Table of Contents

What Are Management Accounting Reports?

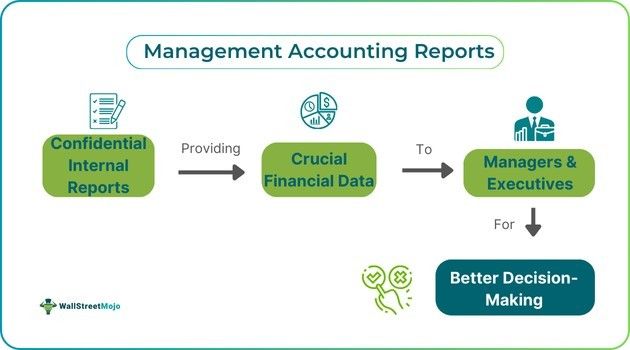

Management accounting reports refer to internal financial statements providing vital information about decision-making to managers. These reports contain information like sales forecasts, cash flow analysis, inventory value, and accounts payable and receivable to aid managers in making appropriate decisions regarding the day-to-day operations of a business.

They can be represented in numerous forms like pictures, charts and diagrams. These reports tend to be extremely confidential and only for internal use. It has its base on business needs and remains highly flexible compared with other accounting types because it has no set structure to follow.

Key Takeaways

- Management accounting reports represent Internal financial statements that give crucial information to managers for decision-making.

- It includes data such as sales predictions, cash flow analysis, inventory valuation, and accounts payable and receivable, helping managers make informed decisions about the day-to-day operations of a firm.

- Its types include budget reports, accounts receivable aging reports, job cost reports, and inventory and manufacturing reports, helping control costs, align credit policies, assess profitability, and optimize production processes.

- Its benefits are - providing valuable insights into cash flow, profitability, liability evaluation, asset management, operating costs reduction, budget allocation, and strategic decision-making for businesses.

Management Accounting Reports Explained

Management accounting reports represent a company's financial position at any given time by compiling data from accounting documents, transactions, regional sales, operational costs, and product profitability. Businesses often rely on these reports as they can guide their managers to make the right decisions toward achieving all goals.

These reports have been designed for internal use without being bound by GAAP standards. So, they can be customized as per the needs of the business to assess operational efficiency and key performance indicators (KPI). These reports include a comprehensive evaluation of cost analysis, budgeting, performance evaluation, operational costs, budget compliance, and product profitability. Therefore, it helps managers to allocate resources efficiently. They are generated weekly or monthly to offer timely details about business operations.

Their implications include influencing operational efficiency, strategic planning and decisions like cost-cutting and investment strategies. Such reports also encourage businesses to examine their financial status and anticipated projections in the absence of any external reports like the balance sheet. It tells the strengths and weaknesses of a company, leading to continuous improvement.

They have become highly useful to internal stakeholders like executives and managers in projecting future trends, making strategic decisions and setting realistic budgets. These reports have also enabled organizations to adapt to new business strategies proactively instead of reactively. Using these reports, businesses have increased profitability, optimized costs, and maintained a competitive edge through real-time financial insights about decision-making.

Types

To succeed in these competitive times, companies need to develop the below types of reports of management accounting:

- Budget Report: It helps owners of businesses to control their costs by assessing past expenses, forecasting future budgets and determining areas needing cost reduction throughout their department or organization.

- Accounts Receivable Aging Report: It has been a crucial report for companies providing credit to customers, enabling adjustment to credit policies as per consumer balances aged 30, 60, and 90. It helps in aligning their credit offering alignment as per the payment abilities of customers.

- Job Cost Report: It enables the comparison of total project costs with that of expected revenue, facilitating leaders in profitability assessment. It also allows attending to the most profitable activity to optimize business operations and enhance decision-making.

- Inventory and Manufacturing Report: Manufacturing companies depend on these reports for centralizing inventory, overhead and labor data. Thus, companies can optimize their production process leading to improved efficacy in machining or assembly.

Examples

Let us use a few examples to understand the topic.

Example #1

Let us assume that TechnoSolutions of Old York City readies a report of management accounting for its sister concern, DataFull LLC, based in New York City. Its CFO, Thompson, collects data on overheads, sales revenue and production costs. In the third quarter of 2024, TechnoSolutions reports $4 million in revenue generation and $2 million in production costs. Thompson then contrasts these data with the budget while underscoring a cost increase of 10%.

His evaluation aids the CEO of the company in making strategic decisions to enhance profitability. Thompson prepared key measures like operation expenses at $500k and gross margin at 50% for presenting got the CEO. As a result, the CEO adjusts the company's pricing strategies. Hence, the reports enable transparency in monitoring financial performance throughout both companies using proper management accounting report templates.

Example #2

Let us assume that a hospital chain called Healthcare Services in Old York City has many branches across the city. The team of management accounting is preparing a report for October 2024. The report gathers and summarizes data from three of its branches- A1 Healthcare Services, B1 Healthcare Services, and C1 Healthcare Services under the supervision of the Chief Medical Officer (CMO).

Then, management accounting reports are prepared that underscore staff salaries, patient revenue and operational costs. After careful analysis, the CMO finds that:

A1 Healthcare Services – shows a rise in patient admissions, increasing revenue by 15%.

B1 Healthcare Services – experiences high salaries disbursement affecting profit.

C1 Healthcare Services – suffers from high operational costs of equipment maintenance.

Furthermore, the above report contains data as a list of management accounting reports on important financial ratios like net profit margin and cost per patient. All these data in suitable management accounting report formats help the CMO make wise decisions concerning efficiency improvement and resource allocation.

Benefits

It has various benefits for small and big businesses alike, as shown below:

- It helps in finding the major business issues and vital points for improvement.

- It offers deep insights into cash flow, aiding businesses to handle their expenses efficiently.

- Reports like profit & loss help track the profitability of a business at the proper length of time, allowing trend analysis and comparison.

- Balance sheets give a vivid picture of financial status, facilitating liability evaluation and asset management.

- Such reports enable companies to minimize operating costs and maximize budget allocations.

- These reports also enable informed decision-making related to strategic future planning.