Why Piecemeal Advice Fails: The Case for a Truly Comprehensive Financial Strategy

Table of Contents

Introduction

Financial advice is everywhere. From social media tips to email newsletters, webinars, and casual recommendations from friends, guidance on money is abundant. Yet despite all this input, many individuals still struggle to achieve financial stability, growth, or peace of mind. The problem isn’t the advice itself—it’s how fragmented it often is.

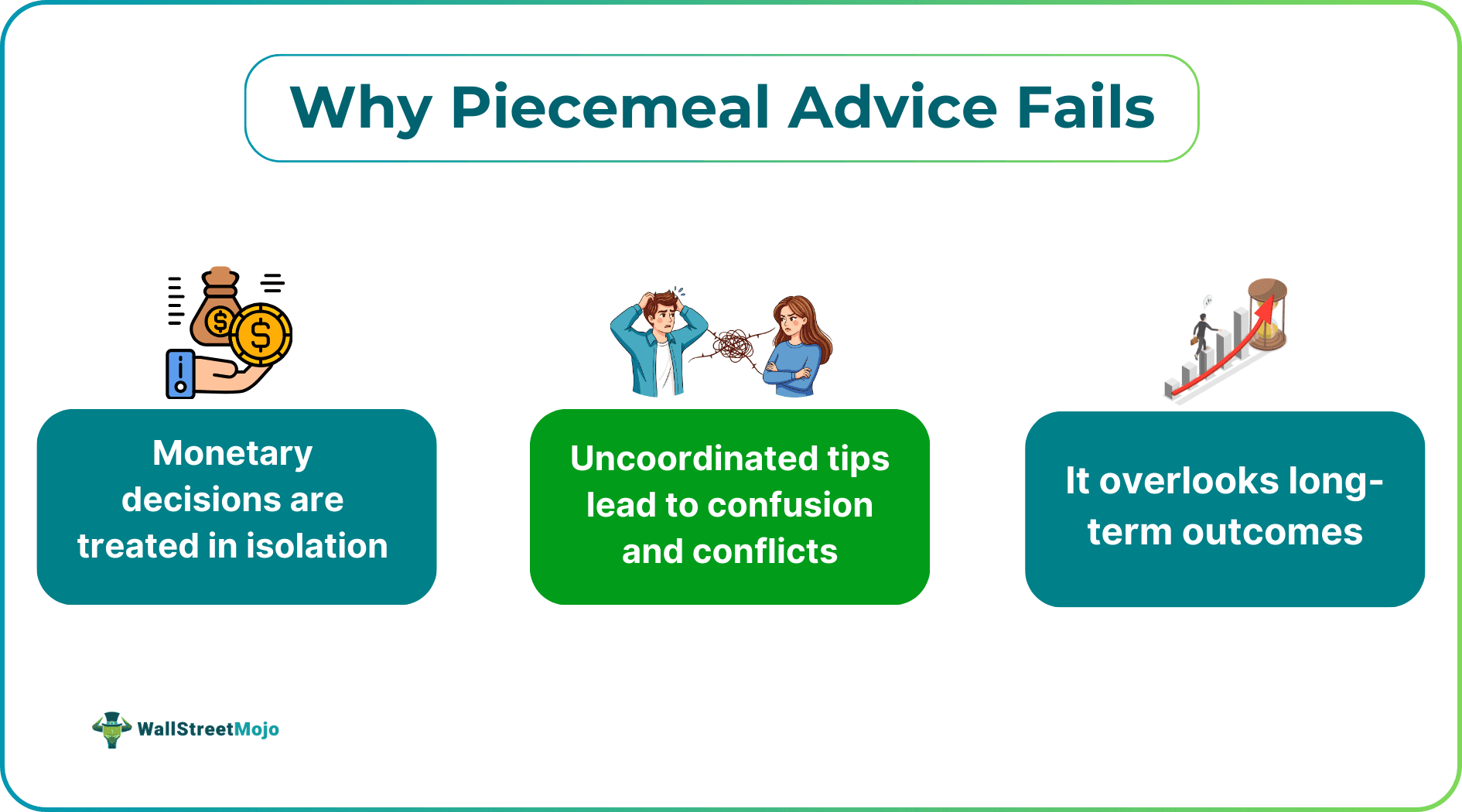

Piecemeal advice addresses isolated problems: how to reduce credit card debt, which stocks to buy, or how to save for a vacation. While useful in the moment, these snippets rarely account for the bigger picture. The result is disjointed decisions that can conflict, create inefficiencies, or even introduce new risks.

A truly effective financial strategy requires coherence, foresight, and alignment across all areas of money management. This is where comprehensive financial planning comes into play.

