Table of Contents

What Is A Rent Roll?

Rent roll refers to a register or document held by a landlord or property owner. It has reports on the rental details of each unit of rental properties. The details include details such as if the unit is occupied, if yes, tenant details, payment history, and the security deposit held against that unit.

A proper rental roll template also details the duration of the tenant's occupying the property and when the current lease or tenancy agreement will cease to exist. It is a crucial document for understanding the income stream from such properties. Thus, property managers, investors, and creditors pay close attention to the minute details of this document.

Key Takeaways

- A rental roll is a document that contains all information about a rental property. It also details the number of tenants, monthly income, and duration of tenancy agreements.

- In practical applicability, it is considered the best way to maintain and gauge the actual income of a property.

- Lenders, potential buyers, landlords, tax collectors, and property managers examine this data to determine a property's true potential.

- In fact, the document also shows whether the current income levels can be sustained for an extended period. Therefore, potential buyers can make a call accordingly.

How Does Rent Roll Work?

A rent roll is documentation of a property's current residents and the amount received from them as rent. It also has all relevant details of the tenant, the duration of their lease or rental agreement, the security advance held, and the period they have already occupied the unit.

Using a rent roll sample will give the user a clear idea that it is one of the most straightforward ways to handle a commercial property's rental documentation. It is extremely helpful in determining the income the property is able to generate and whether it can generate more, as well as whether there are any units that are free to occupy.

Property investors, lenders, and management rely heavily on these documents to ascertain the property's rental income returns. Since these documents are compatible with any form of real estate—commercial, housing, or multi-use developments—they are relatively straightforward yet exceedingly reliable.

If a buyer is looking to purchase a rental property, this document should not only give the potential buyer an idea of the current income generated by the property but also of its sustainability.

Having said that, these documents are only partially accurate. Due to intentional or unintentional human errors, many rent rolls may portray numbers that are way higher than their actual ability to generate such income. Therefore, buyers must conduct thorough due diligence before investing in any such properties.

Who And When Uses A Rent Roll?

The entities that commonly use rent roll software or a physical form of the document are property buyers, landlords, property managers, lenders, and tax collectors. How each of them uses it is unique in its way is explained through a brief account of each of their uses:

- Buyer: The report is worth its weight in gold. It gives buyers a clear picture of the property and all its details, including the number of units, monthly and yearly income, security deposits held, and more. Moreover, it also gives buyers a clear indicator of how long the income inflow will be sustained.

- Property Managers/ Landlords: Landlords or property managers use rent rolls similarly to buyers. However, the intention is different. A property manager looks at it from the perspective of keeping track of whether a tenant is due to pay rent or if a late fee has to be added. It also gives them an idea of whether a tenancy or lease period is coming to an end.

- Tax Collectors/ Lenders: Lenders use the document to determine a property's ability to generate income in the past, present, and future. For instance, if a property has seasoned tenants with consistent income flowing in, it might be easier to provide them with a loan. On the other hand, if the vacancy rate keeps increasing, it shows issues with the building's management. Hence, it might be riskier to sanction a loan in this case.

How Do Buyers Use A Rent Roll?

For a buyer purchasing a property that generates rental income already, there various factors other than its condition and location. A well-maintained rent roll sample shall be able to tell the buyer all details relating to the current and potential cash flow in the future.

Below are a few points that buyers find using the document.

#1 - Cash Flow

For instance, a buyer purchases a housing complex with 15 units in August. Five rental agreements expire in December. Therefore, the buyer knows that there might be a significant difference in cash flow shortly after purchasing the property unless, of course, they are renewed.

It is common for buyers to ask sellers to ensure these expiring agreements are renewed as part of their buying conditions. As a result, the buyer can still generate the same level of income, if not more, after closing their escrow account.

#2 - Seasoned Tenancy

It refers to how long it has been since a tenant has occupied a property. Their being seasoned is considered an indication of their likelihood of continuing to pay rent.

A rule of thumb in the real estate industry is that if a tenant has occupied a property for a minimum of six months and paid their rent on time in that period, they shall be considered seasoned. Therefore, buyers look at the percentage of seasoned tenants and if there are any constant late payers. The buyer will have to take a call to either charge them with steeper late fees or be evicted.

