Differences between these two types of money lenders are listed below:

Table of Contents

What Is A Private Money Lender?

A private money lender is an individual or entity that provides loans to borrowers without being a traditional financial institution such as a bank or credit union. These lenders can be individuals, small businesses, or even larger corporations.

They typically lend money to borrowers who may not qualify for traditional bank loans, such as those with poor credit or those looking to finance unconventional projects. They may charge higher interest rates and fees compared to traditional lenders due to the higher risk involved.

Key Takeaways

- A private money lender is an individual or organization that lends money to borrowers who cannot obtain financing from traditional financial institutions.

- These money lenders provide money to borrowers who may not qualify for traditional bank loans. They offer flexibility, faster access to capital, and tailored lending solutions to meet diverse financial needs.

- Unlike private lenders, hard money lenders are a specific type of private lender that specializes in real estate loans, offering a wider range of loan types.

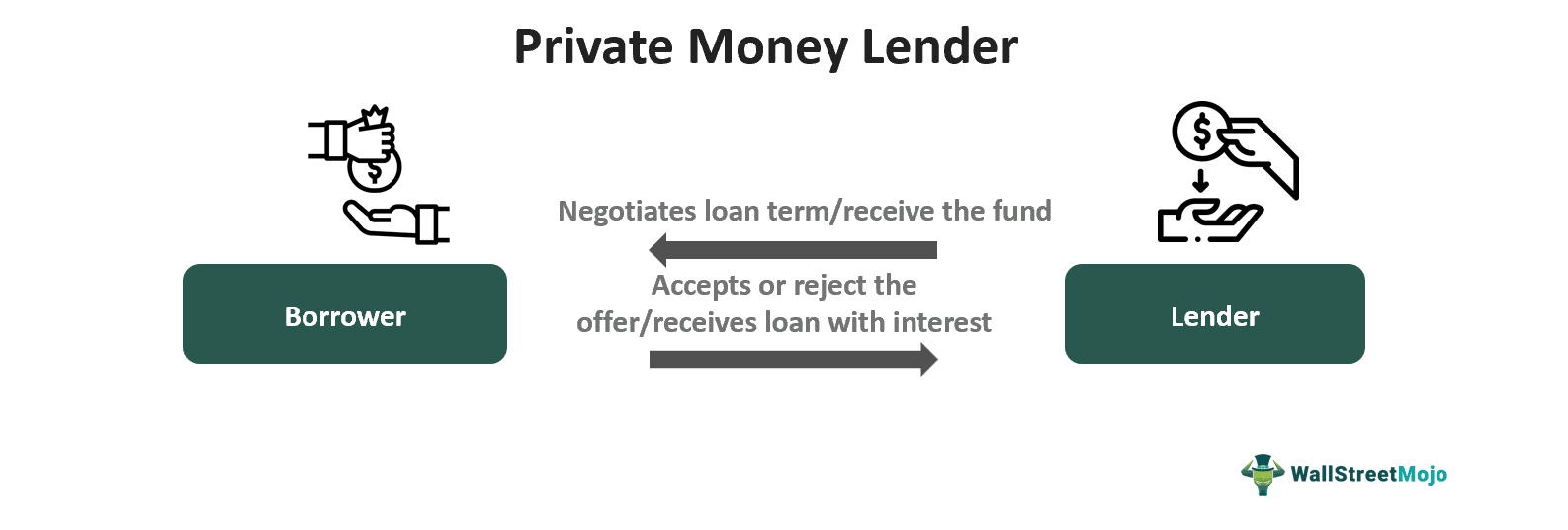

How Does A Private Money Lender Work?

Private money lenders provide loans to borrowers who need financing for various purposes, including real estate investments, business ventures, or personal needs. Unlike traditional banks, they use their own funds to provide loans rather than relying on deposits from customers.

These lenders often specialize in certain types of loans, such as real estate loans or short-term bridge loans. They typically assess the borrower's creditworthiness, the collateral value, and the feasibility of the project before deciding whether to approve the loan. Moreover, due to higher risk, they may charge higher interest rates and fees compared to traditional lenders. The terms and conditions of the loan are typically negotiated between the lender and the borrower and may be more flexible compared to traditional bank loans.

