Table of Contents

What Is Offsetting Transaction?

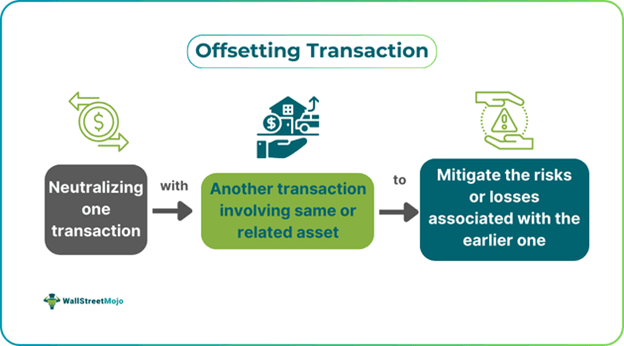

Offsetting Transaction is a trading strategy where an investor nullifies a transaction or trade position with another one. The sole purpose of using this technique is to place another (similar) transaction to cancel off the effect of an existing transaction, carrying significant risk.

Investors and traders take new positions in the market to initiate offsetting transactions. In the process, they close the earlier transactions and replace them with another one to counterbalance the market volatility and safeguard the initial investment by dodging potential losses. This risk-mitigating strategy ensures stable returns and manages exposure to price movements.

Key Takeaways

- An offsetting transaction is an effective trading technique whereby a trader or investor can neutralize a previous trade with a new one.

- It is most commonly used in equity, commodity, currency, and derivatives markets.

- There are two types of offsetting - direct and indirect. While direct offsetting deals in the same type of asset, indirect offsetting involves neutralizing transactions in related assets.

- This tool is useful in managing portfolio risk and counterbalancing any visible price fluctuations. However, unwanted transaction costs can rise during this period.

How Does Offsetting Transaction Work?

Offsetting transactions is a risk management strategy used by traders to cancel one transaction and replace it with another. It tends to nullify the effect of the earlier transaction, which also includes derivatives contracts. For instance, if a person initially took a long position of XYZ stock, offsetting the same with a short position can balance the risk in the initial trade. So, any downward stock price movement can be counterbalanced by a short position (selling) before the stock falls further. In short, a quick action or implementation of an offsetting strategy can reduce the level of loss for traders. However, this strategy depends on the type of offsetting transactions deployed.

Traders either opt for direct or indirect offsetting when trading in financial markets. Direct offsetting usually initiates a new transaction of the same asset to neutralize (offset) the risk of the original transaction. It is commonly seen in derivatives trading, like futures and options. However, indirect offsetting transactions hinder positions in the related assets. For example, if a person holds shares in a steel-providing company, they would offset the risk by taking a futures contract of the same commodity, i.e. steel.

Traders accordingly use either of the strategies to mitigate market movements the most. However, it occurs only after successfully examining the market and deploying the strategy. Also, it is vital to determine the risk exposure associated with the asset and later decide which offsetting strategy to use. Moreover, considering an individual’s risk tolerance level is also equally important in the process.

Examples

Let us look at some examples of how traders use offsetting transactions when trading in different markets:

Example #1

Suppose John is a trader who trades different stocks, commodities, and derivatives contracts. He usually works as an intraday trader, but occasionally, he performs long-term investing as well. John took a long position recently, buying seven shares of a crude oil company stock. He was tracking the stock for the entire day, until the past one hour left for the market to close. John noticed that the stock price was falling, so he took a short position to reduce the losses. The price was $70 at this time, which did not lead to massive losses. If John had delayed the decision to offset the transaction, the price would have dropped to $60.

Example #2

According to an October 2024 report, the Federal Fiscal Court of Germany has ruled to remove the limit of $21,757.58 (€20,000) for offsetting transaction losses occurring on forward contracts. The Annual Tax Act 2024 advocates the abolition of this offsetting limitation, thereby proposing that any such losses occurring in the future could be offset against profits without any limits.

Benefits

Offsetting transactions is a vital risk management tool many traders use, given the benefits offered. Let us look at them in brief:

- Reduce losses: Traders mostly use offsetting strategies to hedge losses in their portfolios. Any trade position near to becoming negative can be balanced off with an offsetting transaction. Likewise, a delay in mitigating risk can cause further losses.

- Manage portfolio risk: Market volatility is a constant risk for traders in stocks, currencies, commodities, and derivatives. Offsetting can help them manage and protect the portfolio risk from volatile fluctuations. If a trader finds the portfolio diverting toward losses, they can implement suitable offsetting transactions to counteract the risk.

- Limits price exposure: As price movements influence the asset’s price, traders can take advantage of offsetting by implementing long and short positions. Likewise, having a diversified portfolio can limit price exposure over the trades taken.

- Flexibility and applicability: Investors can utilize offsetting tools in almost every financial market. Mostly, market participants use it in the stock, commodity, forex, and derivatives markets.

- Risks: Considering offsetting transactions has certain disadvantages to offer to traders. For instance, when taking long and short positions, there can be multiple transaction costs implied during the process. Likewise, having good knowledge of the market is also necessary. Insufficient or limited market information can lead to wrong trading decisions which can further cause a dip in the portfolio. Furthermore, there can be regulatory compliance issues and liquidity risks when trading such instruments.