Table of Contents

What Is Look-Ahead Bias?

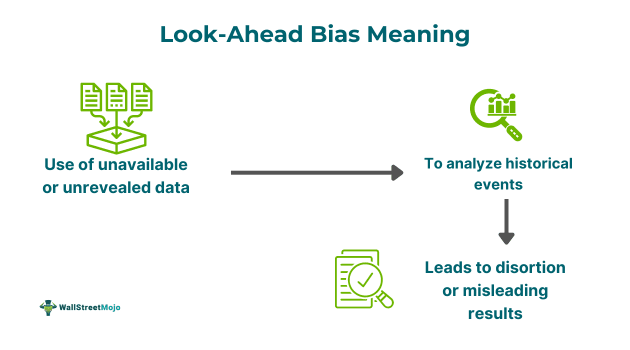

Look-ahead bias is the unintended inclusion of future information into previous trading methods or analyses. It refers to the unconscious utilization of unavailable or unrevealed facts in understanding or replicating historical events. The bias exists in decision-making or evaluation procedures that make use of previously unknown knowledge or data.

Bias occurs when future information is mistakenly incorporated into the analysis, providing insights that may still need to be accessible at the time of the event under consideration. Using future price data to make judgments in the past produces a misleading appearance of predictability. This alters the accuracy of predictive models and jeopardizes the analysis's credibility.

Key Takeaways

- Look-ahead bias is an error in which future information is inadvertently included in historical analysis. It distorts decision-making and backtesting in finance.

- Bias occurs when future information is incorporated into an analysis, providing insights that may not have been available at the time of the event.

- It causes a misleading appearance of predictability, altering the accuracy of predictive models and jeopardizing the analysis's credibility.

- Investors can detect it by scrutinizing data sources, using cross-validation techniques, and seeking expert review.

- Prevent it by segregating training and testing data, updating models regularly, and validating with out-of-sample data.

Look-Ahead Bias In Finance Explained

Look-ahead bias is a phenomenon in which traders unknowingly use unavailable or unrevealed data to analyze historical events, leading to distortion and misleading results. This bias is particularly problematic in financial trading, where accurate and reliable data is crucial for making informed decisions. It can distort the perception of historical data and give traders an unfair advantage over the market.

This bias can also impact backtesting, an essential component for developing successful strategies for trading. Thus, by inadvertently including future information in the analysis, traders may produce "backtest" results that appear profitable but are unlikely to be used in real-time trading, resulting in overly optimistic expectations and possible losses. This bias can also have significant consequences on decision-making processes. One such example is evaluating a marketing strategy's effectiveness using data that incorporates future sales figures. This leads to inaccurate assessments of the strategy's success and potentially misallocation of resources.

It invariably affects areas like risk assessment, investment analysis, and portfolio management, which can derail an investor's long and short-term financial plans. To avoid this bias, analysts must maintain the validity of research, financial forecasting, algorithmic trading, and risk management practices. Recognizing and addressing a look-ahead bias strategy requires rigorous data integrity practices, careful consideration of data availability, and robust validation techniques.

How To Detect?

Various ways to detect such bias are as follows:

- Scrutinization Of Data Acquisition: Traders must have a clear understanding of the analysis timeframe. They should avoid using data collected or calculated using information not available at that specific point in time for the same.

- Examine Data Sources: Carefully analyze data sources to identify any indicators or variables that future events might have influenced and exclude such information to avoid such bias.

- Cross-Validation Techniques: Utilize these techniques to assess the model's performance on unseen data and detect potential bias if the model underperforms on the testing set.

- Out-of-sample Testing: Set aside a part of data for validation purposes and compare the model's performance on the validation set to the training set to identify the bias.

- Review Data Collection Processes: Ensure consistency and avoid delays in data collection to prevent inadvertent inclusion of future information.

- Use statistical methods: Analyze data using varied methods such as the rolling window approach. This helps to identify patterns and relationships over time and avoid incorporating future information.