Once the loan is approved, the borrower receives the funds and begins repaying the loan according to the agreed terms. Payment schedules can vary, ranging from regular payments or a lump sum payment at the end of the loan term, depending on the specific terms of the loan. Overall, these lenders play an important role in providing financing options for borrowers who may not have access to traditional bank loans, and they can offer more flexibility in terms of loan structure and repayment options.

How To Become?

Becoming such a type of money lender typically requires a significant amount of capital, as you will be using your funds to lend to borrowers. Here are some steps you can take to become one:

- Build up your capital: You need to have sufficient funds to lend. This may involve saving money over time, investing in other ventures, or seeking out partners to contribute capital.

- Develop your expertise: While there are no specific educational or licensing requirements to become such a lender, it's essential to develop expertise in the field. This may involve researching the industry, networking with other professionals, and learning about different types of loans.

- Determine your niche: These lenders often specialize in certain types of loans, such as real estate loans or short-term bridge loans. Determine what types of loans you want to offer and what types of borrowers you want to work with.

- Establish your lending criteria: Develop clear lending criteria that you will use to evaluate potential borrowers, such as credit score, income, and the collateral value.

- Build your network: Building relationships with potential borrowers, real estate agents, and other professionals in the industry can help you find opportunities to lend and grow your business.

- Comply with legal requirements: These lenders are subject to various laws and regulations, so it's important to ensure you are operating within the legal framework of your jurisdiction.

Examples

Here are some examples to help you understand the concept better:

Example #1

Suppose Serena is a businesswoman with a great idea but has a short credit history and lacks collateral. Thus, she finds it challenging to get finance from traditional banks. She approaches WF Inc., a private investment company that specializes in lending money to small businesses.

WF Inc. assesses Serena's financial forecasts and business plan and finds room for expansion in her endeavor. Serena receives a $50,000 loan from WF Inc. at a competitive interest rate despite the increased risk involved with startups.

WF Inc.'s money allows Serena to start her business, buy inventory, and sell her goods successfully. Her company grows over time, bringing in larger investors and producing consistent profits.

In this example, WF Inc. entered into a private money lender contract with Serena, providing her with alternative financing options as she had trouble obtaining conventional bank loans.

Example #2

Patch of Land, a well-known real estate crowdfunding platform, finished a big Series A funding round, raising $23.6 million. The lead investor in this round of investment was SF Capital Group, with Prosper President Ron Suber taking part as well. Patch of Land focuses on the financial side of real estate transactions by providing short-term loans to developers.

Patch of Land stands apart in a crowded industry by prioritizing accredited retail investors in addition to institutional ones. The platform's success demonstrates how much the dynamic real estate sector needs alternative financing options.

Private Money Lender Vs. Hard Money Lender

| Aspect | Private Money Lender | Hard Money Lender |

|---|---|---|

| 1. Definition | Individuals or groups of people who loan money to others, typically friends or family members. | Professional lenders who specialize in providing loans to real estate investors. |

| 2. Interest rates | Private money lenders rates may be lower than hard money lenders, as they are usually lending to people they know and trust. | They typically charge higher interest rates because they are lending to riskier borrowers, such as real estate investors who may have poor credit scores or other financial challenges. |

| 3. Loan size | They often provide smaller loans, typically less than $50,000 | These money lenders provide larger loans, often in the range of $100,000 or more. |

| 4. Borrower qualifications | They are more likely to lend to borrowers who have good credit scores and a stable source of income. | Hard money lenders are more focused on the value of the property being purchased and may be more willing to lend to borrowers with poor credit or other financial challenges. |

| 5. Loan terms | They are more flexible with loan terms, as they often have personal relationships with the borrowers. | Hard money lenders typically have stricter loan terms, such as shorter repayment periods and higher down payment requirements. |

| 6. Loan purpose | They may be more flexible with the purpose of the loan and may be willing to lend money for personal expenses or non-real estate-related projects. | Hard money lenders typically only provide loans for real estate investments. |