How Mortgage Rates Move Home Prices: The Affordability Ceiling Model (With Real Examples)

Table of Contents

Introduction

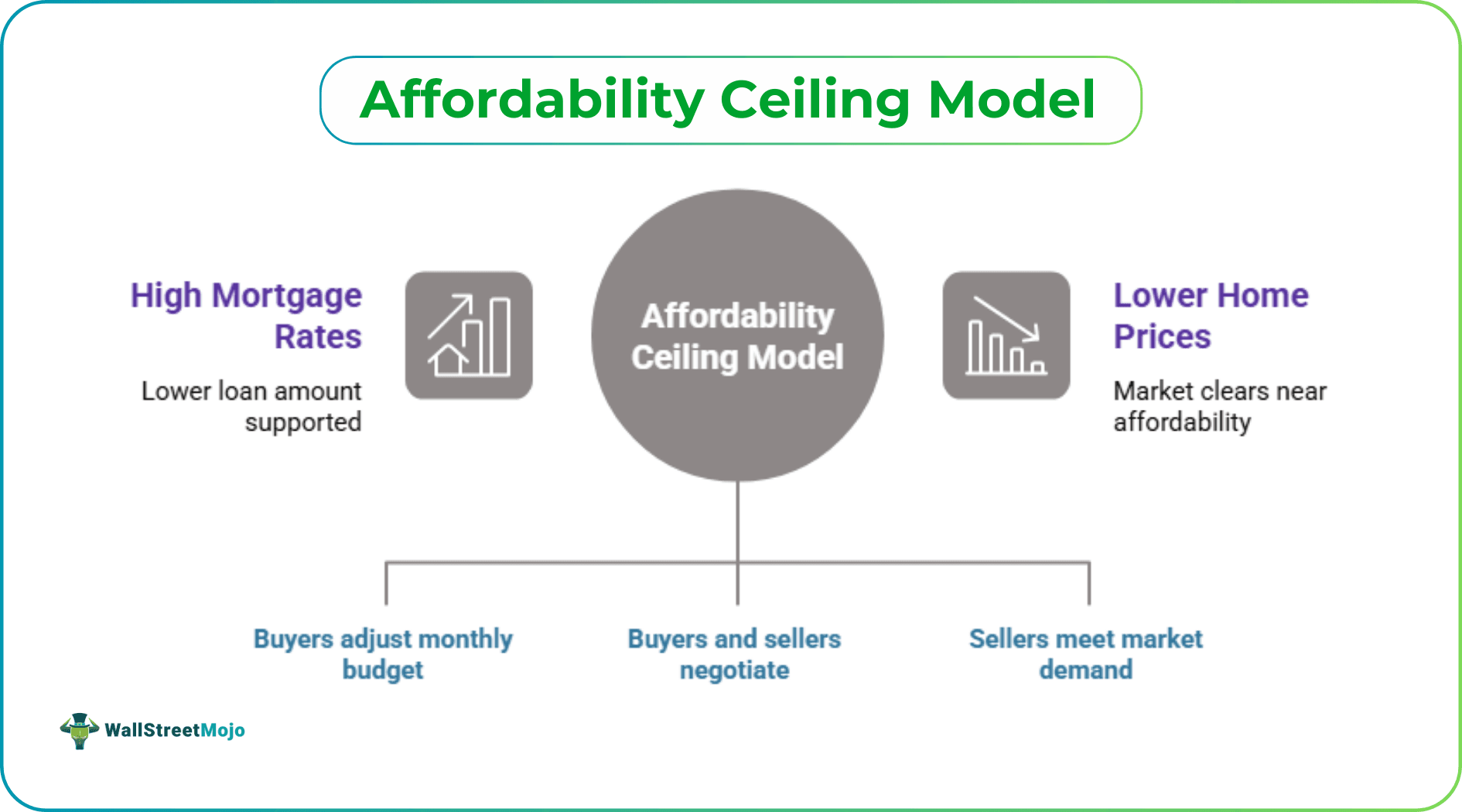

Mortgage rates and home prices are tied together by one simple constraint: most buyers shop by the monthly payment they can afford, not the list price on a sign. When rates rise, that same monthly budget supports a smaller loan amount. When rates fall, it supports a larger one. Over time, markets tend to “clear” near the price level where the largest pool of qualified buyers can still make the payment work.

That price level is what I call the affordability ceiling. It does not mean prices must instantly drop the moment rates tick up. It means the ceiling lowers, which usually changes buyer behavior first, then negotiations, and only later, list prices if sellers need to meet the market.

This model is useful because it turns a noisy question, “Where are prices going?” into a measurable one: “At today’s rate, what price can buyers afford at a typical monthly payment?”

The Affordability Ceiling Model in Plain English

The ceiling is the maximum home price that fits a buyer’s monthly payment target after factoring in down payment and the mortgage rate. In a simplified version (principal and interest only), the chain looks like this:

Monthly payment target → maximum loan amount → maximum purchase price

Taxes, insurance, HOA fees, and mortgage insurance can materially change the real ceiling, but the directional logic stays the same. Higher rates reduce loan capacity. Lower rates expand it. That shift ripples through demand, which is why rates often feel like a lever on prices.

