Although non-deliverable swaps and forwards have similar exchanges, they differ widely. So, let us look at their differences to comprehend them in a better way:

Table of Contents

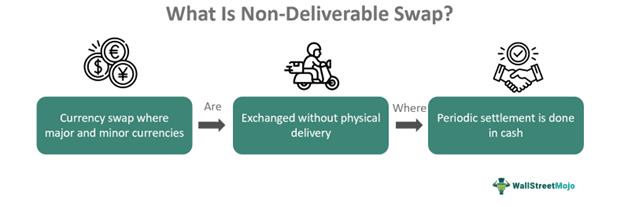

What Is Non-Deliverable Swap (NDS)?

Non-Deliverable Swap (NDS) is a subform or a variation of currency swaps between two (minor and major) currencies. The sole purpose of the NDS is to hedge or mitigate the risk arising from fluctuations in the exchange rates.

The NDS usually occurs within currencies that are not tradable or deliverable to the other party. As a result, a significant currency is used to support transacting deals. It is done on a cash basis, which helps in value settlement. However, limitations can cause complexity in the deal.

Key Takeaways

- A non-deliverable swap, or NDS, is a currency swap (exchange) allowing users to trade with non-tradable or restricted currencies.

- The contents of this swap include a notional amount, fixed (or agreed) rate, floating (or spot) rate, contract duration, and settlement amount.

- It helps in easy accessibility and liquidity in a transaction. In addition, it aids in effective risk management. Plus, we can hedge the risk using this instrument.

- Here, there are two currencies involved. One is a significant currency that mainly includes US dollars. However, the second one can be a weak currency.

Non-Deliverable Swap Explained

Non-deliverable swaps are swaps between two currencies, of which one cannot be traded in the global market. Therefore, the deal between traders can be executed using a primary currency like the US dollar. In short, they act as a hedging instrument to minimize the price volatility in the market. Plus, it also regulates the liquidity, accessibility, and risks associated with it.

The swaps have existed for decades, dating back to the 1970s. However, the prominent usage of non-deliverable swap interest rates occurred by the end of the century. As the name suggests, a swap exchanges items or currency between two parties. There can be instances where the exchange rate difference can be huge. Or else, there are chances of currency depreciation for the minor one. In such a case, the NDS interest rate is used. It helps financial institutions in arbitration and during capital requirements from foreign creditors.

When applying the standards for non-deliverable swap transactions, several variables or components come into play. These include:

- Two currencies involve the primary currency for settlement and the minor currency, which is non-deliverable.

- The notional amount represents the settlement amount of the transaction.

- Dates specifying the duration and timing of the swap.

- Contract swap rates, also known as NDS interest rates.

- The fixed rate is directly derived from the spot rate.

Various risks are associated with taking a loan from an overseas firm. If the debtor's currency is barely liquid, the creditor (loan provider) might expect debt issues. Likewise, future depreciation of currency can also cause the same. Therefore, the lender will use the equation to find the NDS pricing. The debtor will initially use the floating rate (like LIBOR or other rates) to pay the lender. Later, in the end, the difference between both will be paid by the former.

Formula For Non-Deliverable Swap Pricing

Let us look at the formula of NDS as per the non-deliverable swap transaction standards:

Settlement = / S

=N (1 – F/S)

Here, NF refers to the fixed interest rate, and NS is the floating rate that updates frequently. In contrast, S refers to the notional amount of the transaction.

Examples

Let us look at the examples of non-deliverable swaps to comprehend the concept better.

Example #1

Suppose Sackman Ltd is a firm that took a debt of $1 million from Avisis Bank. Here, the borrower deals in Indian (₹ or INR) currency, while the lender operates in the United States dollars ($). This deal was for five years, and the fixed rate was 6% on the debt taken. Plus, they followed the 5-year LIBOR floating rate, which was 6.57% at the time of the agreement. However, Avisis Bank insisted on the non-deliverable swap to avoid the depreciation of INR. Following is the calculation of the settlement amount as per the changing spot rate:

1st settlement = (NS - NF) / S

= / 6

= 570,000 / 6

= $9500

Similarly, the settlement amount changes when the spot rate (floating rate) reaches 7%.

2nd settlement = (NS - NF) / S

= / 6

= 890,000/ 6

= $148,333.33

This calculation will continue until the contract ends. As a result, the lender will receive a hedged yet balanced payment from Sackman Ltd.

Example #2

According to Reuters on May 2023, Chinese government bond yields remained near six-month lows as investors anticipated interest rate cuts amid signs of a faltering economic recovery following the initial rebound from COVID-19. The benchmark 10-year government bond yields stood at 2.745%, having dipped to 2.73% on Friday, the lowest since November 2022. Additionally, the 5-year non-deliverable interest rate swap in Chinese government bonds fell by over 20 basis points in the past month to its lowest level since November 2022. This downward trend suggests market expectations of future rate moves. The prospect of lower yields could attract foreign portfolio flows into Chinese government bonds. Still, analysts remain cautious due to negative yield differentials with the US and geopolitical tensions between the two countries.

Non-Deliverable Swap Vs. Non-Deliverable Forward

| Basis | Non-Deliverable Swap | Non-Deliverable Forward |

|---|---|---|

| 1. Meaning | It refers to a currency swap that has two currencies, out of which one is minor or depreciates faster. | Non-deliverable forward is a contract between two parties to exchange a currency on a future date and determined rate. |

| 2. Purpose | To hedge the risk arising from the price fluctuations in the currency exchange rate. | It allows traders to exchange currencies that are not or partially tradable. |

| 3. Settlement | Various settlements depend on the contract duration and the floating rate. | The difference between the agreed rate and the spot rate is settled at the end. |

| 4. Currency | One major currency (US dollars) and restricted currency. | Here, there are no restrictions to the currency involved. |