Table of Contents

Real Estate Financing Meaning

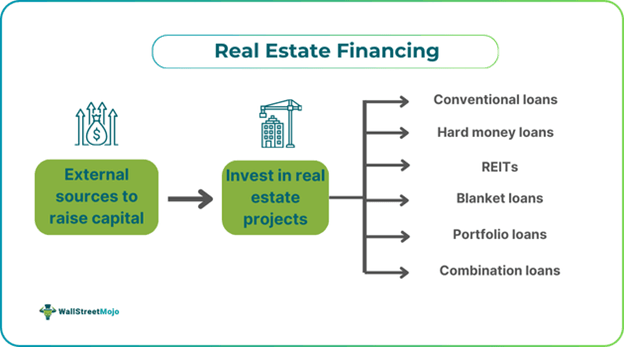

Real estate financing is the process of raising capital to buy or renovate a property. It is done by real estate investors using external financing sources. The property can be anything from a residential home to a commercial building or just a plot of land. It also plays a critical role in analysis, planning, and management.

An investor can use different methods to accumulate funds and raise capital to invest in real estate and participate in development projects, acquisitions, and other real estate-associated operations. Real estate financing dispels the common misconception that a lump sum amount is required to initiate real estate investing.

Key Takeaways

- Real estate financing refers to raising capital using different external sources to buy or renovate a real estate property.

- The most critical types of real estate financing options are blanket loans, portfolio loans, REITs, combination loans, conventional loans, and hard money loans.

- Such financing options have a broader scope and help in property analysis, planning, management, associated procedures, processing, acquisitions, development projects, and other operations.

- With time, new forms of external real estate financing have eased the process of investing and processing funds, documentation, legal procedures, and capital accessibility.

Real Estate Financing Explained

Real estate financing is the concept of seeking sources of money to invest in or fund a real estate property. It is a crucial process and can be done in many ways. Whenever a real estate deal is made, whether for investment, business, or a residential home, the top priority is given to its financing.

The real estate industry has always been booming, and people like to buy and invest their capital in different types of real estate properties, from commercial buildings to vacation homes, apartments, or even just empty plots of land. Earlier, investing in real estate took a lot of work. Still, with time, banks, institutions, and other financial products have made it easy for people to choose the correct form of financing.

When investing in real estate, there are a lot of additional costs, charges, and paperwork that come with the whole process. The financing not only helps with funds but also plays an integral role in property analysis, management, comparison, and planning to save a huge amount of time and effort.

Presently, there are a variety of real estate financing options available that help investors make the wisest real estate investments. The whole housing market relies on real estate financing. Without it, it isn't easy to accumulate funds, maintain a cash flow, and ensure that property documentations are legally regulated with the common interest of profit, growth, and infrastructural development.

Investment Options

Following are the key investment options linked to commercial real estate financing:

- Conventional loans are where investors borrow money from banks at an interest rate and need to be paid in monthly installments. Typically, banks offer 60% to 90% of the property valuation.

- Another option is hard money loans, which are high-interest loans with fewer terms than traditional borrowing. Investors generally use these to buy and renovate properties.

- Then, there are portfolio loans provided by credit unions and community banks. These loans are flexible and good for investors who do not like the complexity of conventional borrowing through big banks. They also have low interest rates and are based on the borrower's overall financial performance, not just their credit score.

- Another good investment option is blanket loans, but they are only used to finance more than one property. Whenever there is a portfolio of properties, blanket loans help in a large investment strategy. They can be used for both commercial and residential properties. Blanket loans help save time and money by consolidating the financing for multiple properties into one loan.

- Combination Loans: These loans combine different types of loans to form a mortgage combination for investors. For example, in 80-20, 80% of the property value is financed through the first mortgage and the rest 20% is financed through another mortgage. Such loans come with two monthly payments.

- Lastly, there are Real Estate Investment Trusts (REITs). These are companies that enable investors to invest in big upcoming real estate projects. An investor can invest in REITs through a broker or by simply purchasing its shares. They are publicly traded, and investors can receive dividends. Through REITs, investors can invest in real estate without actually buying a property.

Examples

Here are two distinct examples of such a financing option:

Example #1

Suppose Gwen is planning to invest in real estate; she comes across a residential property and thinks that it will be perfect for a second home investment; she can also give it on rent. Gwen chooses conventional loans, does her research, and finds a bank that is offering the property value at the lowest interest rate. She immediately makes 20% of the down payment she had saved for the last couple of years, takes a loan from the bank, and buys the property.

Now, Gwen has a salaried job, for which she will be making monthly payments to the bank for the whole loan term. This way, Gwen will have a second home by the time the loan ends. She can also earn extra income by keeping a tenant in her second home and investing that amount in other financial markets. This is a simple real estate financing example, but in the real world, many other aspects are considered.

Example #2

Arixa Capital expanded its joint venture with Oaktree Capital Management to give birth to senior secured loans supported by residential real estate. This partnership was established in August 2023, with an initial commitment of $100 million to address the booming demand for real estate financing. For this, both Arixa and Oaktree have committed an additional $100 million.

This real estate financing is introduced with the aim of rapid execution, reliable capital access, and customer service so that Arixa can expand its capacity to serve experienced and more aware clients looking for reliable alternatives to real estate financing other than the community and regional banking sector. Arixa was founded in 2006 and has now originated over $4 billion in loans. It is planning to capitalize on the funding gap in real estate financing.

Importance

The importance of real estate financing is listed below:

- Help investors accumulate money through different sources

- Assists in breaking the real estate financing complexity and helps in other linked procedures

- Breaks the notion that real estate financing is challenging and requires a lot of initial money

- The real estate industry has never lost its edge, and homes and properties are always in demand. Hence, real estate financing is one of the safer investments compared to other volatile options

- Helps finance any form of real estate property, from residential homes, commercial buildings, vacation homes, or simple plots of land

- Investors learn and become involved in acquisitions, property analysis, planning, development operations, etc.