- Comparative Analysis: When a trader compares results from different analysis methods, they can detect inconsistencies that may hint at such bias. If one method consistently diverges from others, it might imply the inclusion of future data.

- Expert Review: Consulting subject matter experts or experienced professionals can offer valuable insights into the analysis methods used. Experts can assess the suitability of methodologies and identify potential biases or limitations.

Examples

Let us look into a few examples to understand the concept better

Example #1

Suppose there is an investor; let's call him Dan. The investor evaluates a company's past cash flows and forecasts that the current year will be highly profitable based on past cash flow data. However, by doing so, the investor unwittingly integrates knowledge that is not currently available. This could be due to upcoming product launch news or an unannounced significant deal. As a result, the investor's judgment of future return on investment is biased because it is based on knowledge that has yet to be available. This highlights how look-ahead bias can mislead investors and result in poor decision-making.

Example #2

Dennis Carnelossi Furlanetoa, Luiz S. Oliveiraa, David Menotti, and George D.C. Cavalcanti authored a study titled "The models trained with the bias effect on predicting market trends with EMD."

In this study, the effectiveness of Ensemble Empirical Mode Decomposition (EEMD) in predicting market trends is evaluated (ensemble version of EMD- Empirical Mode Decomposition). Previous research suggested that using EEMD on financial time series improved predictions. However, this study found that the positive results were due to inadvertently introducing look-ahead bias through pre-processing the data with EMD. Contrary to previous conclusions, applying EMD and EEMD did not enhance the accuracy or cumulative return of the models used in this study. The EEMD components extracted as a pre-processing step outperformed other models but were influenced by look-ahead bias, encoding future information into past data points. These findings emphasize the importance of caution when employing techniques that utilize data not present in the training set.

Impact

Such bias can negatively impact traders and investors. Some key effects of this bias include:

- Exaggerated Profitability Assessment: the bias inflates perceptions of profitability by integrating future data into historical analysis. Consequently, traders may overestimate potential returns and engage in riskier decision-making.

- Misjudged Risk Evaluation: The bias distorts risk assessments, resulting in underestimation of investment downsides. This may prompt traders to take on excessive risks without fully considering the likelihood of negative outcomes.

- Inefficiency In Portfolio Optimization: The bias may hinder backtesting and optimization of portfolio techniques, resulting in the development of inefficient portfolio allocation strategies. This can limit investors' capacity to diversify their portfolios and fulfill their investment goals successfully.

- False Sense Of Security: This bias instills unwarranted confidence in investors regarding their trading strategies. Investors or traders believe they have discovered foolproof approaches based on historical performance. However, these strategies often fall short when applied to real-time trading scenarios.

- Flawed Decision-Making: Including future information in historical analysis can lead to poor decision-making. Traders, investors, and analysts may make judgments based on inflated expectations of historical performance, resulting in poor outcomes.

- Portfolio performance: This bias can lead to poor portfolio performance as a result of incorrect decision-making and inadequate asset allocation. Investors may fail to attain their targeted investment outcomes and receive lower returns than expected as a result of this bias in portfolio management decisions.

How To Prevent?

Given below are a few steps that investors or traders can employ as part of preventive measures:

- Regularly Update Models and Assumptions: Given the dynamic nature of financial markets and changing business environments, regularly updating models and assumptions to reflect the latest information is important. Traders can mitigate the risk of this bias that results from outdated or stale information influencing decisions by incorporating new data and insights into the analysis process.

- Training and Testing Data Separation: Separating the dataset into training and testing subsets is crucial in mitigating the bias. The training data facilitates model development, while the testing data assesses model performance. This division safeguards against future information impacting decision-making.

- Validate With Out-of-Sample Data: Validation against out-of-sample data is indispensable for confirming the generalizability and robustness of models or decisions. This validation procedure ensures that analyses remain uninfluenced by this bias and can be confidently applied to new, unseen data.