Table of Contents

What Is Reference Price?

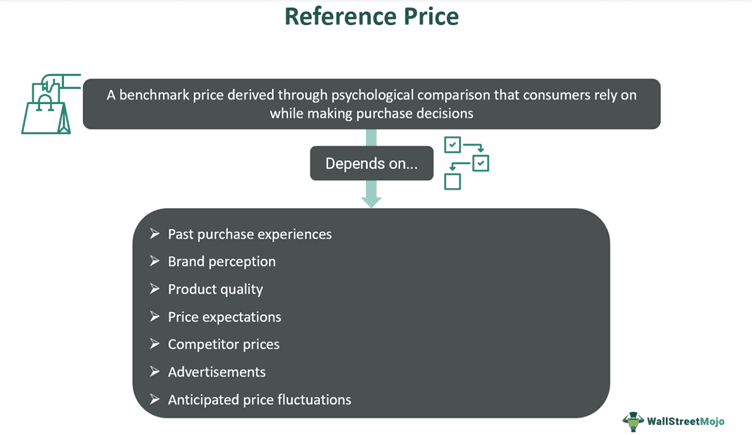

Reference Price is the price consumers consider fair and are willing to pay for a product or service based on advertised prices, past purchase prices, or competitor prices for the same goods or services. They consider this price a benchmark and analyze whether products offered at certain prices are worth purchasing at those prices.

It leverages consumer psychology by coaxing consumers to refer to a previous purchase or a higher current price point as a reference while making buying decisions driven by comparison. It helps bring price transparency across industries. It increases competition among manufacturers and service providers, prompting each player in an industry to produce quality goods or offer top-notch services.

Key Takeaways

- A Reference Price is a price consumers consider just and fair for a product or service. They define it based on comparison, past purchases, product quality, brand image, advertisements, expected price fluctuations, etc.

- Consumers, steered by human psychology, prefer buying products that meet their requirements at the lowest possible prices.

- Marketers use reference pricing strategies to boost the sale of their products and services using tactics like discounts, end-of-season sales, line pricing, etc.

- Internal and external reference pricing strategies are the two main types of pricing methods employed and leveraged by businesses, marketers, and companies.

Reference Price Explained

Reference Price indicates a price that consumers believe is reasonable to pay for a specific product or service when compared to similar products available or advertised in the market. It is usually determined by past prices that consumers have paid for the same products. It is essential to note that such price-based decisions are usually subjective since consumers’ purchase experiences differ, meaning different people find different prices fair or suitable. Using such price points as a reference, consumers can acquire quality goods and services at low prices.

Marketers use these prices to structure their pricing strategies and influence purchasing behavior by setting higher prices for their products and offering discounts on them. At times, market followers adopt a strategy where they set their prices lower than those charged by market leaders for the same products. In this manner, market followers acquire and retain customers, thereby creating customer loyalty through price comparison. Other factors influencing these prices are product quality, brand image, expected price fluctuations, etc.

Consumers often compare the prices of similar goods and services offered by multiple producers or service providers, like plane tickets or hotel accommodations. Such comparisons help them create a reference price for the product or service in question. For example, this practice is prevalent in apparel retail. Discounts are common in this sector in order to influence customers’ purchase decisions, as customers define a point of price reference based on the discounts companies offer on a variety of similar or comparable clothes.

In the banking sector, interest rates on loan products or savings accounts are common examples of such pricing. For instance, customers looking for loans typically compare the interest rates that various banks charge before making decisions regarding mortgages. In finance, bond reference prices help investors compute the amount they will receive upon bond maturity.

Sometimes, the same products are offered in two categories as part of a line pricing strategy. This means that products with the same or similar features and utility are offered in two varieties but with high and low price tags. Consumers tend to consider the product priced lower as the reference point of the said item. This happens because consumers prefer purchasing quality products at the lowest possible prices, driven by the human mind that evaluates the available options and chooses the one that seems more economical, keeping quality factors constant.

Types

Reference pricing can work in different ways. It can be classified into two categories based on the approach and strategy employed to sell products and services. Let us discuss them in this section.

#1 - Internal Reference Pricing

An internal reference price is determined by a seller based on their internal observations and understanding of consumer buying behavior. It depends on the price point at which customers buy an item, or they gather market information about a product before making a purchase decision. Market information involves analyzing the prices competitors charge for the same products. If a seller feels that people prefer to buy an item for $10 more than buying it for $20, they price their products in the $10 range, meaning the final price they set is closer to $10 than it is to $20.

#2 - External Reference Pricing

Marketers generally use external reference prices to influence buyers’ purchase decisions through advertising and discounts. For this, they rely on advertisements, where they highlight a product’s market price and then offer a discount on that price that seems significant or worthwhile to a buyer. They use price tags, sale seasons, advertising signage, and labels to create artificial reference points with respect to the advertised products. This is called reference price marketing. The marked price of products becomes a key tool for referencing prices.

External reference pricing works on certain principles or notions:

- Shopper's evaluations regarding reference pricing are positively influenced or affected when marketers use inflated price points as reference points.

- Typically, consumers do not notice price changes around their set reference points for the prices of various products and services. It means that such reference points remain intact or stable in consumers’ minds for significant periods.

- These prices can also be affected by the prices of unrelated products or services. Hence, studying reference price effects is crucial while forming strategies.

Examples

Let us look at some examples to understand the topic.

Example #1

Suppose Correct Invest is a financial services company that wants to promote one of its investment management products. The company wants its clients to consider a new service option. It offers a more actively managed portfolio service that charges a higher fee compared to its competitors. Per this new option, 1% of the Assets Under Management (AUM) will be taken as a fee compared to 0.25% of AUM charged for other low-cost index fund options.

Jenny, a financial advisor at Correct Invest, decided to apply reference pricing strategies. She also explored target marketing campaigns to ensure client onboarding. Jenny found out that 0.25% is considered the price point of reference for low-cost index fund options in the market. Based on this input, she proposed the following points to management and highlighted how the company could likely attract prospective clients while prompting existing clients to adopt this new investment management practice.

- Despite the increased fee, the new strategy would allow the company to invest in funds that could potentially offer higher returns than normal investments.

- The investments in the new portfolio would be more actively managed than before, with a focus on personalization according to investor risk appetite and continuous monitoring of investment performance.

- Expert portfolio managers would be assigned to each account, and intensive risk management practices would be followed to ensure performance.

- This investment management service would be offered at a discounted price for a limited period.

Jenny’s proposal was accepted, and Correct Invest released advertisements covering all the points that she stated in the proposal. Soon enough, the company had inquiries pouring in from various existing and potential clients.

In this way, reference pricing can help market products and services and onboard customers.

Example #2

A November 2023 news report highlights how reference pricing can be employed in healthcare. The study, conducted by ISPOR—The Professional Society for Health Economics and Outcomes Research, states that Medicare could use reference pricing strategies to negotiate drug prices and generate savings worth $10 billion per year.

By considering a therapeutic reference pricing approach, which involves studying the market for therapeutic alternatives to specific drugs, Medicare could base negotiations (with relevant entities) on the availability of alternatives and lower the prices of in-demand (top-selling) drugs.

This illustrates the use of reference prices across various industries to negotiate, stabilize, or drive down prices (depending on the situation) and initiate savings or cost reductions.