The Limitations of Piecemeal Advice

Piecemeal guidance often emphasizes quick wins. For example, switching to a higher-yield savings account or cutting discretionary spending can provide immediate relief, but without a broader plan, these changes may have little effect on long-term goals such as retirement, homeownership, or debt freedom.

Short-term fixes can also backfire. Aggressively paying down a single debt while ignoring tax implications, investment opportunities, or emergency funds may create new vulnerabilities.

#1 - Lack of Integration Across Financial Decisions

Money is interconnected. Income, expenses, debt, investments, insurance, and taxes all influence one another. Piecemeal advice treats them as separate problems, but decisions in one area often have ripple effects elsewhere. For instance:

- Overemphasizing debt repayment might reduce liquidity needed for emergencies.

- Investing heavily in high-risk assets without adequate insurance can jeopardize financial security.

- Optimizing taxes without considering cash flow may lead to short-term stress.

Without integration, well-intentioned advice can lead to conflicting actions, missed opportunities, or unintended risk exposure.

#2 - The Cognitive Load Problem

Managing finances is complex. Receiving uncoordinated advice increases cognitive load: individuals must track multiple recommendations, determine which are most relevant, and figure out how to implement them. This often leads to decision fatigue, procrastination, or inconsistent action—precisely the opposite of financial progress.

Why Comprehensive Financial Planning Works

Comprehensive financial planning takes all elements of your financial life into account. It doesn’t just focus on one debt, investment, or tax strategy; it looks at how every piece fits together. This approach ensures that each decision aligns with broader goals and reduces the risk of conflicting actions.

By integrating income management, expense planning, investment strategy, risk mitigation, and future planning, individuals can create a cohesive roadmap that is easier to follow and adjust over time.

#1 - Prioritization Based on Goals and Risk

A comprehensive approach prioritizes actions based on their impact on long-term objectives. This means distinguishing between what is urgent and what is important. For instance, while paying down high-interest debt is urgent, building an emergency fund is important for long-term resilience.

By evaluating both goals and risks, families and individuals can allocate resources efficiently, maximizing the benefit of every financial decision.

#2 - Scenario Planning and Contingency Strategies

One of the most powerful features of comprehensive financial planning is scenario analysis. Life is unpredictable: job changes, market volatility, health events, and unexpected expenses all occur. A holistic plan anticipates these possibilities, incorporating contingencies and flexibility to maintain stability.

This foresight reduces stress and reactive decision-making, creating a sense of control and confidence that piecemeal advice rarely provides.

Real-Life Consequences of Fragmented Advice

Consider someone who receives advice to aggressively invest in growth stocks while simultaneously being told to minimize risk through conservative insurance and savings. Following both without coordination can produce contradictory outcomes—overexposure to risk in one area and underutilization of capital in another.

Financial decisions rarely exist in isolation from tax or legal implications. Piecemeal advice often overlooks these connections. For example, withdrawing funds from a retirement account prematurely may satisfy a short-term goal but trigger taxes and penalties that hinder long-term growth.

Fragmented financial advice creates uncertainty. Individuals may second-guess decisions, feel guilty about spending, or struggle to maintain consistency. Emotional stress can undermine rational planning, prompting reactive behavior rather than deliberate action.

How to Adopt a Comprehensive Financial Approach

Start by understanding your complete financial picture: income, expenses, debts, assets, investments, insurance coverage, and future obligations. This assessment forms the foundation for informed decision-making.

- Define Goals Across Time Horizons: Identify short-term, medium-term, and long-term goals. A comprehensive strategy links every decision to these objectives, ensuring that day-to-day actions support future outcomes rather than compete with them.

- Coordinate Professionals When Needed: Complex financial lives often require expertise in multiple areas: accounting, investing, insurance, and estate planning. A coordinated approach ensures advice from different specialists aligns with your overall plan, rather than creating conflicting guidance.

- Monitor, Adjust, and Review: Financial planning is not a one-time activity. Life circumstances change, markets fluctuate, and priorities evolve. A comprehensive strategy includes regular monitoring and periodic adjustments to stay on track, avoiding the reactive cycle that piecemeal advice fosters.

Conclusion

Piecemeal advice can feel helpful in the moment, but it rarely builds sustainable financial stability. Isolated tips, short-term fixes, and uncoordinated recommendations leave gaps that create stress, inefficiency, and vulnerability.

By contrast, comprehensive financial planning provides a structured, integrated approach that accounts for income, expenses, investments, insurance, and future obligations. It prioritizes goals, manages risks, anticipates scenarios, and reduces emotional friction. The result is a financial life that is not just manageable but strategically aligned with long-term aspirations.

In a world of fragmented guidance, taking the comprehensive route isn’t just smarter—it’s the path to lasting financial confidence and control.