Table of Contents

What Is Mortgage Payoff?

Mortgage payoff refers to paying the remaining balance of a mortgage (a loan against property) before or when the loan term ends. Borrowers often try to pay off their mortgage early to relieve themselves of debt and redirect the money toward other personal needs.

Borrowers have a deadline to repay the loan amount by the end of the term. However, if they have the funds, they may choose to repay the amount early. As a result, lenders may impose an early mortgage payoff penalty due to the loss of interest payments they would have received if the borrower had paid over the full term. Borrowers may adopt different strategies for early repayment.

Key Takeaways

- A mortgage payoff refers to the remaining loan balance that must be repaid within a specific period, providing clarity on the outstanding debt that can be settled before the term ends.

- Paying off a mortgage before the term ends may trigger a payoff penalty, as it prevents the lender from earning additional interest on the loan.

- Borrowers can use various strategies, such as the 1/12th rule, lump-sum payments, biweekly payments, or refinancing, to manage their payoff plan effectively.

- Before deciding whether to pay off a mortgage or invest, it’s crucial to consider investment prospects, liquidity, and mortgage interest rates.

Mortgage Payoff Explained

A mortgage payoff is the repayment of the remaining principal of the mortgage as early as possible. Borrowers aim to settle the outstanding balance quickly to avoid further interest payments. Essentially, they want to close the loan out as soon as possible. To facilitate this, they may request a payoff letter that outlines where to send the money, the terms of the payoff, and an estimate of the payoff duration. There is also a separate letter to confirm that the borrower is no longer obligated to make payments once the loan is fully repaid. However, paying off early can lead to an early mortgage payoff penalty for the lender.

Many borrowers develop a mortgage payoff strategy to settle the loan faster. These strategies may include the 1/12th rule, using a savings account, making lump-sum payments, refinancing, or biweekly payments. In the 1/12th rule, individuals divide their monthly principal by 12 and add that amount to their monthly payment, creating 13 payments each year instead of 12. Alternatively, they can deposit 1/12th of the monthly principal into a savings account each month and use this to make a 13th payment. Similarly, using a biweekly payment strategy can help close the loan faster. In this approach, borrowers make payments every two weeks. For example, if the monthly payment is $1200, the borrower would pay $600 every two weeks.

How To Calculate?

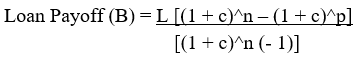

Using a mortgage payoff calculator, a borrower can determine how much should be allocated towards debt repayment and calculate the exact payoff amount. The formula is as follows:

- B = Loan payoff balance due

- L = Total loan amount

- c = Interest rate (annual rate / 12)

- n = Total payments (years x 12)

- p = Number of payments made until now.

The mortgage payoff calculator helps determine how much should be paid to settle the loan faster. However, before starting this process, it’s important to request a payoff quote from the lender or mortgage servicer, which will include the exact remaining principal and interest. Additionally, sticking to the payment schedule and meeting deadlines ensures that the loan obligation is fulfilled on time.

Examples

Let us look at certain examples of how to calculate mortgage payoff for any loan taken by borrowers:

Example #1

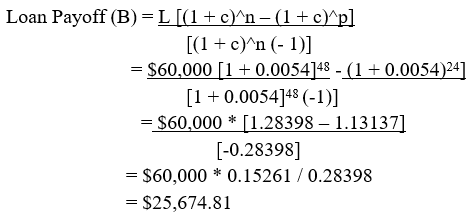

Suppose Kevin took a loan of $60,000 at 6.53% interest two years ago for his son's education. After discussing with John, the bank manager, they agreed on monthly payments of $1,000 for 4 years. However, Kevin found it difficult to manage the loan, and rising interest payments were becoming a burden. To settle the loan faster, Kevin decided to talk to John and used a mortgage payoff calculator to determine the amount still owed. The calculation is as follows:

Therefore, Kevin’s remaining payoff balance for the next two years is $25,674.81.

Example #2

In September 2024, a news report highlighted that many homeowners in China were rushing to pay off their mortgages amidst an economic downturn. With increasing job cuts and salary reductions, individuals aimed to avoid unnecessary interest costs by paying off their mortgages faster. Many homeowners had purchased properties in a booming market, expecting appreciation, but the market did not perform as anticipated.

Mortgage Payoff Or Invest: Which Is Better?

Paying off a mortgage is equivalent to reducing half the financial burden. It clarifies the remaining debt, providing a clear picture of what still needs to be settled. Additionally, it frees up funds that can then be redirected toward investment opportunities. Individuals can choose to invest in stocks, real estate, bonds, or other high-yield financial instruments. However, there's a catch. While paying off a mortgage may be a better option for many borrowers, it can mean compromising on potential investment gains.

When paying the mortgage, funds are quickly diverted towards the payoff, but these could otherwise be used for investment. If borrowers are trying to decide where to allocate their money, comparing the interest rates in both situations is essential. For instance, investing might be the better option if a stock or financial instrument is yielding high returns. Conversely, if mortgage rates are rising or there are extra funds available, paying off the mortgage may be more prudent.

Borrowers should consider a few factors before making a final decision:

- The interest rate on the mortgage

- Liquidity of their assets

- Any tax deductions available on mortgage interest

- Potential investment benefits from the government or gains higher than market returns.