A Simple Worked Example with Real Numbers

Assume a buyer wants to keep principal and interest around $2,400 per month. They have a 20% down payment. How much house can they buy at different rates?

At a 6.0% 30-year fixed rate, a $2,400 monthly principal and interest payment supports roughly a $400,000 loan. With 20% down, that points to about a $500,000 home price.

Now change only the interest rate:

- At 7.0%, that same $2,400 payment supports closer to a $360,000 to $365,000 loan, which points to roughly a $450,000 to $456,000 home price with 20% down.

- At 5.0%, the same payment supports closer to a $450,000 loan, which points to roughly a $560,000 home price with 20% down.

The exact numbers will vary by lender and assumptions, but the pattern is consistent: a one-point move in rates can change purchase power by close to 10% in many common scenarios. That is the affordability ceiling in action.

Why Prices do not Move One-For-One with Rates

If affordability drops, why do prices sometimes stay sticky?

First, sellers anchor to yesterday’s comps. A homeowner who sees neighbors sell for $X expects $X, even if today’s buyers can only afford $X minus 8%. It takes time and failed showings for expectations to reset.

Second, many markets respond with a deal structure before the headline price. Seller credits, temporary rate buydowns, repair concessions, and flexible closing timelines can preserve the list price while lowering the buyer’s effective cost.

Third, supply constraints can override affordability. When there are few listings, buyers compete for the same limited inventory, and the market can remain firm even when monthly payments are painful.

This is why the affordability ceiling is best viewed as a gravitational limit, not an on-off switch. It changes the direction of pressure even if the visible price adjustment arrives later.

What Real Estate Pros see When Rates Move

Agents feel rate shifts quickly because they show up in the conversations buyers have during showings and offer writing.

Cameron Walker, Agent Manager at Clever Offers, puts it plainly: “When rates climb, we see buyers recalibrate in real time. They stop asking, ‘Can we win?’ and start asking, ‘Can we afford to win without being house poor?’ That change lowers urgency and raises sensitivity to concessions.”

From the brokerage side, the first symptoms are often behavioral. “The earliest sign is not always a price cut,” says Lena Hartwell, Director of Residential Advisory at Wisdom Real Estate. “It’s buyers widening their search radius, shifting to smaller floor plans, or prioritizing homes that need less immediate work because their monthly payment already feels stretched.”

Investment-focused markets can react differently, especially where financing is part of the value story. “When borrowing costs rise, cap rates and buyer underwriting assumptions reset,” says Marcus Ellery, Head of Market Strategy at Crescent. “That doesn’t always force instant repricing, but it increases scrutiny. Deals need cleaner numbers, and sellers who are pricing for yesterday’s money get fewer serious bites.”

And from the publishing and digital PR angle, Sarah Lynch, HARO link-building expert at HAROLinked, notes why this topic performs: “Content that explains how rates translate into purchase power earns attention because it answers the real question readers have: ‘What does this do to me?’ When you connect math to behavior, you get a piece that both consumers and professionals want to reference.”

How to use the Ceiling Model in a Real Transaction

The biggest advantage of the model is clarity. Instead of guessing, you can run a few scenarios and plan your offer strategy around them.

Here is a practical way buyers and sellers can apply it:

- Choose a realistic monthly payment ceiling that includes taxes, insurance, and HOA.

- Run the ceiling at three rates: today’s rate, today plus 1%, and today minus 1%.

- Translate each result into a maximum purchase price, then set your search range below the maximum to leave room for competition and closing costs.

- If the ceiling drops, decide whether you will trade location, size, condition, or timeline before you start touring homes.

This is the point where the financing strategy becomes part of the pricing strategy. A buyer who understands their ceiling can negotiate confidently. A seller who understands the buyer pool’s ceiling can price to attract demand rather than chase the market downward.

Where a Mortgage Partner Fits Strategically

The best time to bring a lender into the process is earlier than most buyers think, before you fall in love with a home and start stretching the numbers. In a rate-sensitive market, the difference between a “comfortable” payment and an “uncomfortable” one is often small, and it changes what price range is realistically open to you.

This is where a mortgage partner like Willows Finance adds practical value. Instead of relying on rough online calculators, buyers can sanity-check their budget using real assumptions, including term length, product options, fees, and the documentation timeline that can make or break an offer. It also helps you pressure-test scenarios: What happens if the rate is 0.5% higher by completion? How much does a slightly larger deposit change the payment? Is a different term or product a better fit for cash flow?

For sellers and agents, the same clarity matters because it predicts the size of the qualified buyer pool at a given price. When financing is mapped upfront, pricing and negotiation become more grounded. You can decide whether to prioritise speed, certainty, or maximum price, and structure the offer accordingly, rather than discovering affordability limits after the viewing stage.

The Bottom Line

Mortgage rates affect home prices through affordability. When rates rise, the ceiling lowers, and demand becomes more payment-sensitive. Buyers shift preferences, negotiations lean toward concessions, and only then do prices adjust if the market needs to find a new clearing level. When rates fall, the ceiling lifts and competition can return, especially where inventory is tight.

If you want one reliable lens for thinking about the housing market, use the affordability ceiling. It won’t predict every week’s headline, but it will explain why buyers act the way they do, and why prices eventually follow.