How Procurement and Accounts Payable Work Together to Control Spending

Table of Contents

Introduction

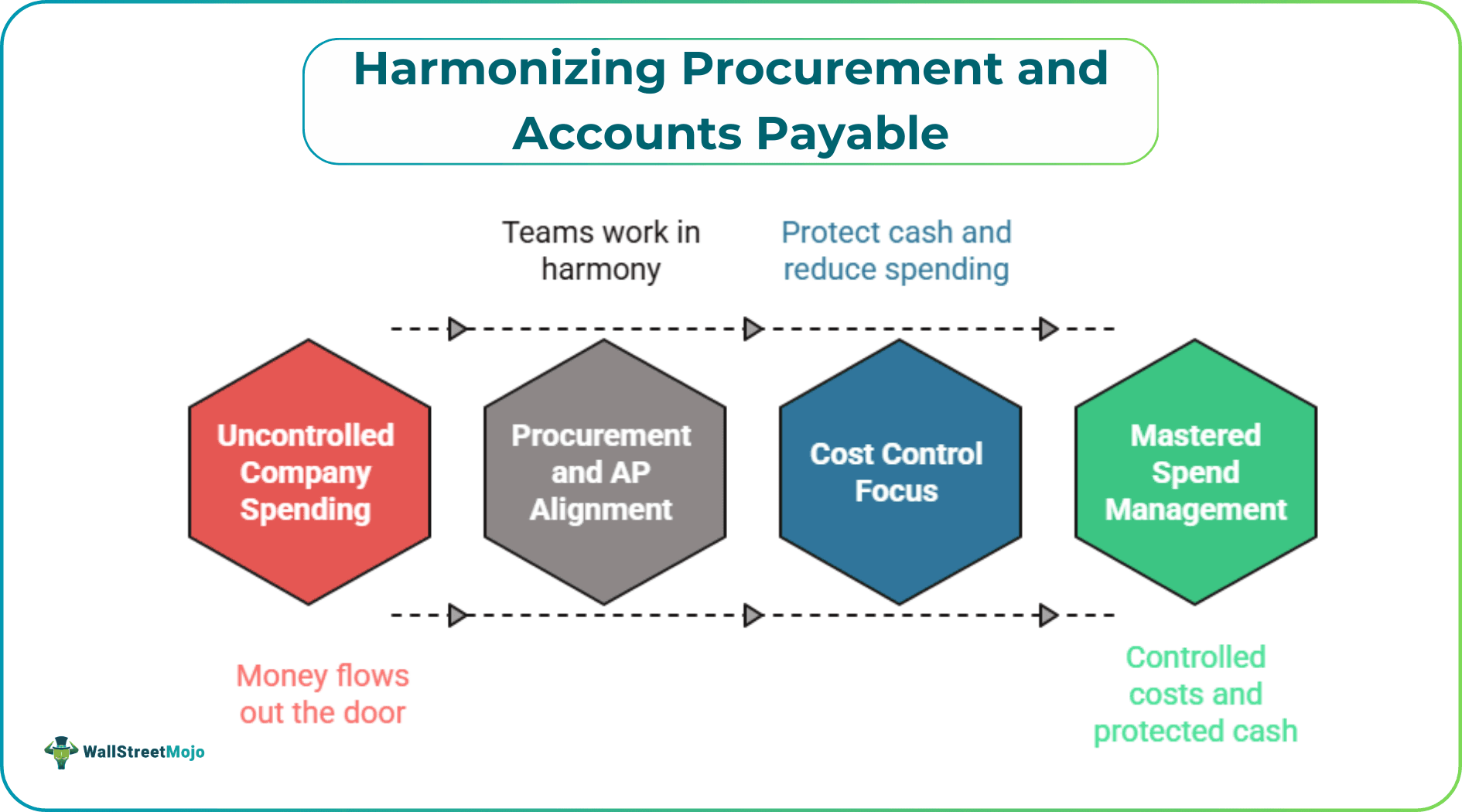

Let's talk about company spending. Money flows out the door for everything. This includes office supplies and raw materials. Two departments guard this exit. They are procurement and accounts payable. They are often separate teams. But their success is totally linked.

