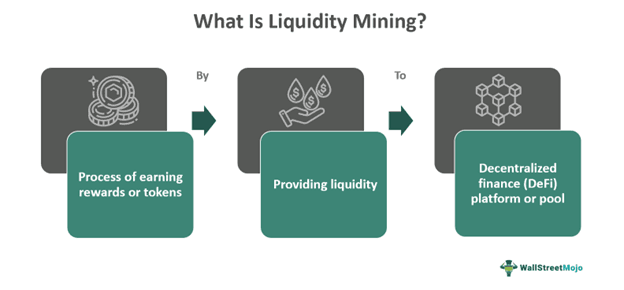

What Is Liquidity Mining?

Liquidity mining refers to a pooling process where the users provide their tokens to the DEX (decentralized exchange) and receive rewards in return. The prime goal of this mining is to put funds within a pool and incorporate liquidity within the platform.

Although IDEX is a well-known DEX established in 2017, the concept of DeFi liquidity mining was popularized by platforms like Compound and Uniswap in 2020. During this period, token providers began participating in these mining pools to earn a passive income on their tokens and to help create a stable environment with the required liquidity in the market.

Key Takeaways

- Liquidity mining is a process of earning passive income by depositing tokens into liquidity pools. Users can generally withdraw their tokens according to the terms specified by the smart contract.

- DEXs use the Automated Market Maker (AMM) structure to facilitate trading and maintain liquidity within the crypto market.

- Crypto traders swap tokens and pay transaction fees, which the DEX then uses to pay rewards to liquidity providers.

- The percentage of rewards a user receives depends on their share of the pool's liquidity. If a person's holdings represent 10% of the pool's liquidity, they receive 10% of the generated fees or rewards.

How Does Liquidity Mining Work?

Liquidity mining is a process that incentivizes users to provide liquidity to decentralized exchanges (DEXs) by depositing their tokens into liquidity pools. These tokens are locked in smart contracts and made available for other users to trade. The liquidity pools are governed by these smart contracts, which manage the tokens within them. In return, liquidity providers receive crypto tokens or governance tokens as rewards. The reward is proportional to the contribution made; for example, if a trader's tokens represent 2% of the total pool, they would receive 2% of the generated fees or rewards.

Liquidity mining allows users to earn rewards on tokens that would otherwise be idle by locking them into liquidity pools. These pools are typically operated on DEXs using Automated Market Maker (AMM) models, which facilitate trading without a centralized authority. Traders pay a fee for each swap (often around 0.3%, though this varies by platform). These fees are distributed to liquidity providers based on their share of the pool, incentivizing more enormous contributions with greater rewards. Liquidity providers can usually withdraw their tokens at any time, earning a passive income in the process.

This process benefits both the DeFi platforms, which gain liquidity, and the liquidity providers, who earn rewards. It also enhances liquidity and price stability on DEX platforms, making trading more efficient.

Examples

Let us look at some examples of liquidity mining to comprehend the concept in a better way.

Example #1

Suppose Kevin has been a crypto trader for the past six years. During this time, he has accumulated a significant amount of tokens in his wallet, including Ethereum (ETH) and Bitcoin (BTC). However, almost 500 ETH and BTC tokens were lying idle in his vault. Therefore, he decided to earn extra tokens on these funds by participating in liquidity mining.

Kevin deposited his coins into a liquidity pool on a decentralized exchange. The pool locked them via smart contracts and made them available for trading on the platform. Other users on the exchange can now trade these tokens, paying a transaction fee for each trade. The exchange collects these fees.

As a result of providing liquidity, Kevin received 100 tokens as a reward. This reward represented 5% of the total fees generated by the pool during that period, proportional to his share of the pool's liquidity. Since his tokens accounted for 5% of the pool's assets, he received 5% of the generated fees as a reward. The more tokens he locks in the pool, the greater his potential rewards.

Example #2

According to a news update as of August 2023, Binance announced that it will halt 39 liquidity mining pools starting September 1, 2023. This decision was made following a periodic review aimed at concentrating liquidity and ensuring an optimized trading experience, including better pricing and reduced slippage for users. As a result, users will not be able to add liquidity to these pools from the announcement date, but they will still be able to redeem and withdraw their assets before the closing date. The removal of these liquidity pools will not affect the trading of the respective pairs on Binance Spot, and users can continue trading on other available liquidity pools on Binance Liquid Swap.

Scams

In contrast to liquidity mining, various crypto scams are associated with these pools. It has resulted in the theft of millions of coins from the platform. However, some common types of scams are listed below:

- Illusionary Balance: One of the significant crypto scams under liquidity mining is the illusion created by the phishers. These scams usually appear normal on screen until the coins disappear. The attacker's primary goal is to keep the user engaged in the pool. So, when a person deposits funds in the liquidity pools, the platform displays records in the blockchain as usual. The hacker swipes all the money out once the pool deposits adequate funds.

- Fake Liquidity Pools: Recently, fraud liquidity pools are another phishing technique associated with this liquidity mining. The attackers try to build personal or close relationships with the person for their purpose. This invite is sent through direct message (DM) on any social media platform, such as Instagram, X (formerly Twitter), or others. And in significant cases, it is a genuine DeFi liquidity mining invitation. Also, the users can deposit any amount they want and earn 1-3% returns daily. The attacker can quickly swipe the funds after the users link their wallets to the liquidity pool.

Advantages And Disadvantages

Liquidity mining provides a perfect space for idle tokens but has equivalent downsides. Let us look at them:

| Advantages | Disadvantages |

|---|---|

| It potentially generates passive income for users. | The liquidity mining risk of cyber attacks can result in coin theft. |

| The distribution of tokens provides voting and governance power to the users. | Entry of rug pulls can lead to the closure of liquidity pools and refrain from returning funds. |

| Anyone can enter into liquidity pools and help maintain a stable market. | Price fluctuations in the locked assets can potentially lead to permanent loss. |

| It supports the decentralized exchange to maintain liquidity. | Low trading volume may interrupt the liquidity in the DeFi platform. |

Liquidity Mining vs Staking

| Basis | Liquidity Mining | Staking |

|---|---|---|

| 1. Meaning | It refers to the deposit of tokens in the liquidity pool and receiving rewards in return. | The crypto assets are collateralized on the blockchain network in the staking mechanism. |

| 2. Participants | Here, the crypto users owning tokens participate in these pools listed on the DEXs. | Miners lock their assets as collateral on blockchain networks. |

| 3. Rewards | The more holding results in more reward. | If the blocks get validated, the network releases a reward via an on-chain system. |

| 4. Type of Token | This mining gives governance tokens as a reward. | Here, the blockchain mints new coins and rewards them. |

| 5. Mechanism | DEXs use the Automated Market Maker (AMM) structure to facilitate the entire process via smart contracts. | Blockchains use the PoS (Proof-of-Stake) mechanism to choose miners based on their stake held. |