#3 - Cash Flow

A thorough review of the rent roll can show potential to increase the property's cash flow. If a property has been collecting rent below the market rate, the new buyer can find new tenants and increase the cash flow to meet market rates as soon as the current tenancy agreements expire.

How Do Landlords Use A Rent Roll?

Landlords or property owners and managers use rent roll software to manage the property more efficiently and ensure it is able to generate revenue as per its maximum ability. A few of the most common ways it helps them include:

- They can easily identify if any lease or rental agreement is expiring soon. If the existing tenant is not willing to renew the agreement, they can market the place beforehand and not lose cash flow in a non-income-generating period.

- Property managers and owners can tell at a single glance if a specific unit has any unpaid rent in the past, pending late fees, or if they have to send a notice to inform the tenant of the late payment formally.

- It can be conducive to reviewing the amount they hold as a security deposit. If the tenant has caused damage that is beyond the scope of general wear and tear, the security deposit should be able to cover those costs.

- They can compare the rent collected by tenants with market rates to determine whether they can increase the rent when their agreements are renewed.

How To Create?

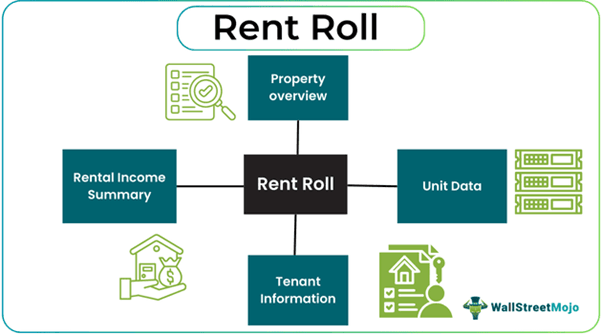

A well-curated rent roll template provides a complete overview of a property. It is intended to be a document that gives the buyer, seller, property manager, or tax collector a single glance at the property's cash flow-related details.

A few points to keep in mind when creating this document include:

Overview Of The Property

- The property management company or the owner's name

- Property type – short-term rental, multifamily, single-family, or commercial)

- Address

- Zone or market area – Urban, residential, suburban, or mixed-use)

Unit Data

- Square footage

- Unit number/numbers

- Number of bedrooms and bathrooms

- Additional features such as a backyard, storage shed, or garage

- Amenities such as common areas, playgrounds, swimming pools, or HOA

Tenant Information

- Tenant’s name

- Total number of occupants

- Start and end dates of the lease/rental agreement

- Monthly rent

- Prepaid rent, if any

- Additional rent, such as appliance rental or maintenance

- Past dues, if any

- Concessions given by the landlord

- Security deposit held by the landlord

Income Summary

- Monthly rent collected – This includes any additional rent or late fees that are collected.

- Year-to-date rent collection. It must include any additional fees or rental income charged for services such as landscaping or pest control.

Examples

Now that the concept's theoretical aspects are well-established, it is time to illuminate its practical aspects through the examples below.

Example #1

Sharon purchased a multifamily housing complex with five housing units for $500,000. Looking at the rent roll template provided by the previous owner, she understood that two of those units would be up for renewal of the tenancy agreement in 3 months.

She spoke to these tenants and understood that one of them would renew the agreement, and the other would opt to move out. Therefore, Sharon was able to market that unit well in advance and find tenants ready to occupy it as soon as the existing tenants vacate the property. As a result, Sharon did not lose out on rental income due to a vacant unit.

Example #2

Workspace Group PLC is one of London's leaders in sustainable and flexible workspace operations and ownership. They provided a business update for the last quarter of the financial year 2023, which ended on 31 March 2024.

Their rent roll was up £8.7 million per annum, generated through 343 new tenants in just the last quarter. Over the last year, they had added 1,238 occupants to their role, generating an impressive rental of £31.3 million.

Importance

Rent roll software has made maintaining properties easier. Below are a few points that signify their importance from different perspectives.

- It clearly indicates how much income the property generates, giving the potential buyer a clear idea of its income-generating abilities.

- If it is maintained in an organized manner, it can show the gross cash flow it generates monthly at a glance.

- More importantly, it can show the potential buyer or the existing property manager if the gross income shall remain the same or might experience a difference. If yes, at what point in the future can also be determined through this document.

- When landlords, lenders, and potential buyers examine the profit and loss statement, they can ascertain whether the rent roll data corroborates with the data in the P&L and is accurate.