What are the Benefits of Taking a Mortgage Loan for Business Expansion?

Table of Contents

Introduction

Expanding a business often demands significant funding—whether for setting up new locations, modernising infrastructure, acquiring machinery, or improving working capital. For entrepreneurs and self-employed professionals, a mortgage loan is one of the most dependable financing solutions available. By using a residential or commercial property as collateral, businesses can secure large loan amounts at relatively affordable terms. With competitive mortgage loan interest rates and flexible repayment options, this funding option supports sustainable, long-term growth. Bajaj Finance simplifies the process further by offering attractive interest rates, quick approvals, and customised repayment plans. Here are five important aspects to consider before applying for a loan against property.

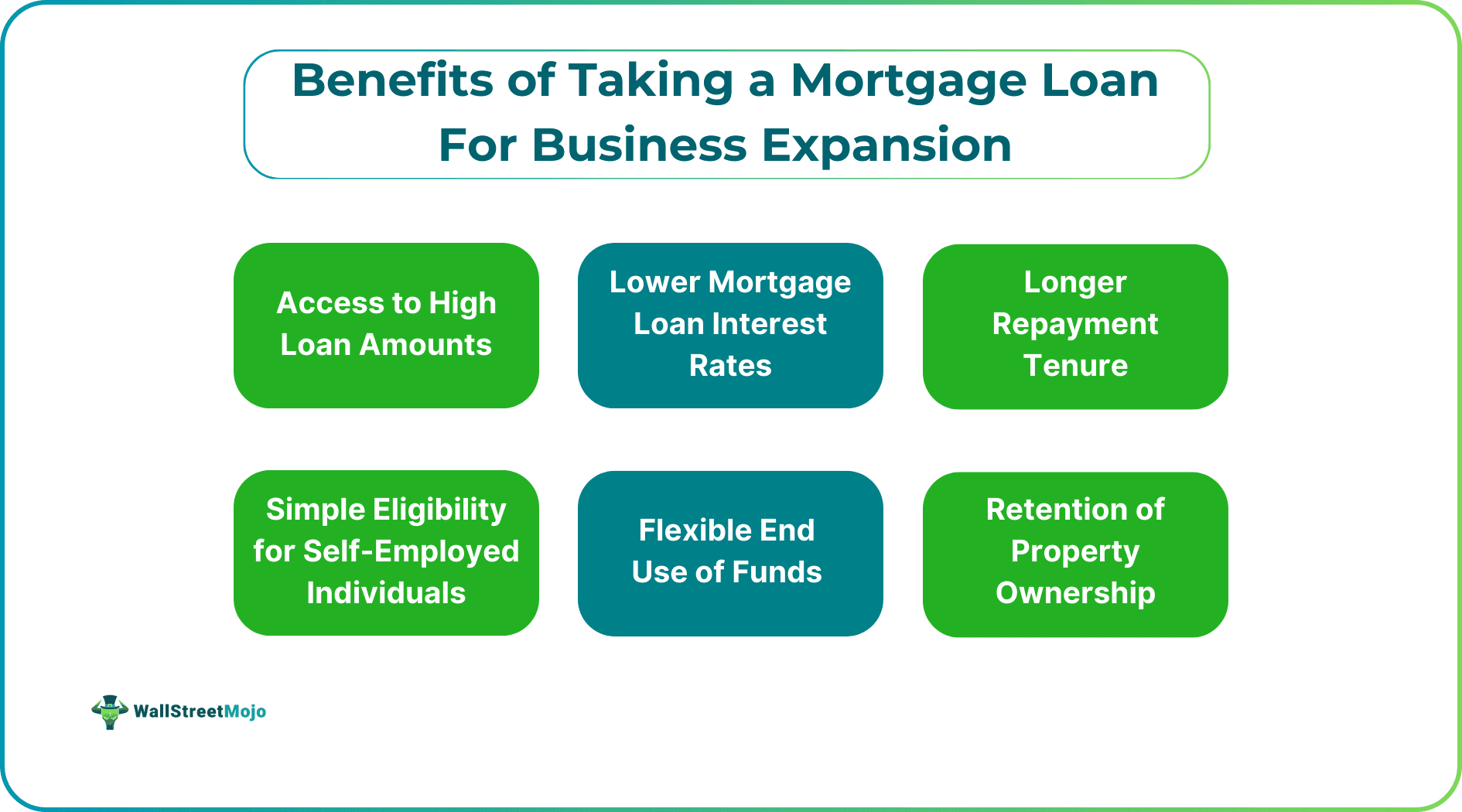

Below are the key benefits of taking a mortgage loan for business expansion.

#1 - Access to High Loan Amounts

One of the biggest advantages of a mortgage loan is the ability to raise a substantial amount of capital. Lenders typically offer higher financing of the property’s market value, depending on eligibility and property type. This makes mortgage loans ideal for large-scale business investments such as factory expansion, purchasing commercial assets, or scaling operations across locations. Unlike unsecured business loans, the presence of collateral allows lenders to approve higher loan limits.

#2 - Lower Mortgage Loan Interest Rates

Compared to unsecured loans, mortgage loans come with significantly lower interest rates. Since the loan is backed by property, lenders face reduced risk, which translates into competitive mortgage loan interest rates, usually ranging between 8%* and 20%* per annum. Lower interest rates help businesses manage their cash flow efficiently and reduce the overall cost of borrowing, making expansion financially sustainable.

#3 - Longer Repayment Tenure

Mortgage loans offer longer repayment tenures—often extending up to 15 years* or more. This extended duration results in lower EMIs, allowing businesses to repay the loan comfortably without putting pressure on monthly finances. For growing businesses, this flexibility is crucial, as it ensures that working capital remains available for day-to-day operations even while servicing the loan.

#4 - Flexible End Use of Funds

A major benefit of a mortgage loan is its flexibility in usage. The funds can be used for a wide range of business purposes, including:

- Expanding production capacity

- Purchasing equipment or machinery

- Renovating or upgrading office or commercial spaces

- Hiring skilled manpower

- Managing operational or seasonal cash flow needs

This versatility makes mortgage loans a preferred option for entrepreneurs looking for comprehensive financial support rather than restricted-use financing.

#5 - Simple Eligibility for Self-Employed Individuals

Self-employed professionals, MSME owners, and entrepreneurs often face challenges when applying for unsecured loans due to income variability. Mortgage loans, however, are more accessible since the property acts as security. As long as the borrower demonstrates income stability, clear property ownership, and a reasonable credit score, approval chances remain strong. This makes mortgage loans especially useful for small and medium businesses planning steady expansion.

#6 - Retention of Property Ownership

Even though the property is mortgaged, the borrower continues to retain ownership rights. Businesses can use the premises and earn rental income while using the property to secure funding. Once the loan is fully repaid, the mortgage is released, and the property remains entirely with the owner—making it a cost-effective way to unlock capital without selling assets.

Conclusion

A mortgage loan is an effective way for businesses to unlock substantial capital by leveraging the value of their property. By clearly understanding eligibility criteria, loan-to-value ratios, mortgage loan interest rates, and repayment terms, business owners can make well-informed financing decisions. With Bajaj Finance, borrowers benefit from competitive rates, a seamless application process, and convenient digital loan management—making business expansion smoother, smarter, and more sustainable.

*Terms and conditions apply.