Smart businesses know this. They make these teams work in harmony. The goal is simple. It is to control costs and protect cash. Understanding how procurement and accounts payable are connected is the first step to mastering spend.

Two Sides of the Same Coin

Think of buying something for the business. Procurement handles the first part. They find the right supplier. They negotiate a strong price. They create an official purchase order. This document is crucial. It states what the company agrees to buy. It also states the cost.

Then the process moves to accounts payable. They receive an invoice from the supplier. Their job is to pay it. But they must be careful. They need to check the invoice first. They must confirm the company actually got the goods. They must also verify the price matches the agreement. One team spends. The other team pays. They are two halves of a whole process.

The Purchase Order: Your Best Friend

This is the secret weapon. The purchase order (PO) is a game-changer. It is a contract created by procurement. The PO goes to the supplier. It is also sent to accounts payable. Now everyone has the same information.

When an invoice arrives, the AP clerk has a checklist. Did we order these exact items? Is the price on the invoice the same as the PO price? Were the items delivered and accepted? The PO gives them the power to say "no." They can reject incorrect invoices. This stops overpayments. It stops payments for things never ordered. Without a PO, AP is paying blind. With a PO, they are enforcing a pre-made deal.

Catching Errors and Fraud

Mistakes happen. A supplier might send a wrong invoice. The quantity might be off. The price might be higher than agreed. Sometimes, duplicate invoices get sent. Rogue fraud does occur. Accounts payable acts as the final inspector. They compare the invoice to the PO and the delivery receipt.

This three-way match is a powerful control. It catches honest errors. It also prevents deliberate overcharging. Every caught error saves money. This control exists only if procurement creates the PO. And only if AP uses it to check every bill. Their collaboration forms a vital financial firewall.

The Data Dream Team

Information is power. Procurement and AP see different pieces of the spending puzzle. Procurement has data on negotiated rates and supplier performance. AP has data on actual payment timing and invoice accuracy. When they share this data, magic happens.

AP can tell procurement if a supplier sends messy, incorrect invoices. Procurement can then renegotiate or find a better partner. Procurement can tell AP about special payment terms for early discounts. AP can then pay sooner to save money. Together, they build a clear picture of spending habits. This helps the company make smarter buying decisions.

Building Strong Supplier Relationships

Suppliers are partners. Good relationships matter. Procurement builds these relationships during the buying phase. But AP manages the relationship during the payment phase. Timely, accurate payments make suppliers happy. Happy suppliers offer better service. They might even give better prices next time.

If AP pays late or argues over every tiny error, the relationship sours. Procurement and AP must align. They need one clear message to suppliers. The rules are fair. The payments are reliable. This teamwork strengthens the company's entire supply chain.

The Cost of Working Apart

What happens if these teams don't talk? Chaos ensues. Procurement might cut a great deal. But then AP pays the old, higher price by mistake. Employees might buy things without a PO. AP gets an invoice for a surprise purchase. They have no choice but to pay it.

Spending spirals out of control. The company loses money on duplicate payments and missed discounts. Morale suffers in both departments. They blame each other for problems. The finance chief gets nasty surprises. This siloed approach is expensive and stressful for everyone.

Forging a Powerful Alliance

The path forward is clear. Break down the wall. Procurement and AP must be allies. They should have regular meetings. They should use shared software systems. They must agree on clear rules for spending. Everyone in the company should know the process. No PO, no purchase. No exceptions.

This partnership turns spending from a reactive chore into a controlled strategy. It saves real money. It reduces risk. It gives leaders true confidence in their financial numbers. Ultimately, controlling spending isn't about saying "no" to everything. It's about buying wisely and paying correctly. That takes a tag team. And that team is procurement and accounts payable, working in sync.