Table of Contents

What Is Regulation K?

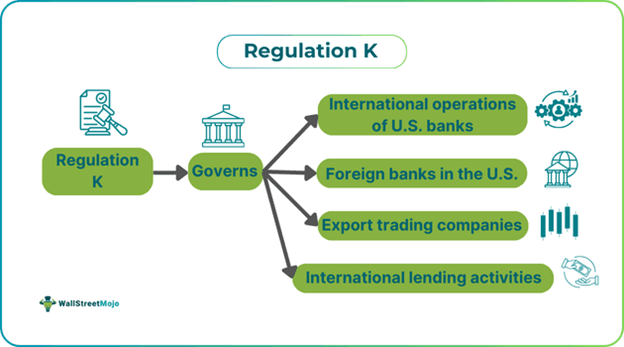

Regulation K is a U.S. regulation governing international banking activities. It was established by the Federal Reserve Board (FRB) and the Federal Deposit Insurance Corporation (FDIC) to address various international banking issues.

Regulation K serves as a doctrine for international banking in the U.S., covering both U.S. bank holding companies involved in international trade and foreign banks operating domestically. It sets guidelines on transactions, holding companies, financial practices, and the extent to which institutions can participate in international banking.

Key Takeaways

- Regulation K is a U.S. regulation that governs international banking activities for U.S. companies involved in global trade and foreign banks operating domestically in the U.S.

- Regulation K is divided into four parts, each addressing a specific aspect of international banking, collectively providing a comprehensive framework for U.S. financial operations.

- Part A provides guidelines for U.S. banks operating internationally, Part B focuses on foreign banks operating in the U.S., Part C covers export trading firms, and Part D deals with international lending regulations.

- All U.S. banks and investment entities must comply with Regulation K's sections, guidelines, and laws to meet regulatory and compliance requirements.

Regulation K Explained

Regulation K is a collection of Federal Reserve regulations defining the legal framework for banks and other financial institutions in the U.S. It primarily focuses on international banking activities and transactions and how foreign banks and entities must operate within the U.S.

When a bank or financial institution is established in the U.S., or if a foreign bank opens a branch in the U.S., it must follow certain guidelines to ensure customer protection, compliance, and the prevention of deceptive or illicit activities, including privacy violations. Regulation K was introduced for this purpose, and over time, it has been updated with new regulations and guidelines as needed. The FDIC and FRB introduced it to govern domestic and foreign organizations operating on both sides.

Regulation K is divided into four parts:

- Part A governs U.S. banks with international operations, defining permissible activities and investments for U.S. banks when setting up foreign branches, including lending limits, capital requirements, deposit limits, and other services.

- Part B addresses the operations of foreign banks inside the U.S., outlining the laws and limitations they must adhere to, including reporting requirements and permitted activities.

- Part C focuses on export trading companies, covering disclosure procedures, investments, and credit lines.

- Part D covers international lending, including reporting requirements, transfer risk reserves, government credit lines, fees, and other disclosures.

History

A brief history of Regulation K:

- In 1979, Regulation K was first adopted to remove regulatory constraints on cross-border banking in the U.S. and address customers falling outside the U.S. banking regulatory framework.

- In 1985, the Board updated Regulation K to clarify that foreign banking organizations cannot directly underwrite, sell, distribute, or own more than 10% of a company’s voting shares that underwrite, distribute, or sell securities in the U.S.

- Since then, the Board has updated Regulation K with several new provisions, which U.S. banks and holding companies are required to follow.

Compliance Requirements

The compliance requirements for Regulation K are as follows:

- Regulation K applies to all U.S. domestic banks, entities, and foreign banks located in the United States.

- A bank with a foreign branch must maintain its accounts, reports, and data separately from the head office and other foreign branches. Foreign banks must hold the proper licenses and comply with U.S. laws.

- Foreign banks without proper licenses cannot produce, distribute, trade, or deal in commercial products.

- They are also prohibited from underwriting, selling, or distributing securities without proper licensing or certification and must adhere to compliance rules.

- Foreign branches in the U.S. are allowed to accept deposits from U.S. residents, but depositors must be informed of the risks associated with such deposits by the Board.

- Investments that exceed general consent procedure limits require 45 days prior written notice to the Board.

- If the investment doesn’t meet the qualifying criteria for general consent, it cannot proceed without Board approval.

- For activities not listed in Regulation K, the specific consent procedure must be followed for any first investment, subsidiary, or joint venture.

- U.S. banking institutions must conduct foreign banking operations with high banking and financial prudence standards under Regulation K.

- Organizations must maintain accurate records, controls, and reports to keep management informed, as required by Regulation K.

- The regulation clearly states that each organization must have accurate records of their internal and external audits.

- Investors must maintain sufficient records and information regarding their activities and conditions as per Regulation K.

Impacts on Financial Institutions

The impact of Regulation K on financial institutions includes:

- It provides a comprehensive framework for the U.S. banking system, holding companies, and trade entities internationally and domestically.

- Regulation K allows Edge Act corporations to engage in a variety of global banking practices.

- Domestic U.S. banks are only permitted to own non-financial foreign business entities through special permission under Regulation K.

- Policy changes by the FRB and FDIC periodically impact the efficiency, processing, and authorization of activities under Regulation K.

- Regulation K serves as a compliance and regulatory guide for U.S. domestic banks, holding companies, and foreign banks operating in the U.S.

- The four sections of Regulation K limit the activities, operations, and practices of U.S. banking institutions and other financial entities.

- No U.S. domestic bank can operate internationally outside the guidelines of Regulation K.

- Similarly, no foreign bank located in the U.S. can engage in trades or transactions that are not permitted under Regulation K.